Looking At Verizon Communications's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Verizon Communications.

Looking at options history for Verizon Communications (NYSE:VZ) we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 53% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $117,002 and 11, calls, for a total amount of $551,257.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $47.0 for Verizon Communications during the past quarter.

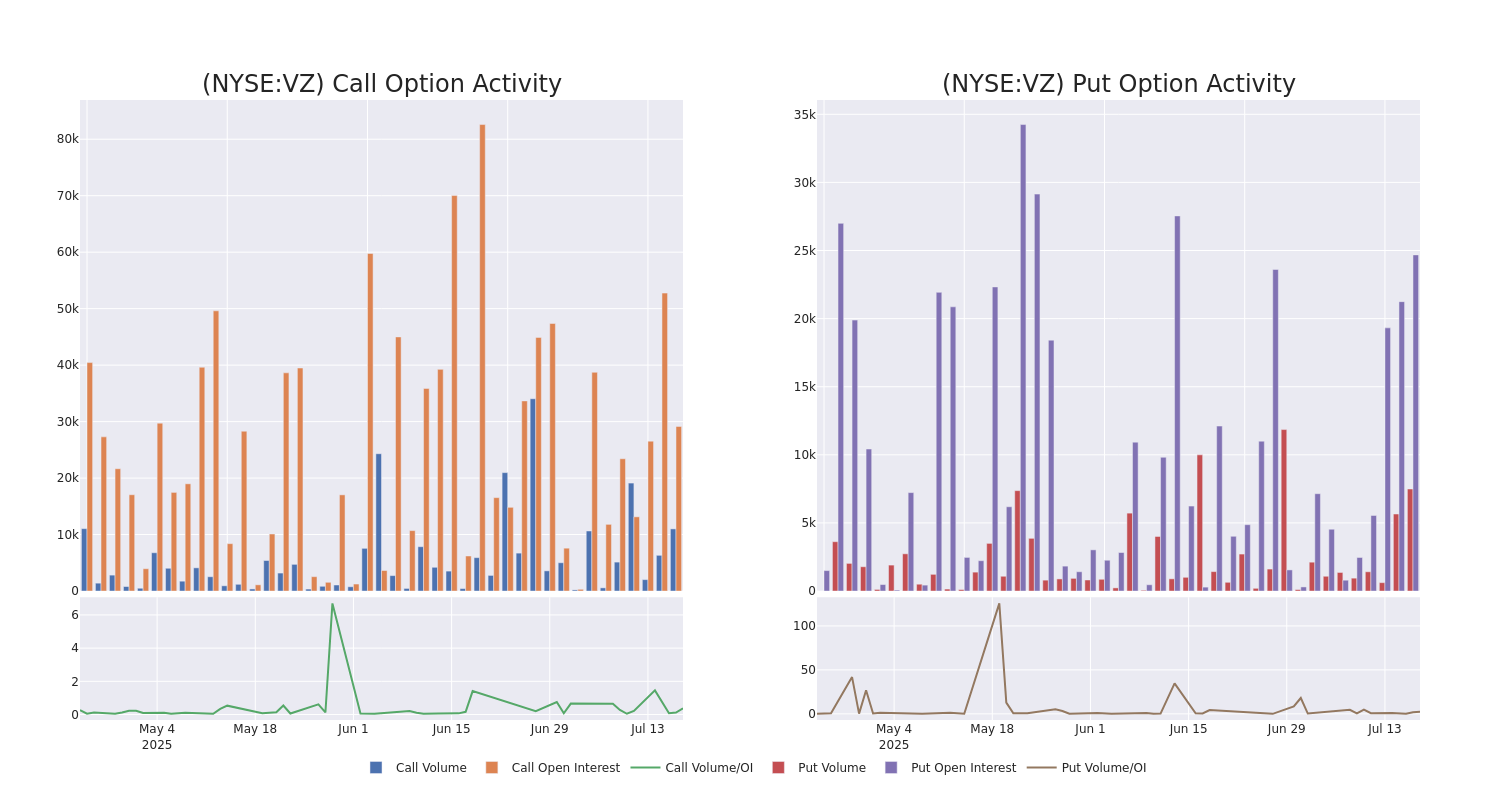

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Verizon Communications's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Verizon Communications's significant trades, within a strike price range of $40.0 to $47.0, over the past month.

Verizon Communications 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | TRADE | BULLISH | 03/20/26 | $1.0 | $0.97 | $1.0 | $47.00 | $100.0K | 1.0K | 1.0K |

| VZ | CALL | SWEEP | BEARISH | 09/19/25 | $1.37 | $1.34 | $1.34 | $43.00 | $80.1K | 7.5K | 1.4K |

| VZ | CALL | SWEEP | BULLISH | 10/17/25 | $0.67 | $0.65 | $0.65 | $45.00 | $78.9K | 7.7K | 2.2K |

| VZ | CALL | SWEEP | BEARISH | 01/16/26 | $3.75 | $3.35 | $3.35 | $40.00 | $67.0K | 10.2K | 3 |

| VZ | CALL | SWEEP | BEARISH | 01/16/26 | $1.03 | $1.0 | $1.0 | $45.00 | $40.0K | 24.3K | 390 |

About Verizon Communications

Wireless services account for nearly 75% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 30 million homes and businesses, including about 20 million with the Fios fiber optic network. These networks serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks. Verizon agreed to acquire Frontier Communications in September 2024.

Following our analysis of the options activities associated with Verizon Communications, we pivot to a closer look at the company's own performance.

Where Is Verizon Communications Standing Right Now?

- With a trading volume of 38,759,733, the price of VZ is up by 4.2%, reaching $42.55.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

Expert Opinions on Verizon Communications

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $45.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Neutral, setting a price target of $45.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Verizon Communications, maintaining a target price of $43.

* An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $47.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Verizon Communications, Benzinga Pro gives you real-time options trades alerts.