United Rentals Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on United Rentals.

Looking at options history for United Rentals (NYSE:URI) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 45% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $129,260 and 9, calls, for a total amount of $344,280.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $450.0 to $845.0 for United Rentals over the last 3 months.

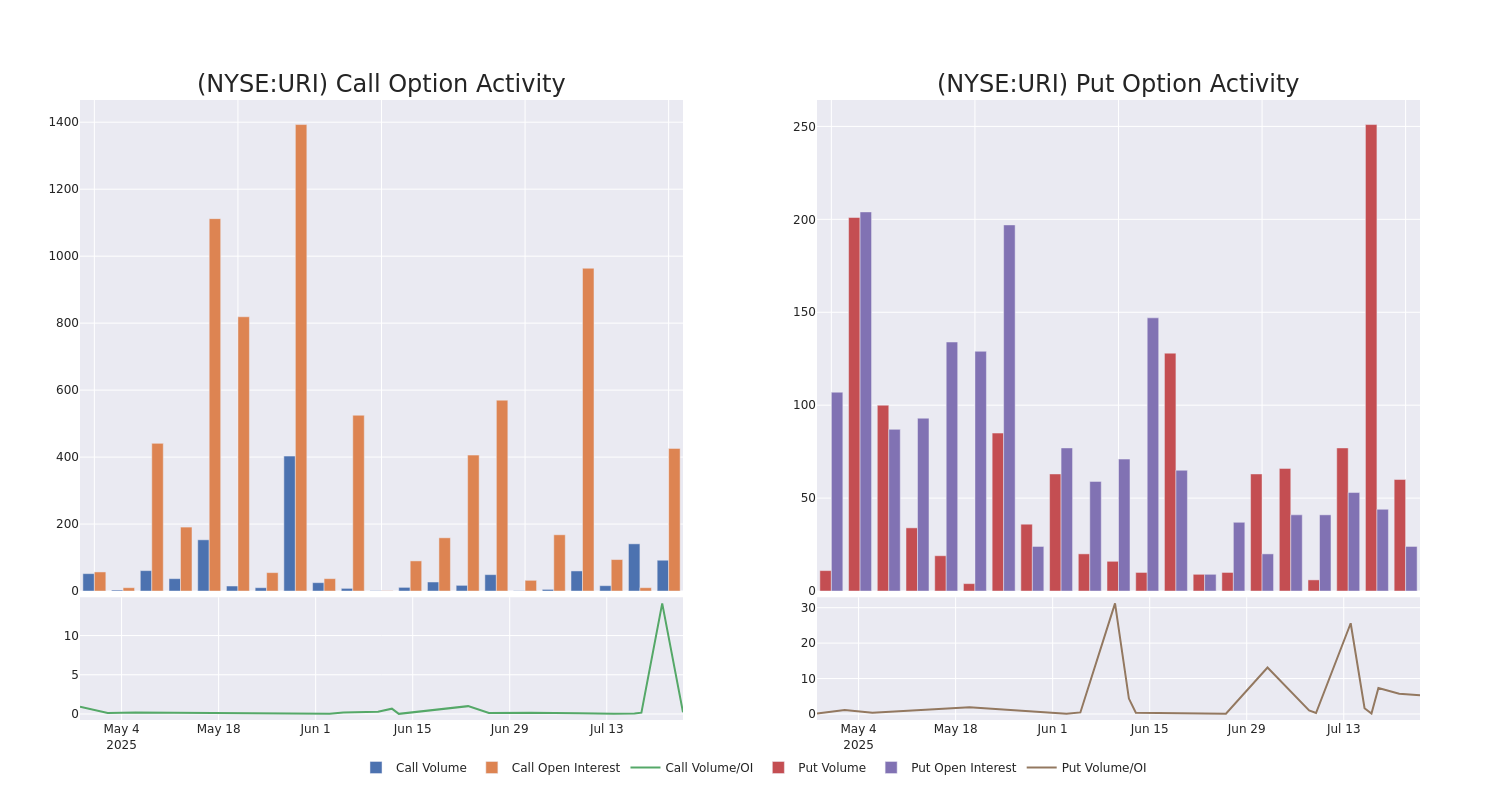

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for United Rentals's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of United Rentals's whale activity within a strike price range from $450.0 to $845.0 in the last 30 days.

United Rentals Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | PUT | TRADE | BEARISH | 01/15/27 | $21.0 | $11.0 | $17.85 | $450.00 | $89.2K | 11 | 50 |

| URI | CALL | TRADE | BULLISH | 01/15/27 | $370.9 | $367.0 | $370.9 | $500.00 | $74.1K | 30 | 2 |

| URI | CALL | SWEEP | BULLISH | 08/15/25 | $54.0 | $50.9 | $54.0 | $800.00 | $54.0K | 71 | 13 |

| URI | CALL | SWEEP | BULLISH | 07/25/25 | $42.0 | $37.3 | $42.0 | $810.00 | $42.0K | 136 | 19 |

| URI | PUT | TRADE | BULLISH | 12/19/25 | $43.5 | $38.1 | $40.01 | $800.00 | $40.0K | 13 | 10 |

About United Rentals

United Rentals is the world's largest equipment rental company, principally operating in the US and Canada. It has 16% share in a highly fragmented market serving general industrial (49%), commercial construction (46%), and residential construction (5%). The company operates a $21 billion fleet of equipment, including aerial platforms, forklifts, excavators, trucks, power generators, and various other materials serving local and national accounts from nearly 1,600 locations in North America and 100 abroad. It has pursued a strategy of bundling specialty rental capabilities to offer its customers more advanced solutions in addition to its core equipment rental business, supporting its ambitions to become a one-stop shop for customers and enhance and maintain its margin profile.

After a thorough review of the options trading surrounding United Rentals, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of United Rentals

- With a trading volume of 124,393, the price of URI is up by 5.62%, reaching $848.42.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 90 days from now.

What The Experts Say On United Rentals

3 market experts have recently issued ratings for this stock, with a consensus target price of $823.33.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Buy rating on United Rentals, which currently sits at a price target of $900.

* Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for United Rentals, targeting a price of $620.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for United Rentals, targeting a price of $950.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Rentals, Benzinga Pro gives you real-time options trades alerts.