Market Whales and Their Recent Bets on MRNA Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Moderna.

Looking at options history for Moderna (NASDAQ:MRNA) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $88,510 and 6, calls, for a total amount of $227,347.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $115.0 for Moderna over the recent three months.

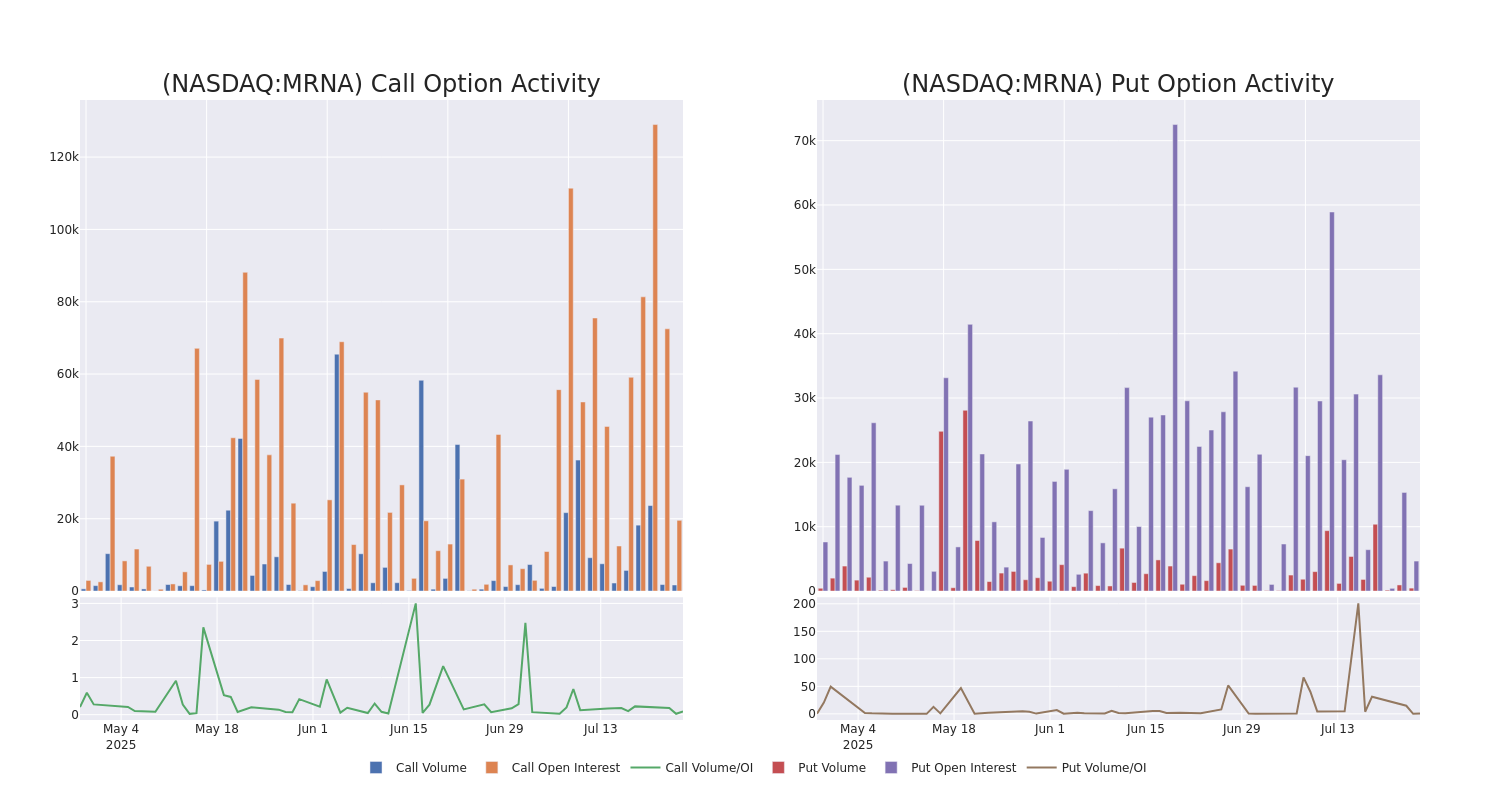

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $17.5 to $115.0 in the last 30 days.

Moderna 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | SWEEP | BEARISH | 08/01/25 | $1.0 | $0.97 | $0.97 | $35.50 | $70.0K | 7.2K | 656 |

| MRNA | CALL | SWEEP | BULLISH | 03/20/26 | $6.85 | $6.7 | $6.85 | $35.00 | $34.2K | 1.4K | 50 |

| MRNA | CALL | SWEEP | BULLISH | 08/01/25 | $0.47 | $0.45 | $0.47 | $38.00 | $33.6K | 6.7K | 569 |

| MRNA | CALL | SWEEP | BULLISH | 06/18/26 | $8.15 | $8.0 | $8.15 | $35.00 | $32.6K | 3.0K | 43 |

| MRNA | PUT | SWEEP | BEARISH | 01/16/26 | $81.05 | $80.75 | $80.97 | $115.00 | $32.3K | 12 | 4 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

In light of the recent options history for Moderna, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Moderna

- With a trading volume of 3,874,073, the price of MRNA is down by -0.12%, reaching $33.97.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 7 days from now.

Professional Analyst Ratings for Moderna

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $25.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Underperform rating for Moderna, targeting a price of $25.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Moderna with Benzinga Pro for real-time alerts.