What the Options Market Tells Us About GE Vernova

Investors with a lot of money to spend have taken a bullish stance on GE Vernova (NYSE:GEV).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GEV, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 119 uncommon options trades for GE Vernova.

This isn't normal.

The overall sentiment of these big-money traders is split between 46% bullish and 27%, bearish.

Out of all of the special options we uncovered, 29 are puts, for a total amount of $2,006,893, and 90 are calls, for a total amount of $9,541,129.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $900.0 for GE Vernova over the recent three months.

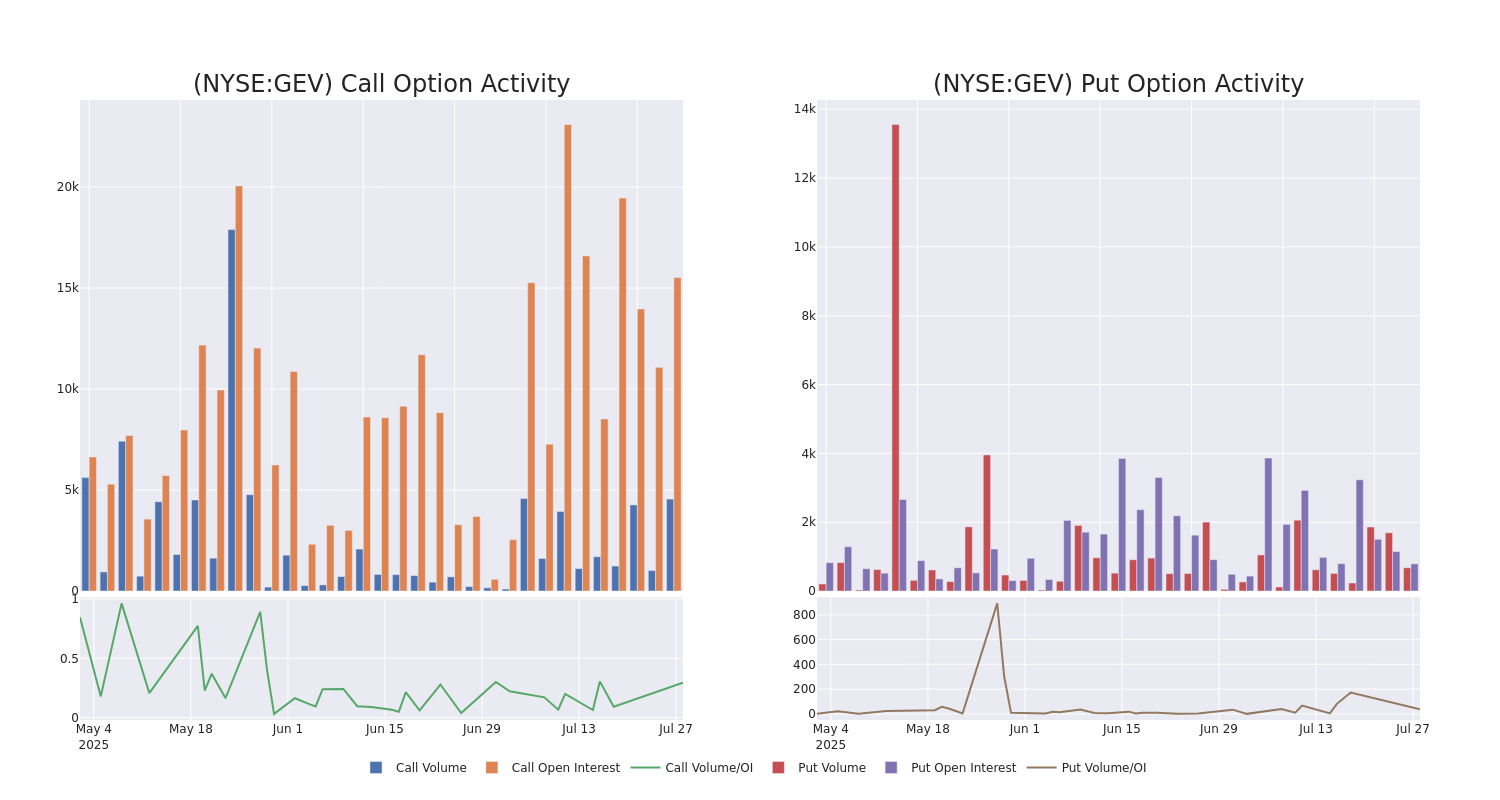

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for GE Vernova's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GE Vernova's whale activity within a strike price range from $160.0 to $900.0 in the last 30 days.

GE Vernova 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GEV | CALL | TRADE | BEARISH | 09/19/25 | $12.8 | $12.3 | $12.3 | $740.00 | $2.8M | 146 | 2.3K |

| GEV | CALL | TRADE | BEARISH | 02/20/26 | $176.1 | $173.0 | $173.0 | $520.00 | $190.3K | 100 | 12 |

| GEV | CALL | TRADE | BEARISH | 08/01/25 | $10.5 | $9.6 | $9.6 | $650.00 | $182.4K | 2.4K | 2.1K |

| GEV | CALL | TRADE | BULLISH | 01/15/27 | $240.1 | $238.4 | $240.1 | $500.00 | $120.0K | 1.6K | 11 |

| GEV | CALL | SWEEP | BULLISH | 08/01/25 | $53.9 | $53.9 | $53.9 | $600.00 | $96.8K | 270 | 21 |

About GE Vernova

GE Vernova is a global leader in the electric power industry, with products and services that generate, transfer, convert, and store electricity. The company has three business segments: power, wind, and electrification. Power includes gas, nuclear, hydroelectric, and steam technologies, providing dispatchable power. The wind segment includes wind generation technologies, inclusive of onshore and offshore wind turbines and blades. Electrification includes grid solutions, power conversion, electrification software, and solar and storage solutions technologies required for the transmission, distribution, conversion, and storage of electricity from the point of generation to point of consumption.

GE Vernova's Current Market Status

- With a volume of 1,877,404, the price of GEV is up 3.29% at $653.49.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 84 days.

What Analysts Are Saying About GE Vernova

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $652.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Seaport Global downgraded its rating to Buy, setting a price target of $630.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for GE Vernova, targeting a price of $670.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on GE Vernova, which currently sits at a price target of $675.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for GE Vernova, targeting a price of $706.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for GE Vernova, targeting a price of $580.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GE Vernova options trades with real-time alerts from Benzinga Pro.