Unpacking the Latest Options Trading Trends in Nike

Deep-pocketed investors have adopted a bearish approach towards Nike (NYSE:NKE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NKE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Nike. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 46% bearish. Among these notable options, 8 are puts, totaling $1,070,292, and 20 are calls, amounting to $1,667,454.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $95.0 for Nike over the last 3 months.

Volume & Open Interest Development

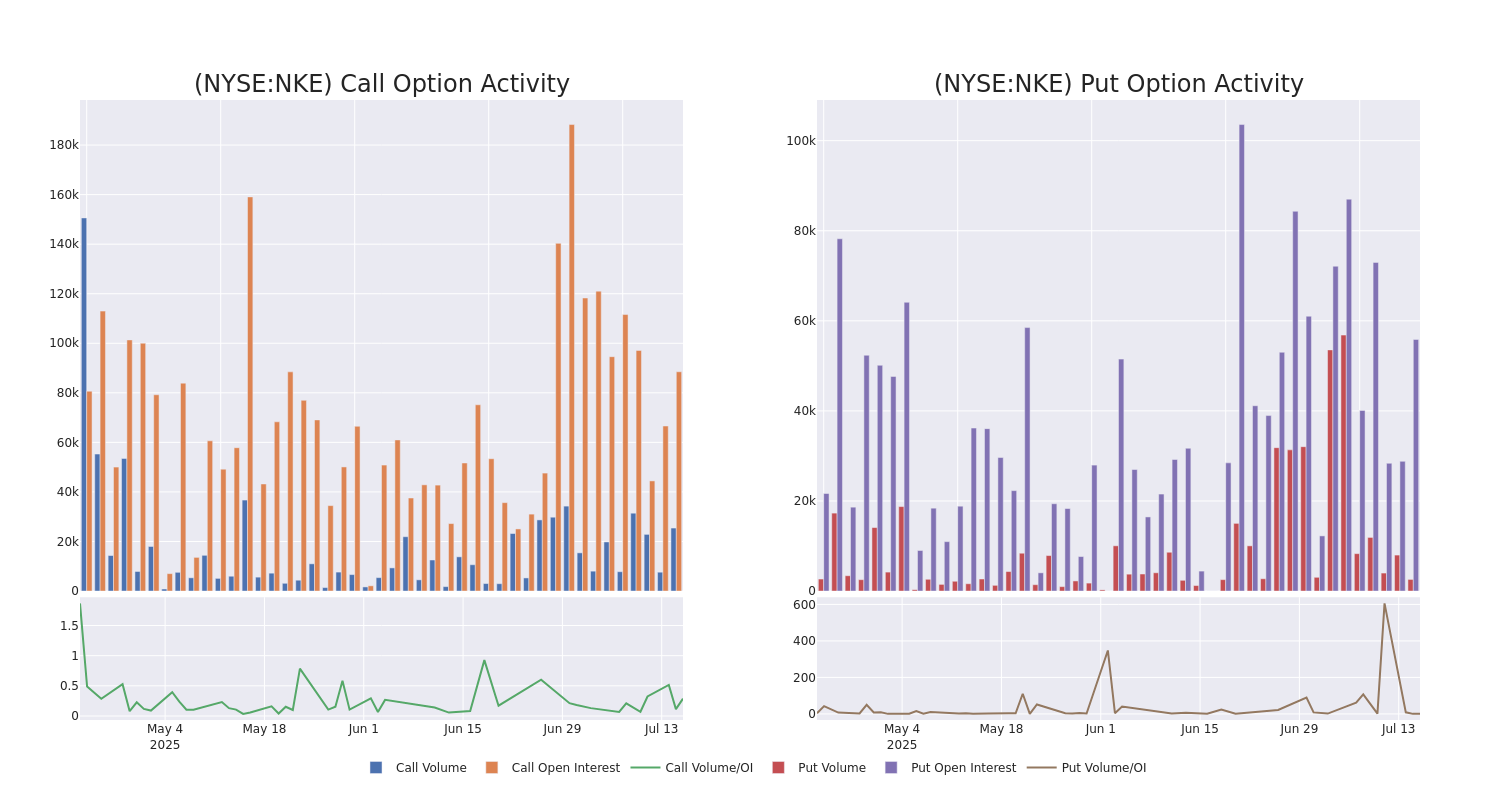

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nike's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike's whale trades within a strike price range from $50.0 to $95.0 in the last 30 days.

Nike Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | TRADE | BULLISH | 06/18/26 | $10.2 | $10.05 | $10.1 | $75.00 | $505.0K | 606 | 502 |

| NKE | PUT | TRADE | BEARISH | 01/16/26 | $8.05 | $7.9 | $8.05 | $75.00 | $362.2K | 13.6K | 450 |

| NKE | CALL | SWEEP | BULLISH | 12/17/27 | $28.8 | $27.9 | $28.8 | $50.00 | $288.0K | 775 | 302 |

| NKE | CALL | SWEEP | BEARISH | 12/17/27 | $28.75 | $28.7 | $28.7 | $50.00 | $284.1K | 775 | 202 |

| NKE | CALL | SWEEP | NEUTRAL | 12/17/27 | $29.05 | $28.75 | $28.8 | $50.00 | $146.7K | 775 | 52 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Nike's Current Market Status

- Currently trading with a volume of 6,679,254, the NKE's price is up by 0.01%, now at $72.0.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 76 days.

Expert Opinions on Nike

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $80.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a positive move, an analyst from Argus Research has upgraded their rating to Buy and adjusted the price target to $85.

* An analyst from Truist Securities persists with their Buy rating on Nike, maintaining a target price of $73.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Nike with a target price of $85.

* An analyst from Deutsche Bank persists with their Buy rating on Nike, maintaining a target price of $71.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Nike, targeting a price of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nike options trades with real-time alerts from Benzinga Pro.