Constellation Energy's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bearish approach towards Constellation Energy (NASDAQ:CEG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CEG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Constellation Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 50% bearish. Among these notable options, 4 are puts, totaling $550,446, and 14 are calls, amounting to $798,300.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $270.0 to $390.0 for Constellation Energy over the last 3 months.

Analyzing Volume & Open Interest

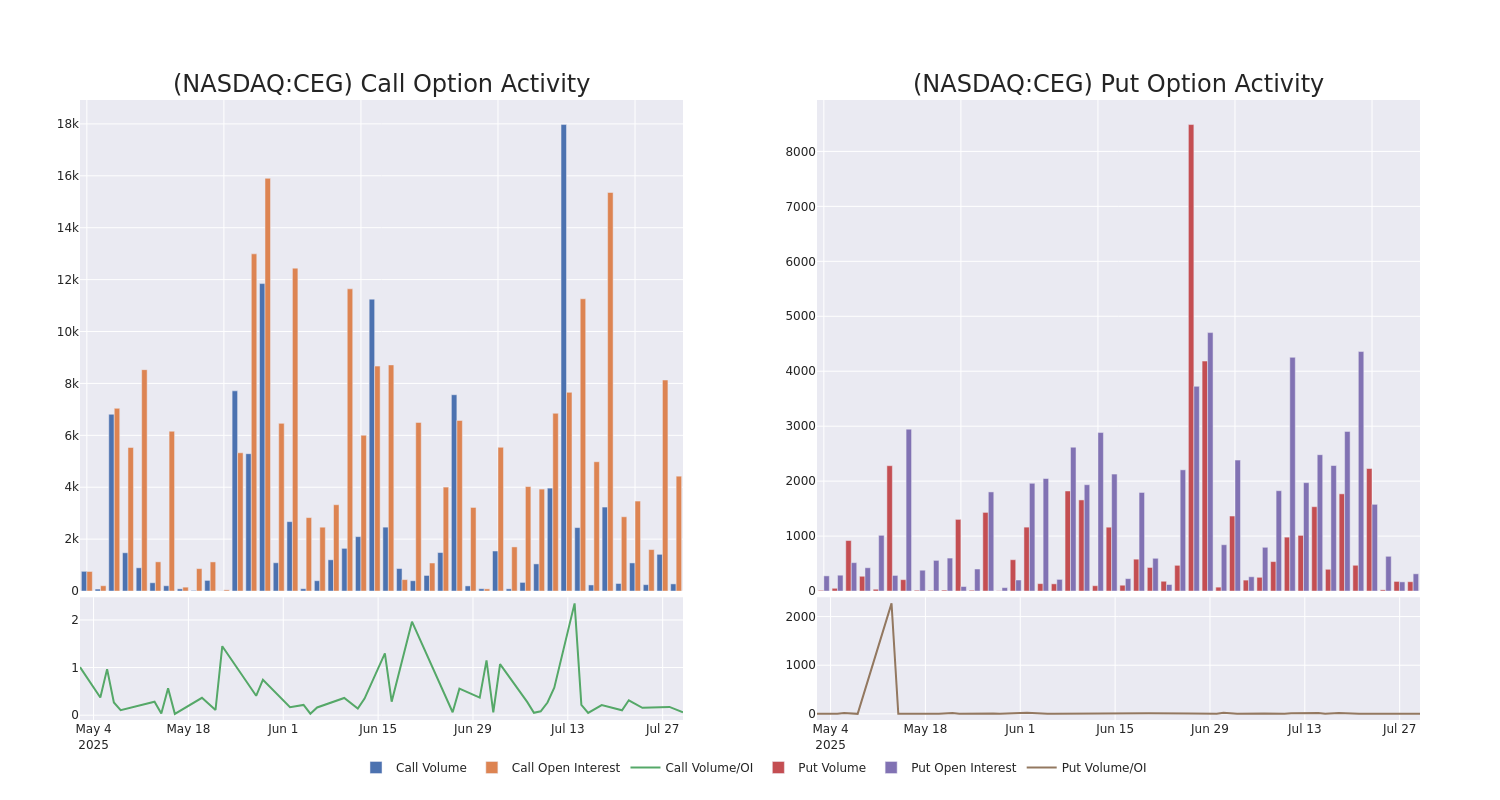

In today's trading context, the average open interest for options of Constellation Energy stands at 296.25, with a total volume reaching 435.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Constellation Energy, situated within the strike price corridor from $270.0 to $390.0, throughout the last 30 days.

Constellation Energy Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | SWEEP | BULLISH | 01/16/26 | $39.4 | $38.5 | $38.5 | $340.00 | $385.0K | 48 | 100 |

| CEG | CALL | TRADE | BEARISH | 03/20/26 | $62.6 | $62.3 | $62.3 | $320.00 | $373.8K | 210 | 60 |

| CEG | PUT | TRADE | BEARISH | 03/20/26 | $18.0 | $17.3 | $18.0 | $270.00 | $90.0K | 243 | 50 |

| CEG | CALL | TRADE | NEUTRAL | 09/19/25 | $31.0 | $29.3 | $30.0 | $330.00 | $45.0K | 994 | 16 |

| CEG | PUT | TRADE | BULLISH | 11/21/25 | $41.9 | $39.1 | $40.0 | $350.00 | $44.0K | 10 | 11 |

About Constellation Energy

Constellation Energy Corp producer of carbon-free energy and a supplier of energy products and services. The company offers generating capacity that includes nuclear, wind, solar, natural gas, and hydroelectric assets. It sells electricity, natural gas, and other energy-related products and sustainable solutions to various types of customers, including distribution utilities, municipalities, cooperatives, and commercial, industrial, public sector, and residential customers in markets across multiple geographic regions. Its operating segments and reporting units are Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions.

Current Position of Constellation Energy

- Trading volume stands at 840,401, with CEG's price up by 0.3%, positioned at $331.5.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 8 days.

What The Experts Say On Constellation Energy

2 market experts have recently issued ratings for this stock, with a consensus target price of $387.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Constellation Energy, maintaining a target price of $390.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Constellation Energy with a target price of $385.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Constellation Energy with Benzinga Pro for real-time alerts.