This Is What Whales Are Betting On Uber Technologies

Deep-pocketed investors have adopted a bearish approach towards Uber Technologies (NYSE:UBER), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UBER usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 49 extraordinary options activities for Uber Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 46% bearish. Among these notable options, 16 are puts, totaling $954,375, and 33 are calls, amounting to $1,763,908.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $105.0 for Uber Technologies over the last 3 months.

Insights into Volume & Open Interest

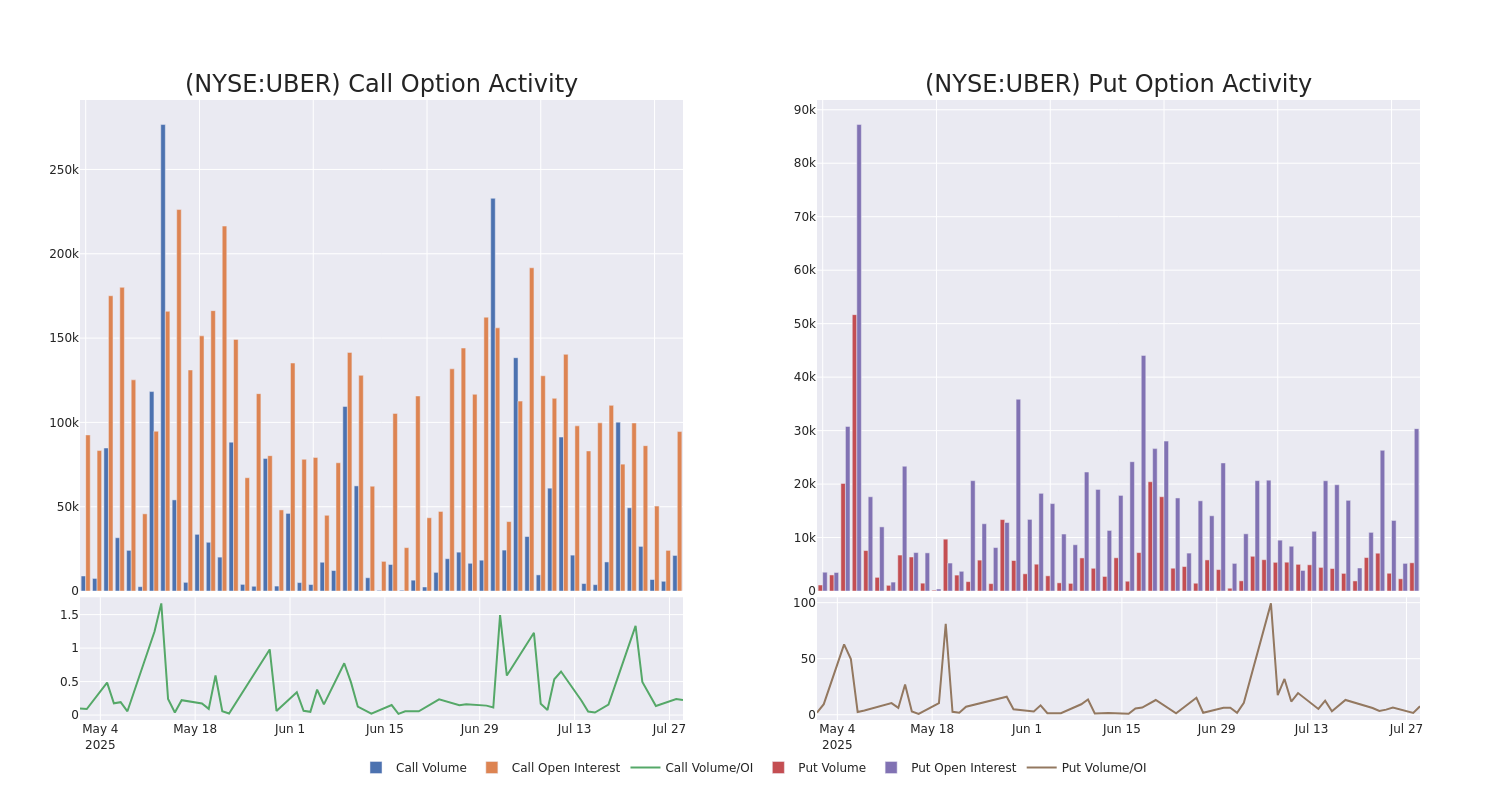

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Uber Technologies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Uber Technologies's substantial trades, within a strike price spectrum from $55.0 to $105.0 over the preceding 30 days.

Uber Technologies 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | CALL | SWEEP | BULLISH | 03/20/26 | $10.3 | $10.15 | $10.27 | $90.00 | $411.7K | 2.1K | 460 |

| UBER | PUT | SWEEP | BEARISH | 09/19/25 | $4.0 | $3.95 | $4.0 | $85.00 | $361.2K | 13.2K | 881 |

| UBER | CALL | TRADE | BEARISH | 09/19/25 | $5.9 | $5.8 | $5.8 | $87.50 | $174.0K | 2.7K | 316 |

| UBER | CALL | SWEEP | BULLISH | 08/15/25 | $1.11 | $1.07 | $1.11 | $95.00 | $111.0K | 12.6K | 1.8K |

| UBER | CALL | SWEEP | BEARISH | 01/16/26 | $4.75 | $4.7 | $4.7 | $100.00 | $96.3K | 16.0K | 665 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food couriers, and shippers with carriers. The firm's on-demand technology platform is currently utilized by traditional cars as well as autonomous vehicles, but could eventually be used for additional products and services, such as delivery via drones or electronic vehicle take-off and landing (eVTOL) technology. Uber operates in over 70 countries, with over 170 million users who order rides or food at least once a month.

Having examined the options trading patterns of Uber Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Uber Technologies

- With a volume of 16,657,502, the price of UBER is down -3.42% at $87.5.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 8 days.

What Analysts Are Saying About Uber Technologies

In the last month, 5 experts released ratings on this stock with an average target price of $109.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Uber Technologies with a target price of $110.

* Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Uber Technologies with a target price of $110.

* An analyst from Needham persists with their Buy rating on Uber Technologies, maintaining a target price of $109.

* An analyst from Stifel persists with their Buy rating on Uber Technologies, maintaining a target price of $117.

* An analyst from Piper Sandler persists with their Overweight rating on Uber Technologies, maintaining a target price of $103.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Uber Technologies with Benzinga Pro for real-time alerts.