Super Micro Computer's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bullish on Super Micro Computer (NASDAQ:SMCI), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SMCI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 20 options trades for Super Micro Computer. This is not a typical pattern.

The sentiment among these major traders is split, with 55% bullish and 35% bearish. Among all the options we identified, there was one put, amounting to $129,500, and 19 calls, totaling $1,203,102.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $80.0 for Super Micro Computer, spanning the last three months.

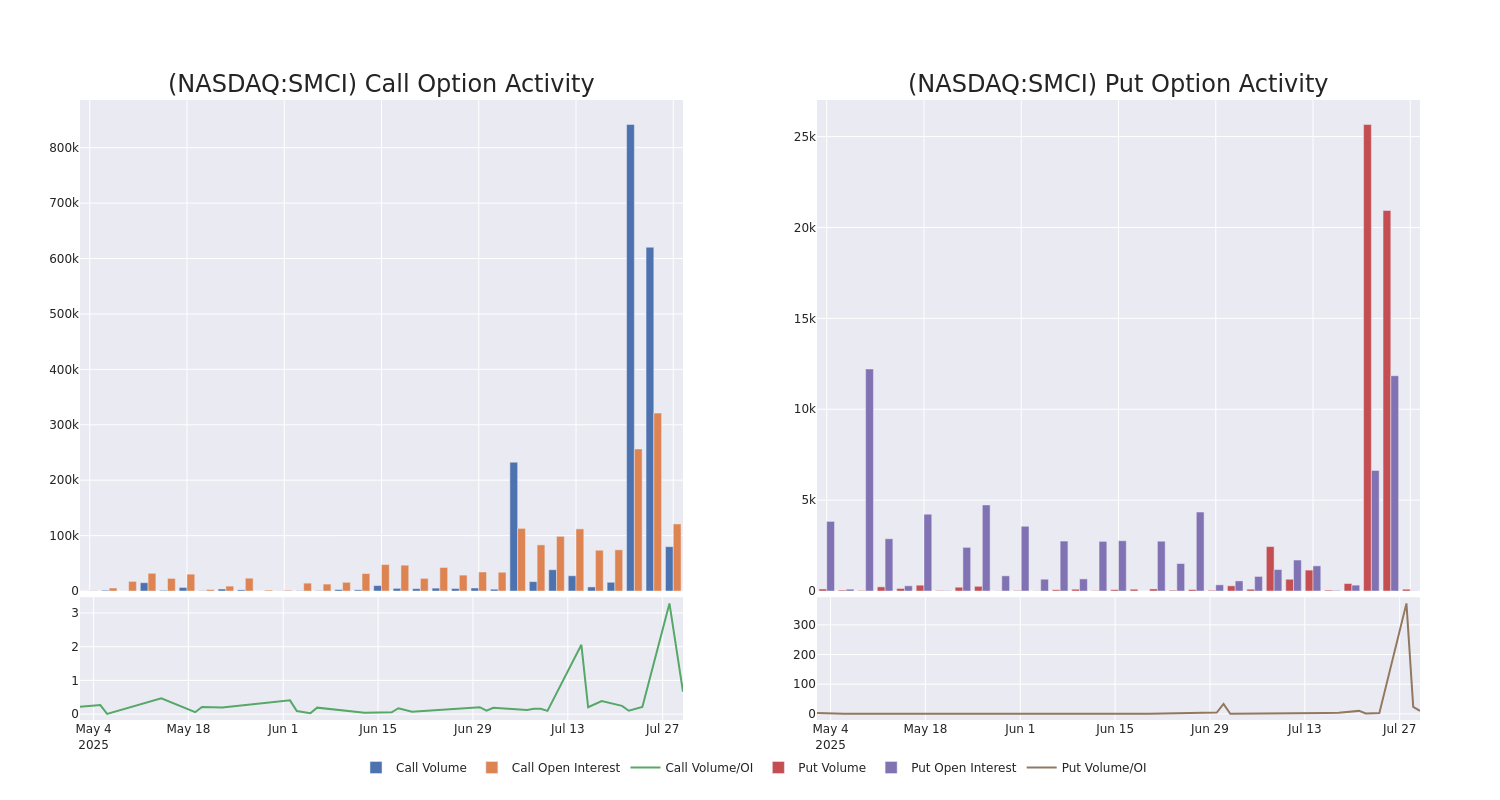

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Super Micro Computer options trades today is 12107.3 with a total volume of 80,034.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Super Micro Computer's big money trades within a strike price range of $55.0 to $80.0 over the last 30 days.

Super Micro Computer Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | CALL | SWEEP | NEUTRAL | 08/01/25 | $1.81 | $1.75 | $1.8 | $60.00 | $314.0K | 26.3K | 3.7K |

| SMCI | PUT | TRADE | BULLISH | 09/05/25 | $13.4 | $12.95 | $12.95 | $70.00 | $129.5K | 10 | 100 |

| SMCI | CALL | SWEEP | BEARISH | 08/01/25 | $1.88 | $1.85 | $1.85 | $60.00 | $100.0K | 26.3K | 6.9K |

| SMCI | CALL | SWEEP | BULLISH | 08/01/25 | $2.1 | $2.09 | $2.1 | $61.00 | $98.3K | 28.4K | 7.3K |

| SMCI | CALL | SWEEP | BULLISH | 08/15/25 | $5.95 | $5.85 | $5.93 | $60.00 | $88.9K | 23.3K | 1.1K |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data centers, Big Data, high-performance computing, and the "Internet of Things" embedded markets. Its solutions include server, storage, blade, and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular, and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

After a thorough review of the options trading surrounding Super Micro Computer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Super Micro Computer

- Trading volume stands at 5,664,602, with SMCI's price up by 3.23%, positioned at $60.52.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 6 days.

What The Experts Say On Super Micro Computer

4 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Mizuho has decided to maintain their Neutral rating on Super Micro Computer, which currently sits at a price target of $47.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Underperform, setting a price target of $35.

* An analyst from JP Morgan has decided to maintain their Neutral rating on Super Micro Computer, which currently sits at a price target of $46.

* An analyst from Citigroup has decided to maintain their Neutral rating on Super Micro Computer, which currently sits at a price target of $52.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Super Micro Computer with Benzinga Pro for real-time alerts.