What the Options Market Tells Us About Upstart Hldgs

Financial giants have made a conspicuous bearish move on Upstart Hldgs. Our analysis of options history for Upstart Hldgs (NASDAQ:UPST) revealed 25 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $158,923, and 21 were calls, valued at $3,520,294.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $100.0 for Upstart Hldgs during the past quarter.

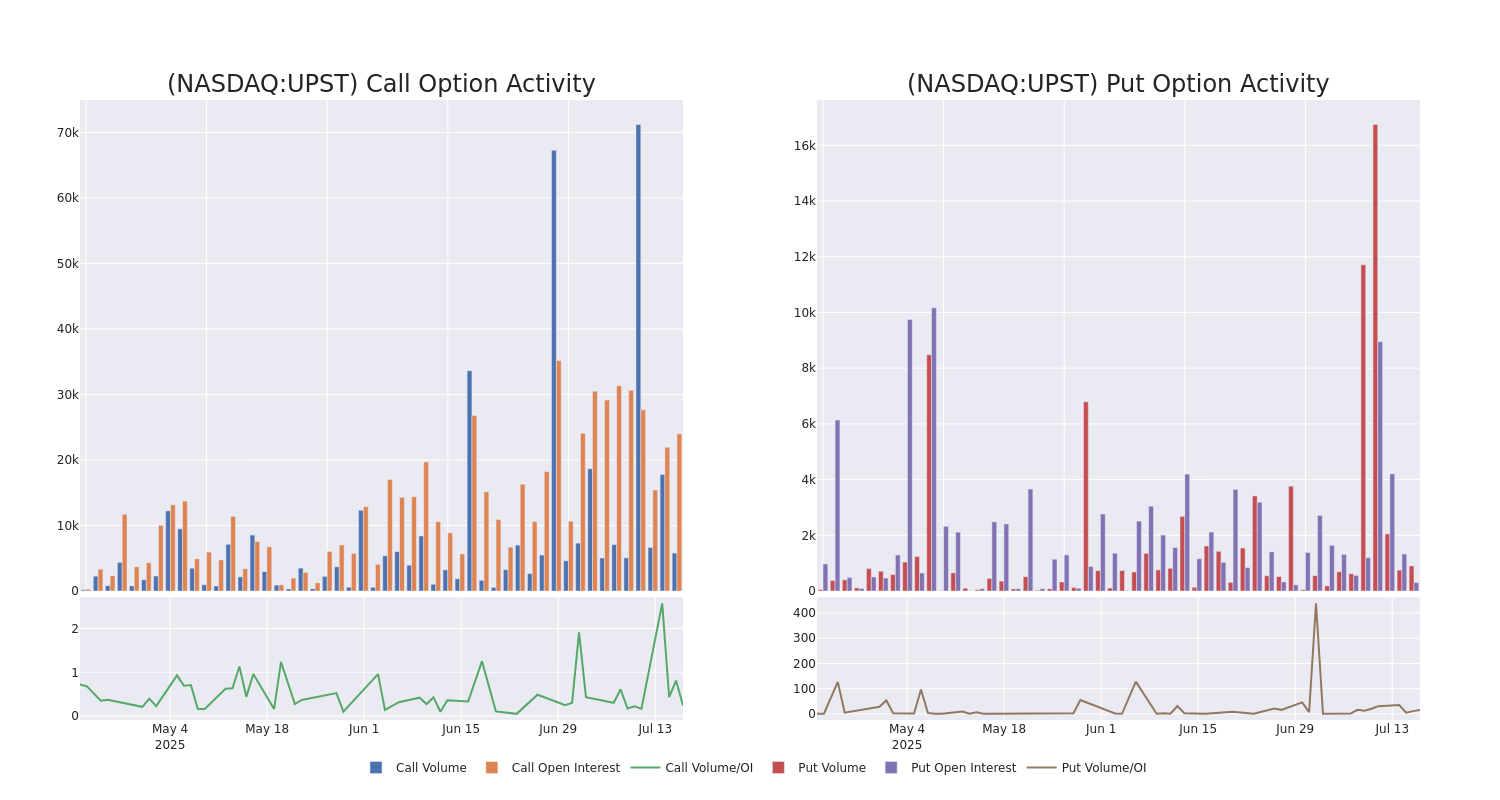

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Upstart Hldgs options trades today is 1278.79 with a total volume of 6,664.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Upstart Hldgs's big money trades within a strike price range of $45.0 to $100.0 over the last 30 days.

Upstart Hldgs 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPST | CALL | SWEEP | BEARISH | 09/19/25 | $18.95 | $18.6 | $18.95 | $65.00 | $1.1M | 1.5K | 609 |

| UPST | CALL | SWEEP | BEARISH | 01/16/26 | $18.0 | $17.9 | $17.9 | $80.00 | $966.3K | 6.1K | 551 |

| UPST | CALL | TRADE | BULLISH | 01/16/26 | $14.35 | $14.2 | $14.35 | $90.00 | $430.5K | 1.9K | 300 |

| UPST | CALL | TRADE | BULLISH | 01/16/26 | $11.55 | $11.3 | $11.5 | $100.00 | $138.0K | 1.2K | 125 |

| UPST | CALL | SWEEP | BULLISH | 07/25/25 | $2.2 | $2.0 | $2.2 | $80.00 | $132.0K | 1.1K | 623 |

About Upstart Hldgs

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. Upstart's platform includes personal loans, automotive retail and refinance loans, home equity lines of credit, and small-dollar loans.

In light of the recent options history for Upstart Hldgs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Upstart Hldgs Standing Right Now?

- Currently trading with a volume of 3,620,733, the UPST's price is up by 2.25%, now at $78.69.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 19 days.

What Analysts Are Saying About Upstart Hldgs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $73.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs downgraded its action to Sell with a price target of $71.

* An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $75.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Upstart Hldgs options trades with real-time alerts from Benzinga Pro.