Market Whales and Their Recent Bets on FUTU Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Futu Holdings.

Looking at options history for Futu Holdings (NASDAQ:FUTU) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 10% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $359,730 and 6, calls, for a total amount of $629,438.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $200.0 for Futu Holdings over the last 3 months.

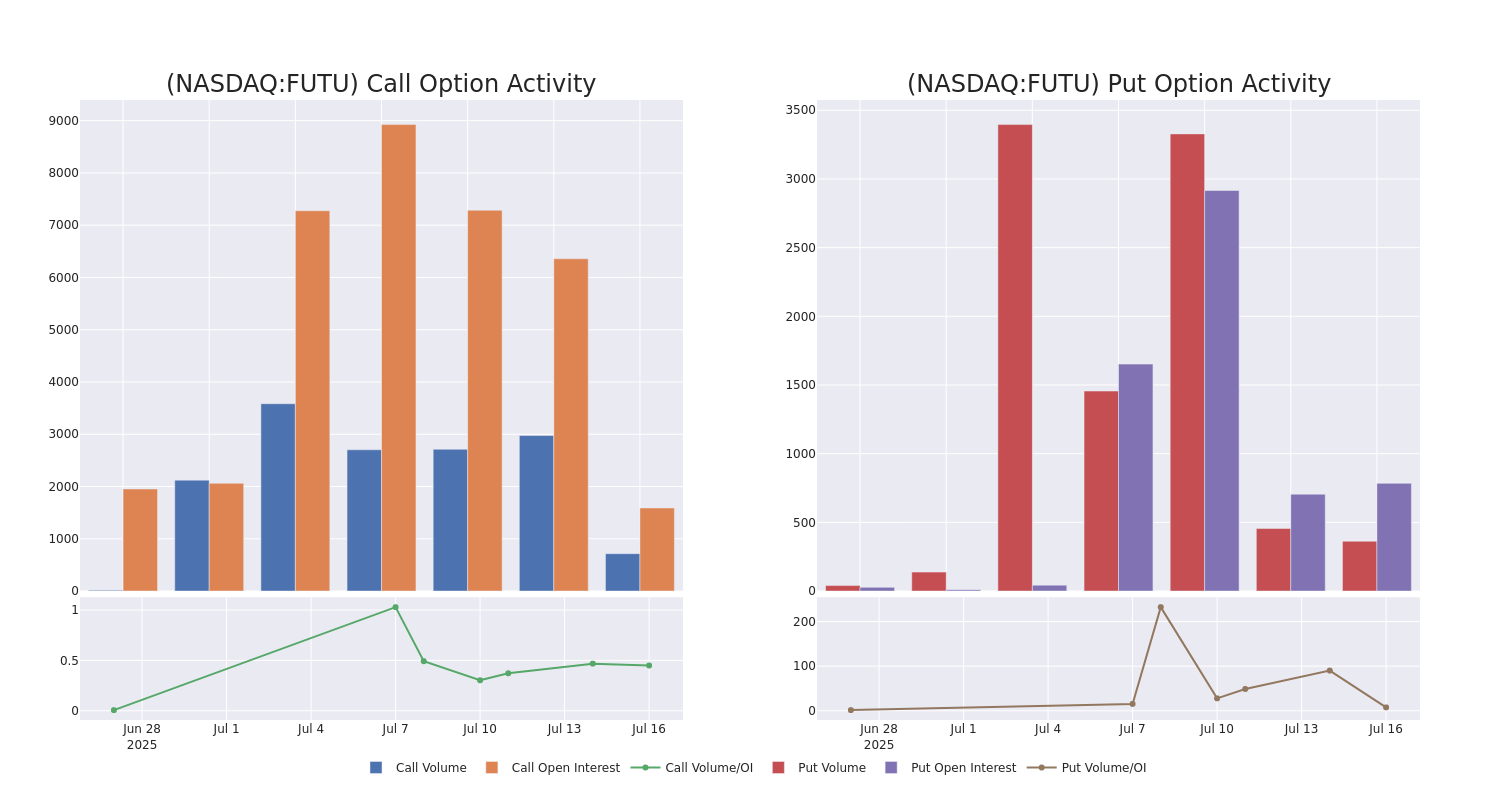

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Futu Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Futu Holdings's whale trades within a strike price range from $130.0 to $200.0 in the last 30 days.

Futu Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FUTU | PUT | SWEEP | BULLISH | 08/15/25 | $6.0 | $5.95 | $5.95 | $160.00 | $236.2K | 33 | 400 |

| FUTU | CALL | TRADE | BULLISH | 07/25/25 | $42.2 | $41.2 | $42.2 | $130.00 | $211.0K | 74 | 54 |

| FUTU | CALL | TRADE | BULLISH | 11/21/25 | $16.0 | $13.65 | $15.5 | $200.00 | $167.4K | 3 | 108 |

| FUTU | CALL | TRADE | BULLISH | 09/19/25 | $20.1 | $18.5 | $19.6 | $165.00 | $98.0K | 223 | 0 |

| FUTU | CALL | TRADE | NEUTRAL | 09/19/25 | $15.1 | $13.7 | $14.49 | $180.00 | $72.4K | 602 | 50 |

About Futu Holdings

Futu Holdings Ltd is an online broker providing one-stop online investing services. The company provides its services through its digital platform Futu NiuNiu, which includes market data, trading service, and news feed of Hong Kong, Mainland China, Singapore, and the United States equity markets. It generates its revenue in the form of brokerage commission and handling charge services, and interest income.

Having examined the options trading patterns of Futu Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Futu Holdings

- With a trading volume of 735,807, the price of FUTU is up by 1.67%, reaching $167.0.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 27 days from now.

What Analysts Are Saying About Futu Holdings

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $176.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup has decided to maintain their Neutral rating on Futu Holdings, which currently sits at a price target of $176.

* In a cautious move, an analyst from Barclays downgraded its rating to Overweight, setting a price target of $176.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Futu Holdings options trades with real-time alerts from Benzinga Pro.