What the Options Market Tells Us About Microsoft

Deep-pocketed investors have adopted a bullish approach towards Microsoft (NASDAQ:MSFT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MSFT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 185 extraordinary options activities for Microsoft. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 38% bearish. Among these notable options, 37 are puts, totaling $2,799,283, and 148 are calls, amounting to $10,769,703.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $210.0 to $760.0 for Microsoft during the past quarter.

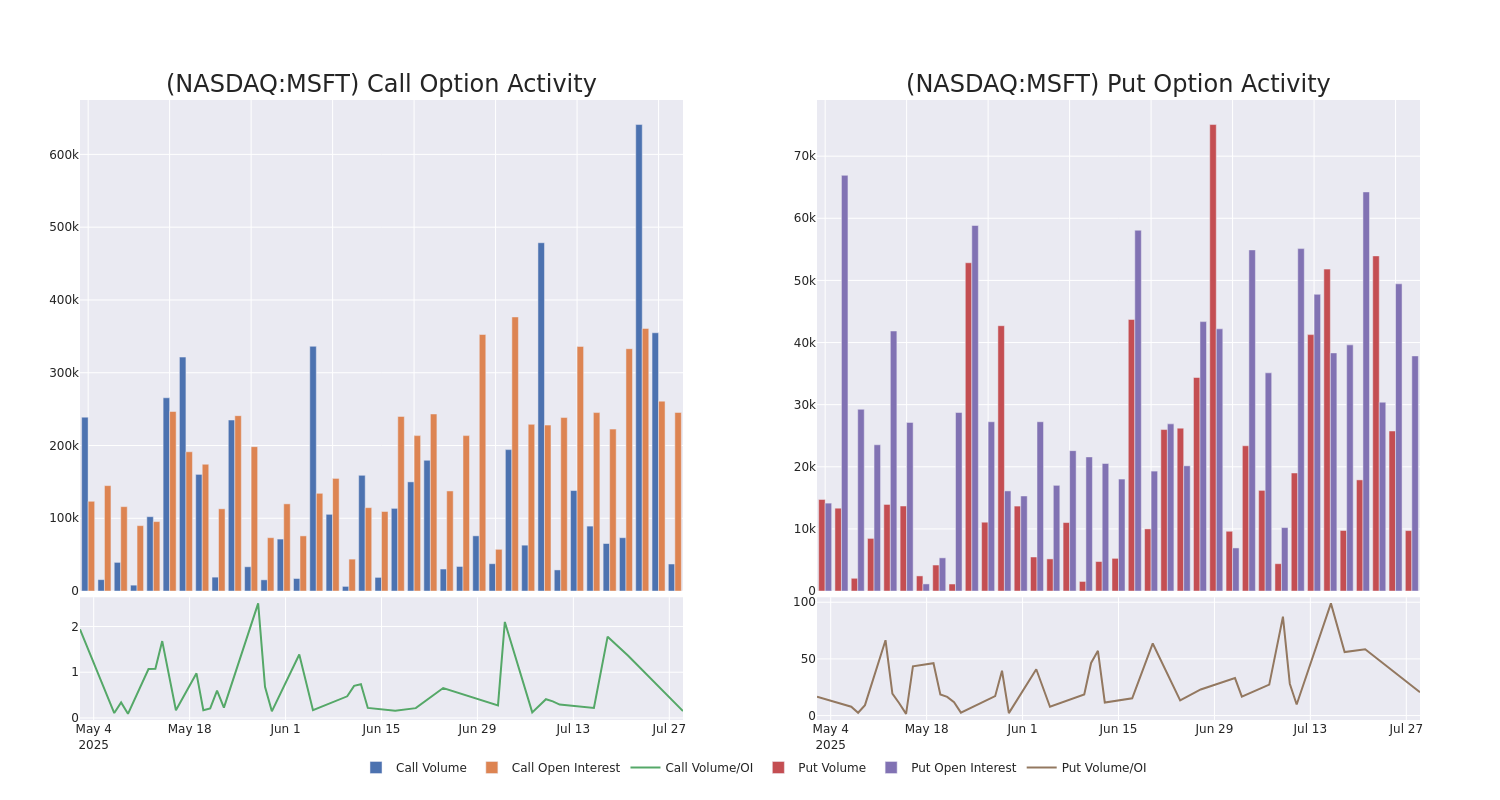

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Microsoft's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Microsoft's substantial trades, within a strike price spectrum from $210.0 to $760.0 over the preceding 30 days.

Microsoft 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | PUT | TRADE | NEUTRAL | 08/01/25 | $9.25 | $9.15 | $9.2 | $510.00 | $460.0K | 2.7K | 1.1K |

| MSFT | CALL | TRADE | BULLISH | 06/18/26 | $113.65 | $112.55 | $113.33 | $425.00 | $294.6K | 530 | 0 |

| MSFT | CALL | SWEEP | BEARISH | 12/19/25 | $28.95 | $28.8 | $28.8 | $520.00 | $201.6K | 3.1K | 81 |

| MSFT | CALL | SWEEP | BEARISH | 11/21/25 | $60.15 | $58.95 | $58.95 | $470.00 | $147.3K | 10 | 22 |

| MSFT | CALL | TRADE | BEARISH | 09/18/26 | $75.7 | $75.0 | $75.0 | $490.00 | $105.0K | 58 | 38 |

About Microsoft

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

Following our analysis of the options activities associated with Microsoft, we pivot to a closer look at the company's own performance.

Where Is Microsoft Standing Right Now?

- Trading volume stands at 8,356,327, with MSFT's price down by -0.08%, positioned at $512.11.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 1 days.

What The Experts Say On Microsoft

5 market experts have recently issued ratings for this stock, with a consensus target price of $569.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Microsoft with a target price of $540.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Microsoft, which currently sits at a price target of $545.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Microsoft with a target price of $613.

* An analyst from Oppenheimer has elevated its stance to Outperform, setting a new price target at $600.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Microsoft with a target price of $550.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Microsoft, Benzinga Pro gives you real-time options trades alerts.