This Is What Whales Are Betting On Centene

Investors with a lot of money to spend have taken a bullish stance on Centene (NYSE:CNC).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CNC, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Centene.

This isn't normal.

The overall sentiment of these big-money traders is split between 66% bullish and 33%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $30,000, and 8, calls, for a total amount of $1,296,575.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $47.5 for Centene during the past quarter.

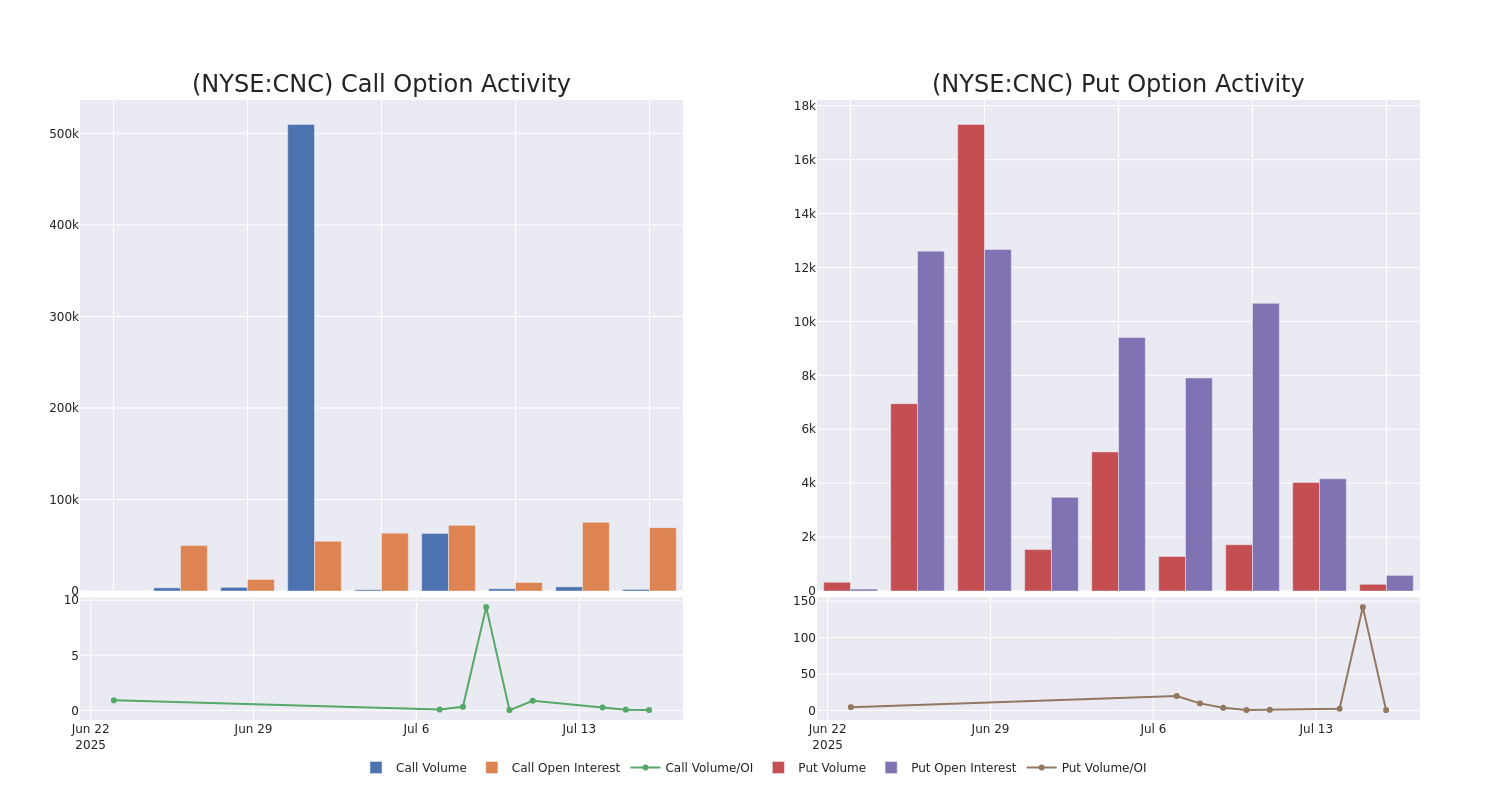

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Centene's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Centene's whale activity within a strike price range from $20.0 to $47.5 in the last 30 days.

Centene Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CNC | CALL | TRADE | BEARISH | 01/15/27 | $10.8 | $10.7 | $10.7 | $25.00 | $428.0K | 64.9K | 424 |

| CNC | CALL | SWEEP | BULLISH | 01/15/27 | $13.3 | $13.1 | $13.2 | $20.00 | $382.7K | 234 | 0 |

| CNC | CALL | SWEEP | BULLISH | 01/15/27 | $13.4 | $12.3 | $13.3 | $20.00 | $224.7K | 234 | 290 |

| CNC | CALL | SWEEP | BULLISH | 01/15/27 | $10.8 | $10.5 | $10.8 | $25.00 | $81.0K | 64.9K | 507 |

| CNC | CALL | TRADE | BEARISH | 01/15/27 | $10.9 | $10.8 | $10.8 | $25.00 | $54.0K | 64.9K | 474 |

About Centene

Centene is a managed care organization that focuses on government-sponsored healthcare plans, including Medicaid, Medicare, and the individual exchanges. Centene served 22 million medical members as of December 2024, mostly in Medicaid (about 60% of membership), the individual exchanges (about 20%), and Medicare (about 5%). The company also has a military contract and provides Medicare Part D pharmaceutical plans.

After a thorough review of the options trading surrounding Centene, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Centene's Current Market Status

- With a volume of 1,684,142, the price of CNC is down -0.47% at $29.86.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 9 days.

Expert Opinions on Centene

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $49.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from UBS lowers its rating to Neutral with a new price target of $45.

* An analyst from Oppenheimer persists with their Outperform rating on Centene, maintaining a target price of $51.

* An analyst from Morgan Stanley has revised its rating downward to Equal-Weight, adjusting the price target to $33.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Centene with a target price of $52.

* Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Overweight rating on Centene with a target price of $65.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Centene with Benzinga Pro for real-time alerts.