Thermo Fisher Scientific's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Thermo Fisher Scientific (NYSE:TMO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TMO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Thermo Fisher Scientific. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 30% bearish. Among these notable options, 2 are puts, totaling $135,565, and 11 are calls, amounting to $1,830,969.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $330.0 to $500.0 for Thermo Fisher Scientific over the last 3 months.

Volume & Open Interest Development

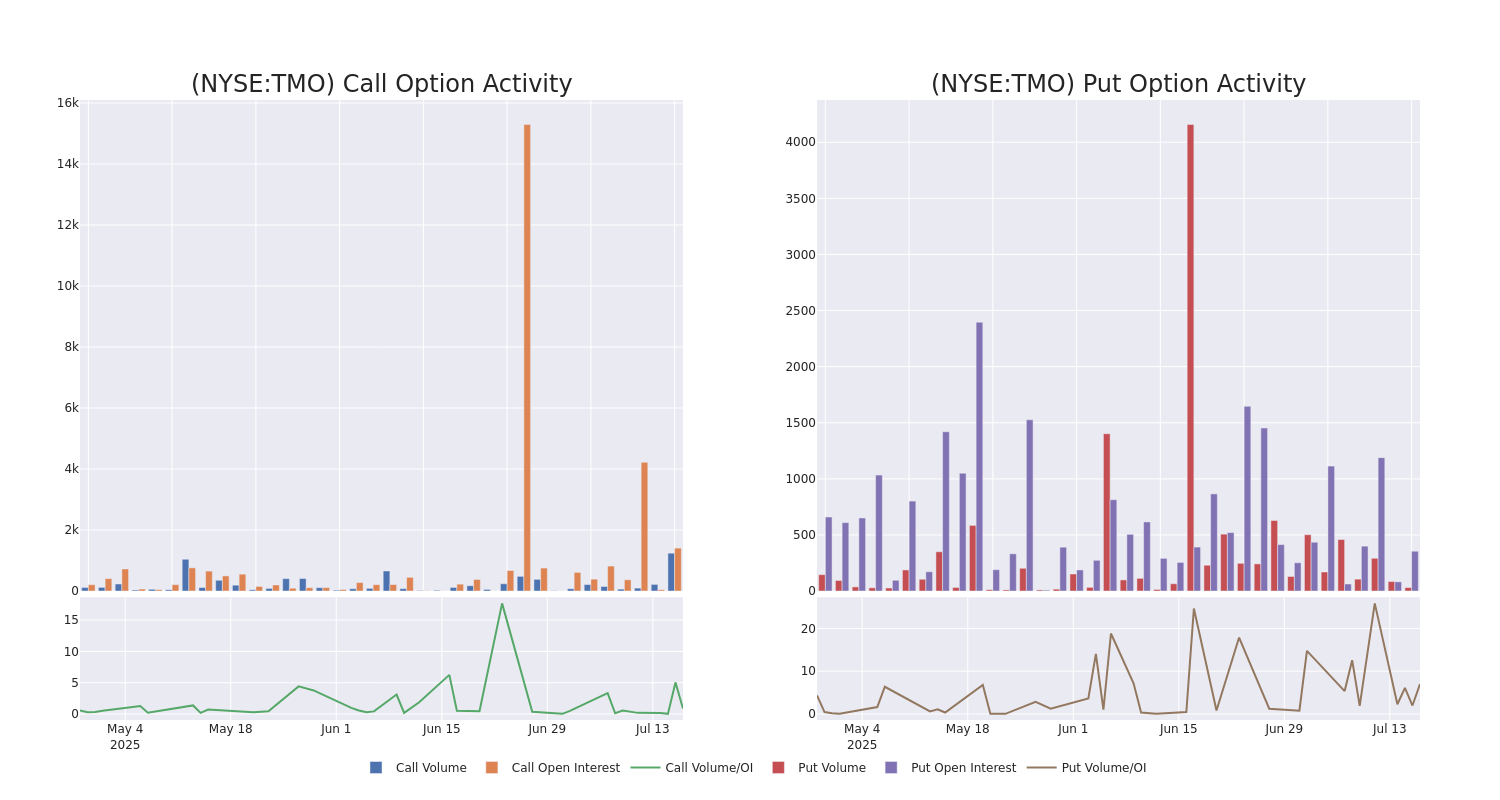

In today's trading context, the average open interest for options of Thermo Fisher Scientific stands at 175.8, with a total volume reaching 1,244.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Thermo Fisher Scientific, situated within the strike price corridor from $330.0 to $500.0, throughout the last 30 days.

Thermo Fisher Scientific Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | TRADE | BEARISH | 08/01/25 | $15.9 | $14.7 | $14.8 | $420.00 | $1.3M | 12 | 1.0K |

| TMO | PUT | SWEEP | BULLISH | 09/18/26 | $41.8 | $39.4 | $39.4 | $400.00 | $110.3K | 4 | 28 |

| TMO | CALL | TRADE | BULLISH | 06/18/26 | $121.0 | $117.0 | $121.0 | $330.00 | $96.8K | 1 | 8 |

| TMO | CALL | SWEEP | BULLISH | 01/16/26 | $69.7 | $68.6 | $69.7 | $380.00 | $69.6K | 15 | 0 |

| TMO | CALL | SWEEP | BULLISH | 08/01/25 | $15.0 | $14.0 | $14.65 | $420.00 | $58.6K | 12 | 60 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of year end-2024 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (11%); life science solutions (23%); and lab products and services, which includes CRO services (the remainder).

Having examined the options trading patterns of Thermo Fisher Scientific, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Thermo Fisher Scientific's Current Market Status

- With a volume of 1,787,229, the price of TMO is down -0.7% at $413.4.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 6 days.

Expert Opinions on Thermo Fisher Scientific

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $495.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $460.

* Showing optimism, an analyst from Scotiabank upgrades its rating to Sector Outperform with a revised price target of $590.

* An analyst from Barclays persists with their Equal-Weight rating on Thermo Fisher Scientific, maintaining a target price of $450.

* An analyst from Evercore ISI Group persists with their Outperform rating on Thermo Fisher Scientific, maintaining a target price of $480.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Thermo Fisher Scientific, Benzinga Pro gives you real-time options trades alerts.