Behind the Scenes of T-Mobile US's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on T-Mobile US (NASDAQ:TMUS).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TMUS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for T-Mobile US.

This isn't normal.

The overall sentiment of these big-money traders is split between 72% bullish and 18%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $871,770, and 6 are calls, for a total amount of $220,223.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $250.0 for T-Mobile US over the last 3 months.

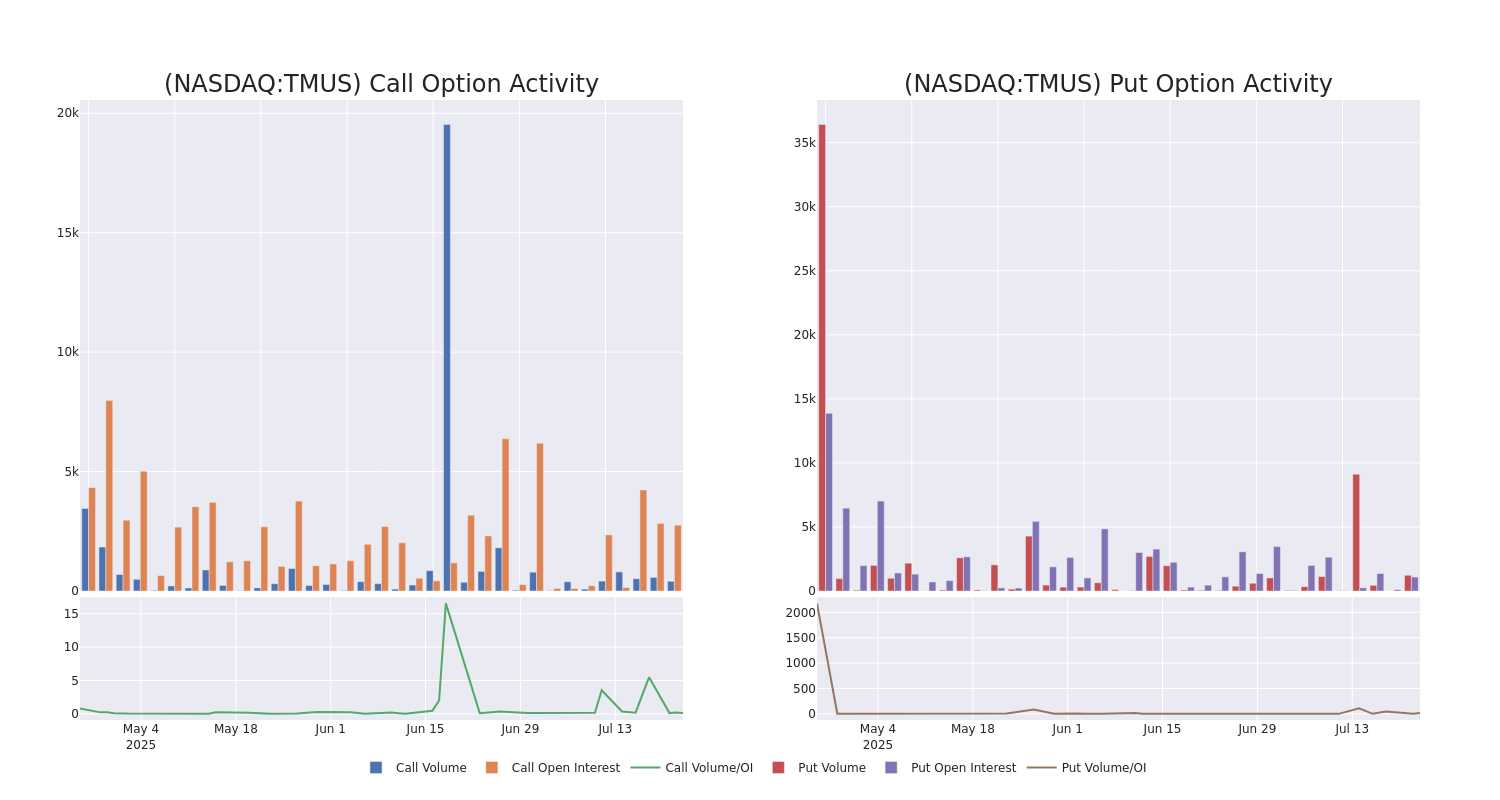

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for T-Mobile US options trades today is 350.09 with a total volume of 1,637.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for T-Mobile US's big money trades within a strike price range of $180.0 to $250.0 over the last 30 days.

T-Mobile US Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | PUT | TRADE | BULLISH | 06/18/26 | $15.55 | $14.95 | $15.05 | $220.00 | $752.5K | 304 | 500 |

| TMUS | CALL | TRADE | BULLISH | 09/18/26 | $63.45 | $62.75 | $63.45 | $180.00 | $63.4K | 21 | 10 |

| TMUS | CALL | SWEEP | BULLISH | 07/25/25 | $5.4 | $5.15 | $5.4 | $232.50 | $52.3K | 227 | 103 |

| TMUS | PUT | SWEEP | BULLISH | 07/25/25 | $7.15 | $7.05 | $7.05 | $235.00 | $35.2K | 96 | 163 |

| TMUS | PUT | SWEEP | BULLISH | 07/25/25 | $2.32 | $2.23 | $2.23 | $225.00 | $31.5K | 437 | 297 |

About T-Mobile US

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the US. T-Mobile now serves 80 million postpaid and 25 million prepaid phone customers, equal to around 30% of the US retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves 7 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

In light of the recent options history for T-Mobile US, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of T-Mobile US

- Trading volume stands at 1,585,276, with TMUS's price down by -0.49%, positioned at $232.1.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

What The Experts Say On T-Mobile US

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $240.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Neutral, setting a price target of $255.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for T-Mobile US, targeting a price of $280.

* An analyst from Redburn Atlantic upgraded its action to Neutral with a price target of $228.

* Reflecting concerns, an analyst from Keybanc lowers its rating to Underweight with a new price target of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for T-Mobile US with Benzinga Pro for real-time alerts.