Market Whales and Their Recent Bets on SNOW Options

Financial giants have made a conspicuous bearish move on Snowflake. Our analysis of options history for Snowflake (NYSE:SNOW) revealed 12 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $62,851, and 10 were calls, valued at $342,434.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $185.0 and $220.0 for Snowflake, spanning the last three months.

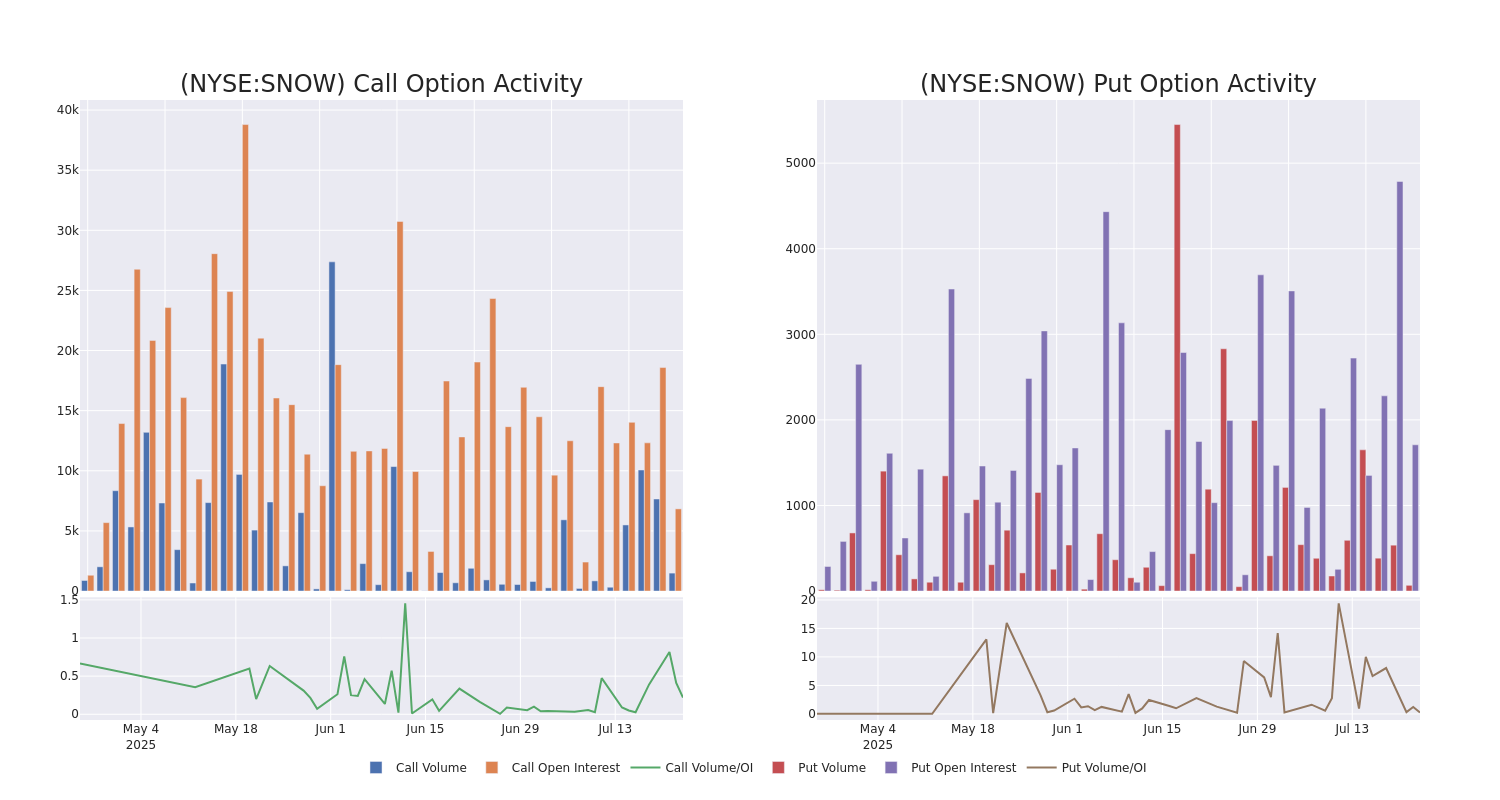

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Snowflake options trades today is 1067.75 with a total volume of 1,559.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Snowflake's big money trades within a strike price range of $185.0 to $220.0 over the last 30 days.

Snowflake 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | TRADE | BEARISH | 09/19/25 | $33.95 | $33.35 | $33.35 | $185.00 | $50.0K | 570 | 15 |

| SNOW | CALL | TRADE | NEUTRAL | 12/19/25 | $27.25 | $26.75 | $27.01 | $210.00 | $48.6K | 505 | 18 |

| SNOW | CALL | SWEEP | BULLISH | 09/19/25 | $12.8 | $12.65 | $12.75 | $220.00 | $35.9K | 4.7K | 381 |

| SNOW | PUT | SWEEP | BULLISH | 08/15/25 | $12.85 | $12.1 | $12.1 | $220.00 | $35.1K | 1.5K | 30 |

| SNOW | CALL | SWEEP | BULLISH | 09/19/25 | $12.75 | $12.65 | $12.9 | $220.00 | $33.3K | 4.7K | 430 |

About Snowflake

Founded in 2012, Snowflake is a fully managed platform that consolidates data hosted on different public clouds for centralized analytics and governance. Snowflake's cloud-native architecture allows users to independently scale the compute and storage layers, providing customers with optimized performance at lower costs. The company's data lake and data warehouse products support a variety of use cases, including business analytics, data engineering, and artificial intelligence. Snowflake is widely used by Fortune 2000 companies in financial services, media, and retail sectors.

In light of the recent options history for Snowflake, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Snowflake

- With a volume of 407,745, the price of SNOW is up 0.38% at $213.05.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

Professional Analyst Ratings for Snowflake

In the last month, 3 experts released ratings on this stock with an average target price of $261.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Snowflake with a target price of $260.

* In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $262.

* An analyst from Stephens & Co. has revised its rating downward to Overweight, adjusting the price target to $261.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.