Spotlight on Lululemon Athletica: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Lululemon Athletica.

Looking at options history for Lululemon Athletica (NASDAQ:LULU) we detected 56 trades.

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 26 are puts, for a total amount of $1,702,580 and 30, calls, for a total amount of $2,431,013.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $300.0 for Lululemon Athletica during the past quarter.

Volume & Open Interest Development

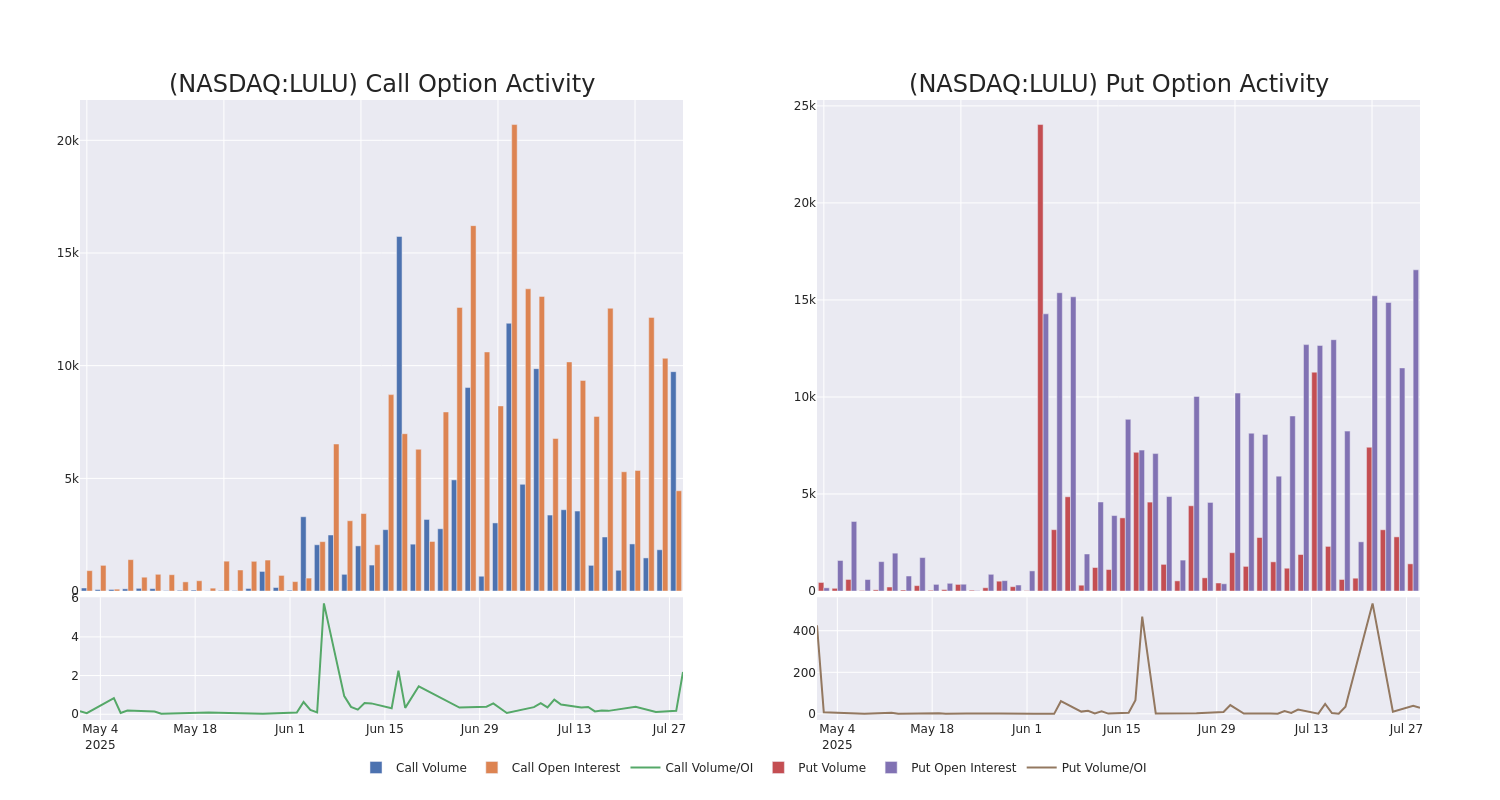

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lululemon Athletica's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lululemon Athletica's substantial trades, within a strike price spectrum from $110.0 to $300.0 over the preceding 30 days.

Lululemon Athletica Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | CALL | TRADE | BULLISH | 12/18/26 | $48.1 | $46.3 | $47.45 | $220.00 | $422.3K | 35 | 307 |

| LULU | CALL | SWEEP | BEARISH | 06/18/26 | $38.4 | $38.35 | $38.35 | $220.00 | $372.0K | 314 | 109 |

| LULU | PUT | SWEEP | BEARISH | 01/15/27 | $28.5 | $28.55 | $28.5 | $195.00 | $190.9K | 77 | 46 |

| LULU | PUT | TRADE | NEUTRAL | 08/29/25 | $51.2 | $48.3 | $49.75 | $265.00 | $144.2K | 144 | 30 |

| LULU | CALL | TRADE | BEARISH | 05/15/26 | $12.3 | $11.9 | $11.9 | $300.00 | $141.6K | 2 | 120 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. The company offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. Lululemon also sells fitness accessories, such as bags, yoga mats, and equipment. It sells its products through digital channels, a small number of wholesale partners, more than 760 company-owned stores in about two dozen countries in North America, Asia, and Western Europe, and about 40 franchised locations in the Middle East. The company was founded in 1998 and is based in Vancouver, Canada.

Following our analysis of the options activities associated with Lululemon Athletica, we pivot to a closer look at the company's own performance.

Lululemon Athletica's Current Market Status

- Currently trading with a volume of 2,151,838, the LULU's price is down by -0.39%, now at $215.75.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 30 days.

What Analysts Are Saying About Lululemon Athletica

In the last month, 2 experts released ratings on this stock with an average target price of $212.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler has decided to maintain their Neutral rating on Lululemon Athletica, which currently sits at a price target of $200.

* Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $224.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lululemon Athletica, Benzinga Pro gives you real-time options trades alerts.