Market Whales and Their Recent Bets on Boeing Options

Financial giants have made a conspicuous bearish move on Boeing. Our analysis of options history for Boeing (NYSE:BA) revealed 24 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $333,201, and 19 were calls, valued at $2,418,174.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $240.0 for Boeing, spanning the last three months.

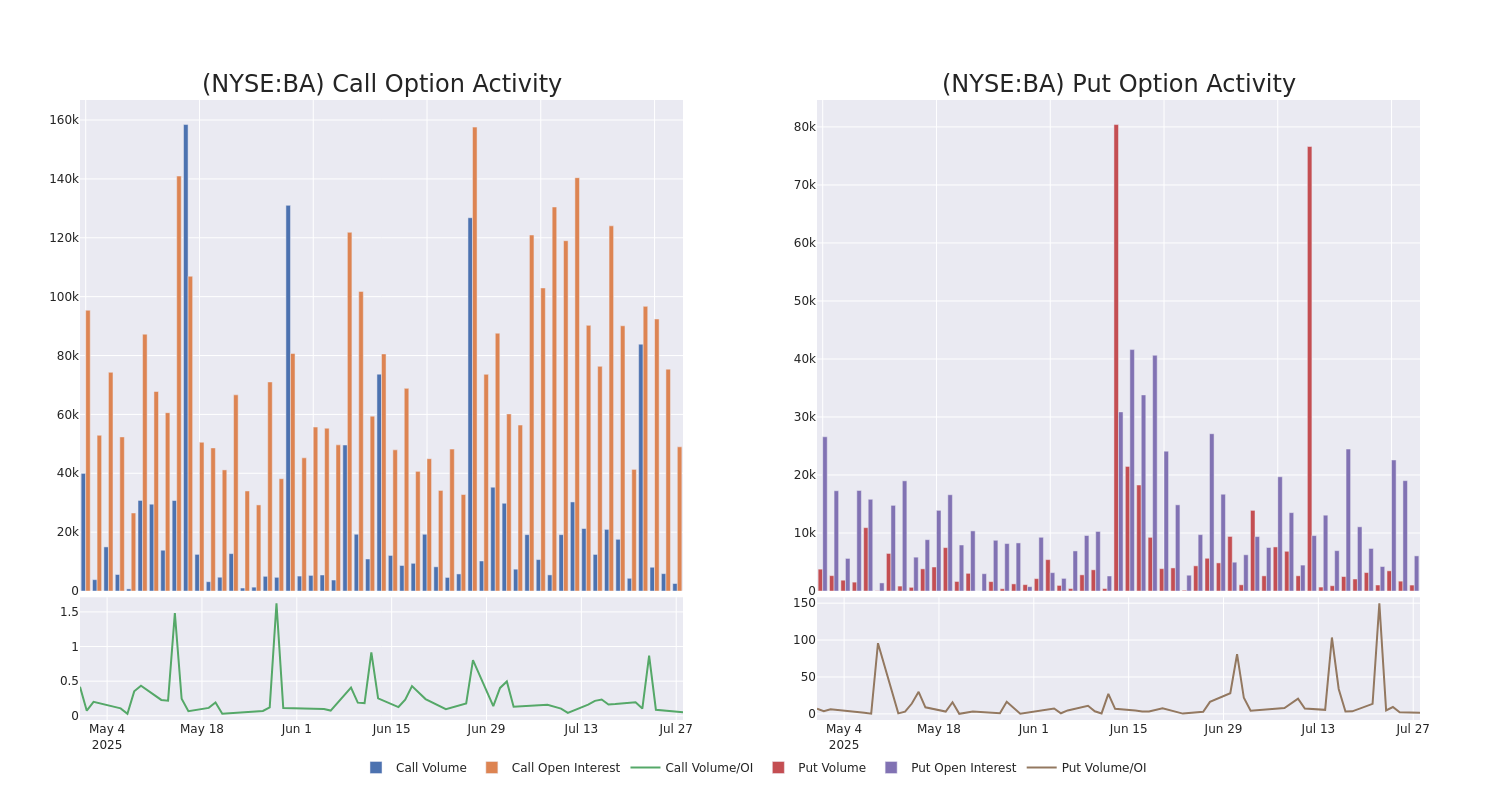

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Boeing options trades today is 2897.37 with a total volume of 3,589.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Boeing's big money trades within a strike price range of $135.0 to $240.0 over the last 30 days.

Boeing 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | CALL | TRADE | BULLISH | 01/16/26 | $18.8 | $18.45 | $19.0 | $240.00 | $570.0K | 8.6K | 302 |

| BA | CALL | TRADE | BULLISH | 12/19/25 | $22.4 | $21.85 | $22.18 | $230.00 | $443.6K | 2.1K | 1 |

| BA | CALL | TRADE | BULLISH | 09/19/25 | $8.35 | $8.15 | $8.3 | $240.00 | $332.0K | 14.9K | 909 |

| BA | CALL | TRADE | BULLISH | 01/15/27 | $63.0 | $61.35 | $63.0 | $200.00 | $321.3K | 2.5K | 0 |

| BA | PUT | SWEEP | NEUTRAL | 08/01/25 | $6.15 | $5.75 | $5.9 | $235.00 | $147.8K | 542 | 260 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with defense contractors such as Lockheed Martin and Northrop Grumman to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

Current Position of Boeing

- With a volume of 721,560, the price of BA is up 0.72% at $234.74.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 1 days.

Professional Analyst Ratings for Boeing

5 market experts have recently issued ratings for this stock, with a consensus target price of $250.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Boeing, targeting a price of $230.

* An analyst from Susquehanna has decided to maintain their Positive rating on Boeing, which currently sits at a price target of $265.

* Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Boeing, targeting a price of $252.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Boeing with a target price of $235.

* An analyst from Citigroup has decided to maintain their Buy rating on Boeing, which currently sits at a price target of $270.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.