This Is What Whales Are Betting On MARA Holdings

Whales with a lot of money to spend have taken a noticeably bearish stance on MARA Holdings.

Looking at options history for MARA Holdings (NASDAQ:MARA) we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 24% of the investors opened trades with bullish expectations and 64% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $142,697 and 21, calls, for a total amount of $1,520,957.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $30.0 for MARA Holdings over the last 3 months.

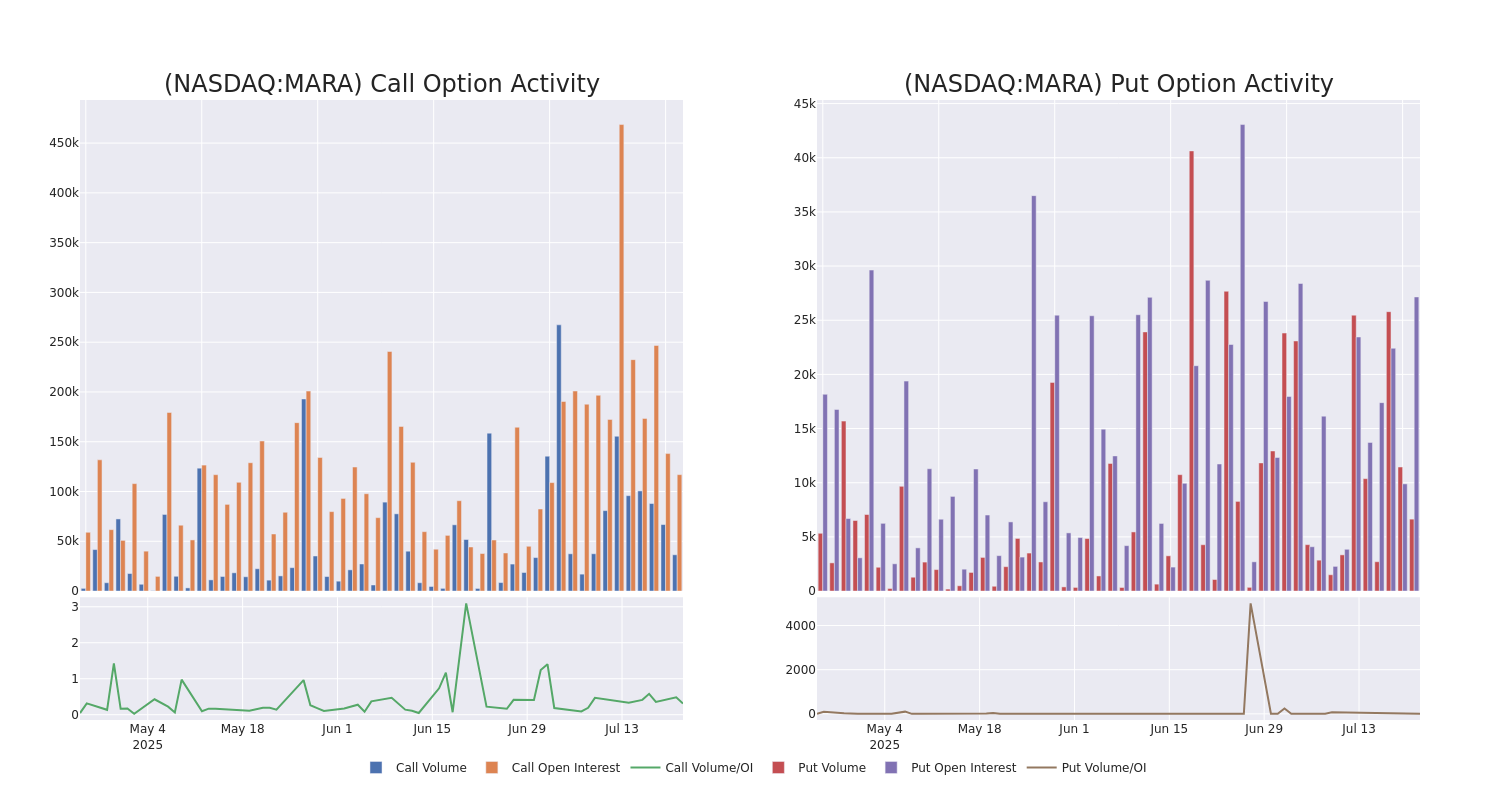

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MARA Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MARA Holdings's substantial trades, within a strike price spectrum from $12.0 to $30.0 over the preceding 30 days.

MARA Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | CALL | TRADE | NEUTRAL | 12/17/27 | $6.2 | $6.05 | $6.12 | $30.00 | $397.8K | 1.0K | 1.3K |

| MARA | CALL | SWEEP | BEARISH | 09/19/25 | $2.33 | $2.3 | $2.3 | $19.00 | $153.6K | 7.5K | 2.5K |

| MARA | CALL | SWEEP | BEARISH | 07/25/25 | $0.92 | $0.9 | $0.9 | $19.00 | $90.1K | 8.8K | 8.7K |

| MARA | CALL | SWEEP | BEARISH | 08/15/25 | $0.41 | $0.39 | $0.39 | $25.00 | $78.2K | 9.7K | 791 |

| MARA | CALL | SWEEP | BULLISH | 07/25/25 | $0.75 | $0.73 | $0.75 | $19.50 | $75.0K | 10.3K | 10.5K |

About MARA Holdings

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value. The company also offers technology solutions to optimize data center operations, including next-generation liquid immersion cooling and firmware for bitcoin miners. It is focused on computing for, acquiring, and holding digital assets as a long-term investment.

In light of the recent options history for MARA Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is MARA Holdings Standing Right Now?

- With a volume of 24,667,678, the price of MARA is up 4.73% at $19.72.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 7 days.

Expert Opinions on MARA Holdings

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for MARA Holdings, targeting a price of $26.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MARA Holdings, Benzinga Pro gives you real-time options trades alerts.