McDonald's's Options: A Look at What the Big Money is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on McDonald's.

Looking at options history for McDonald's (NYSE:MCD) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $142,590 and 5, calls, for a total amount of $206,986.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $270.0 to $310.0 for McDonald's over the recent three months.

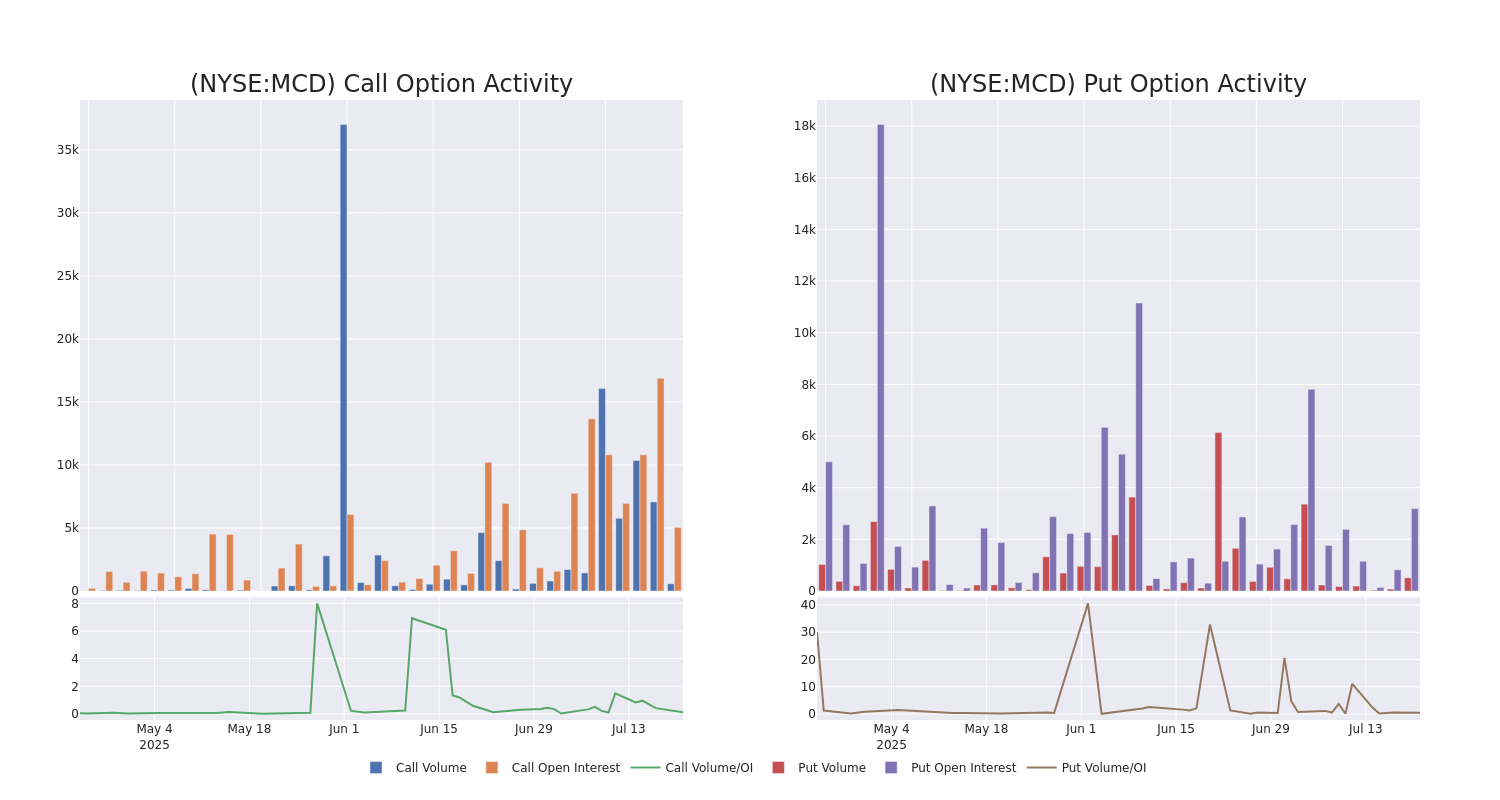

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for McDonald's's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across McDonald's's significant trades, within a strike price range of $270.0 to $310.0, over the past month.

McDonald's Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCD | PUT | SWEEP | BEARISH | 09/19/25 | $3.4 | $3.3 | $3.38 | $280.00 | $67.9K | 1.2K | 414 |

| MCD | CALL | SWEEP | NEUTRAL | 08/15/25 | $5.35 | $5.3 | $5.3 | $300.00 | $62.5K | 4.0K | 147 |

| MCD | CALL | SWEEP | NEUTRAL | 08/01/25 | $27.7 | $26.4 | $27.2 | $270.00 | $54.3K | 81 | 40 |

| MCD | PUT | TRADE | BEARISH | 03/20/26 | $10.9 | $10.7 | $10.85 | $280.00 | $43.4K | 332 | 42 |

| MCD | CALL | SWEEP | BULLISH | 08/15/25 | $6.3 | $6.2 | $6.3 | $300.00 | $36.5K | 4.0K | 352 |

About McDonald's

McDonald's is the largest restaurant owner-operator in the world, with 2024 system sales of $131 billion across more than 43,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

In light of the recent options history for McDonald's, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is McDonald's Standing Right Now?

- Trading volume stands at 2,128,330, with MCD's price down by -0.4%, positioned at $295.87.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 16 days.

What Analysts Are Saying About McDonald's

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $342.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup has decided to maintain their Buy rating on McDonald's, which currently sits at a price target of $365.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for McDonald's, targeting a price of $322.

* Showing optimism, an analyst from Goldman Sachs upgrades its rating to Buy with a revised price target of $345.

* An analyst from Truist Securities persists with their Buy rating on McDonald's, maintaining a target price of $356.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on McDonald's with a target price of $325.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for McDonald's with Benzinga Pro for real-time alerts.