Decoding RTX's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on RTX. Our analysis of options history for RTX (NYSE:RTX) revealed 12 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $67,085, and 10 were calls, valued at $468,398.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $130.0 and $155.0 for RTX, spanning the last three months.

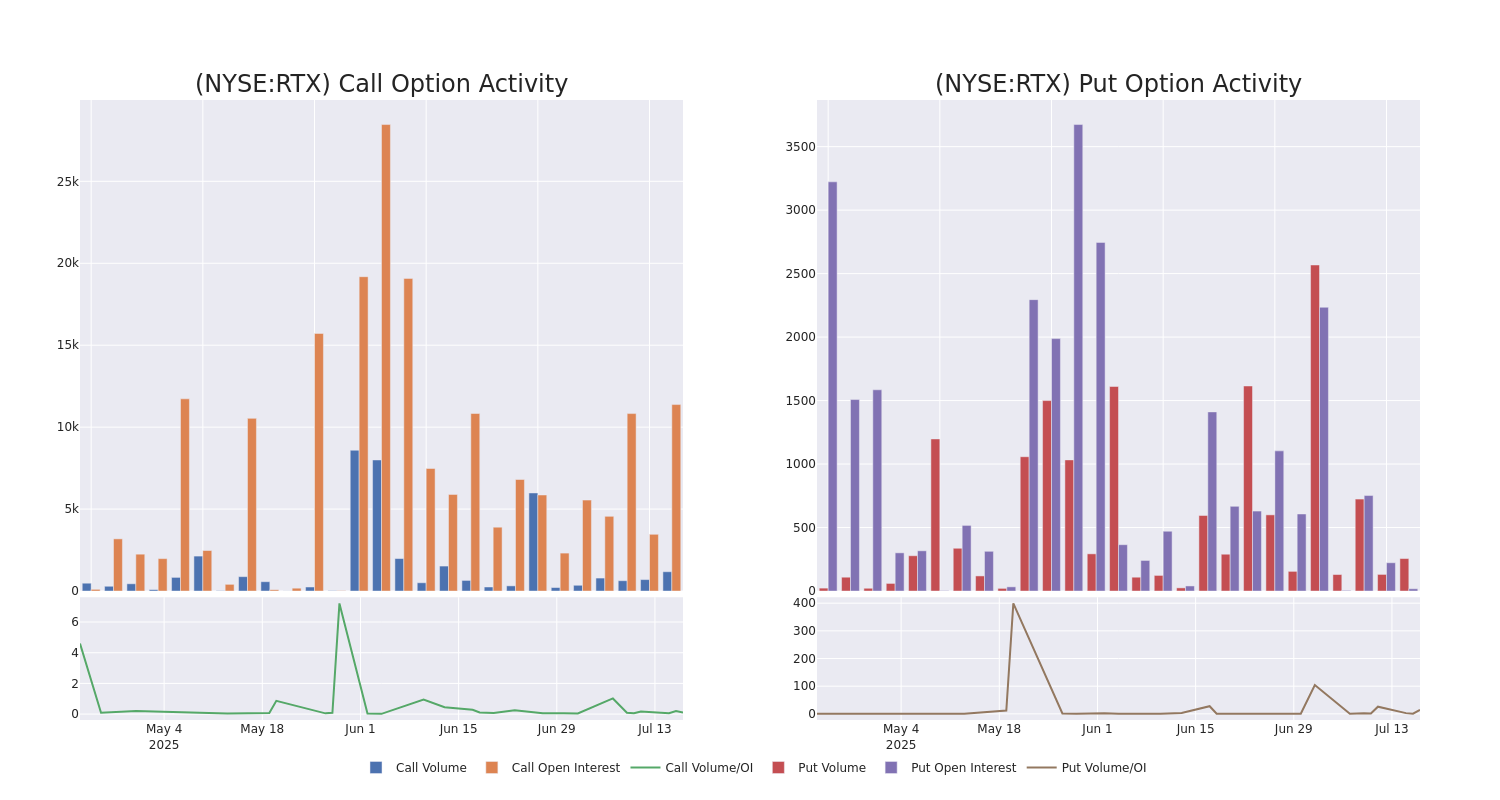

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for RTX's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of RTX's whale trades within a strike price range from $130.0 to $155.0 in the last 30 days.

RTX 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RTX | CALL | SWEEP | BULLISH | 11/21/25 | $9.6 | $9.55 | $9.6 | $150.00 | $192.0K | 1.0K | 228 |

| RTX | CALL | SWEEP | BEARISH | 09/19/25 | $4.65 | $4.05 | $4.18 | $155.00 | $42.1K | 2.2K | 100 |

| RTX | PUT | TRADE | BULLISH | 03/20/26 | $6.4 | $6.25 | $6.25 | $140.00 | $40.6K | 18 | 176 |

| RTX | CALL | TRADE | BULLISH | 08/15/25 | $9.1 | $9.1 | $9.1 | $145.00 | $37.3K | 3.1K | 227 |

| RTX | CALL | SWEEP | BEARISH | 07/18/25 | $11.15 | $11.0 | $11.0 | $140.00 | $34.1K | 1.6K | 61 |

About RTX

RTX is an aerospace and defense manufacturer formed from the merger of United Technologies and Raytheon, with roughly equal exposure as a supplier to commercial aerospace and to the defense market across three segments: Collins Aerospace, a diversified aerospace supplier; Pratt & Whitney, a commercial and military aircraft engine manufacturer; and Raytheon, a defense prime contractor providing a mix of missiles, missile defense systems, sensors, hardware, and communications technology to the military.

Where Is RTX Standing Right Now?

- Trading volume stands at 2,868,233, with RTX's price up by 0.2%, positioned at $150.47.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 5 days.

Expert Opinions on RTX

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $157.67.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on RTX with a target price of $165.

* An analyst from Goldman Sachs persists with their Neutral rating on RTX, maintaining a target price of $126.

* An analyst from Citigroup has decided to maintain their Buy rating on RTX, which currently sits at a price target of $182.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for RTX with Benzinga Pro for real-time alerts.