Shopify's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on Shopify (NASDAQ:SHOP).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SHOP, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 38 uncommon options trades for Shopify.

This isn't normal.

The overall sentiment of these big-money traders is split between 52% bullish and 39%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $422,132, and 33 are calls, for a total amount of $2,799,115.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $170.0 for Shopify over the recent three months.

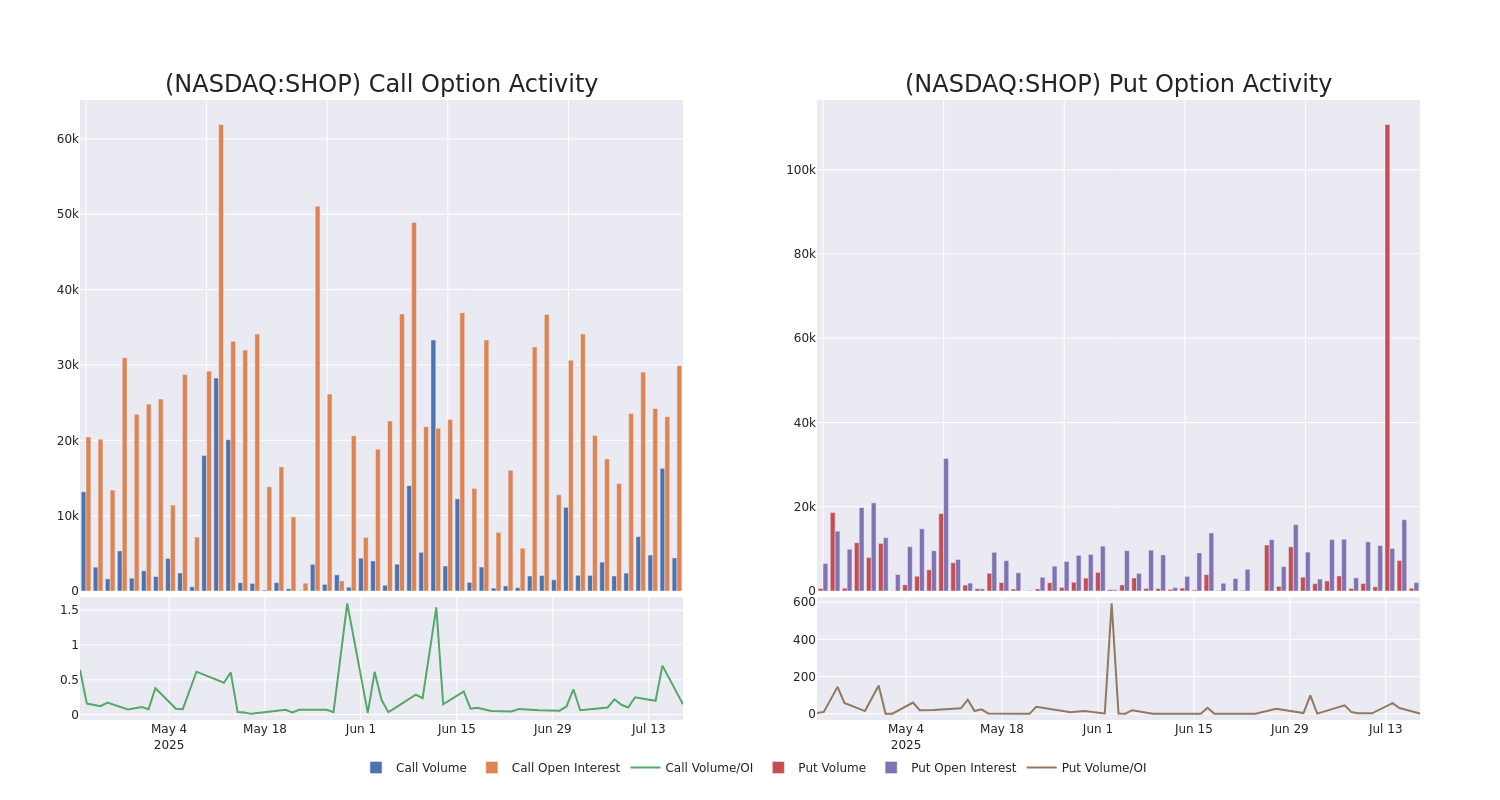

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Shopify's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Shopify's substantial trades, within a strike price spectrum from $70.0 to $170.0 over the preceding 30 days.

Shopify Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | BULLISH | 09/19/25 | $5.05 | $4.85 | $5.0 | $145.00 | $500.0K | 1.4K | 1.0K |

| SHOP | PUT | SWEEP | BULLISH | 12/18/26 | $20.5 | $20.05 | $20.21 | $115.00 | $258.6K | 159 | 128 |

| SHOP | CALL | SWEEP | BEARISH | 08/08/25 | $11.2 | $11.05 | $11.0 | $122.00 | $211.2K | 72 | 219 |

| SHOP | CALL | SWEEP | NEUTRAL | 01/16/26 | $13.3 | $13.25 | $13.3 | $140.00 | $171.5K | 784 | 134 |

| SHOP | CALL | TRADE | BULLISH | 07/18/25 | $5.45 | $5.2 | $5.45 | $123.00 | $162.9K | 2.0K | 329 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

In light of the recent options history for Shopify, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Shopify's Current Market Status

- Currently trading with a volume of 5,319,449, the SHOP's price is up by 0.93%, now at $127.93.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 19 days.

What The Experts Say On Shopify

3 market experts have recently issued ratings for this stock, with a consensus target price of $121.67.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Stifel keeps a Hold rating on Shopify with a target price of $110.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $135.

* An analyst from Baird has decided to maintain their Outperform rating on Shopify, which currently sits at a price target of $120.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Shopify with Benzinga Pro for real-time alerts.