STMicroelectronics Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on STMicroelectronics. Our analysis of options history for STMicroelectronics (NYSE:STM) revealed 11 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $208,085, and 6 were calls, valued at $749,507.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $27.0 and $41.0 for STMicroelectronics, spanning the last three months.

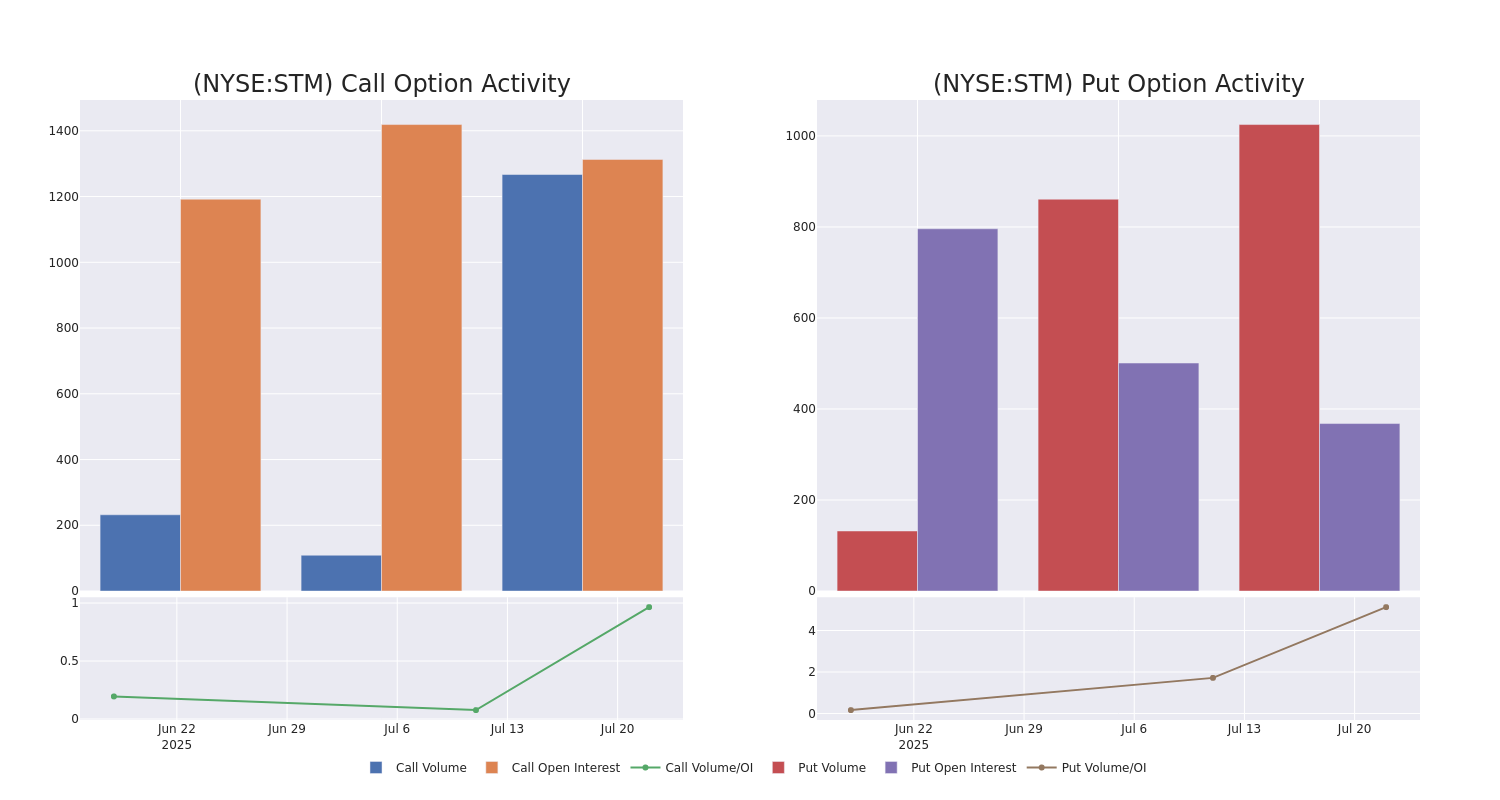

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for STMicroelectronics's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across STMicroelectronics's significant trades, within a strike price range of $27.0 to $41.0, over the past month.

STMicroelectronics 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| STM | CALL | SWEEP | BULLISH | 01/16/26 | $3.3 | $3.0 | $3.2 | $33.00 | $493.4K | 472 | 1.5K |

| STM | CALL | SWEEP | BULLISH | 08/15/25 | $4.1 | $4.0 | $4.1 | $28.00 | $81.9K | 434 | 203 |

| STM | CALL | TRADE | BEARISH | 08/15/25 | $4.3 | $4.1 | $4.15 | $28.00 | $62.2K | 434 | 355 |

| STM | PUT | TRADE | BEARISH | 01/16/26 | $9.9 | $9.6 | $9.8 | $41.00 | $49.0K | 0 | 200 |

| STM | PUT | TRADE | BEARISH | 01/16/26 | $9.9 | $9.6 | $9.8 | $41.00 | $49.0K | 0 | 150 |

About STMicroelectronics

A merger between Italian firm SGS Microelettronica and the nonmilitary business of Thomson Semiconducteurs in France formed STMicroelectronics in 1987. STMicroelectronics is a leader in a variety of semiconductor products, including analog chips, discrete power semiconductors, microcontrollers, and sensors. It is an especially prominent chip supplier to the industrial and automotive industries.

In light of the recent options history for STMicroelectronics, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of STMicroelectronics

- With a trading volume of 14,597,144, the price of STM is down by -5.55%, reaching $31.55.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 1 days from now.

Professional Analyst Ratings for STMicroelectronics

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $45.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Baird upgraded its action to Outperform with a price target of $50.

* An analyst from Susquehanna has decided to maintain their Positive rating on STMicroelectronics, which currently sits at a price target of $40.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for STMicroelectronics, Benzinga Pro gives you real-time options trades alerts.