Carvana Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Carvana.

Looking at options history for Carvana (NYSE:CVNA) we detected 99 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 48 are puts, for a total amount of $4,011,798 and 51, calls, for a total amount of $2,536,497.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $160.0 and $520.0 for Carvana, spanning the last three months.

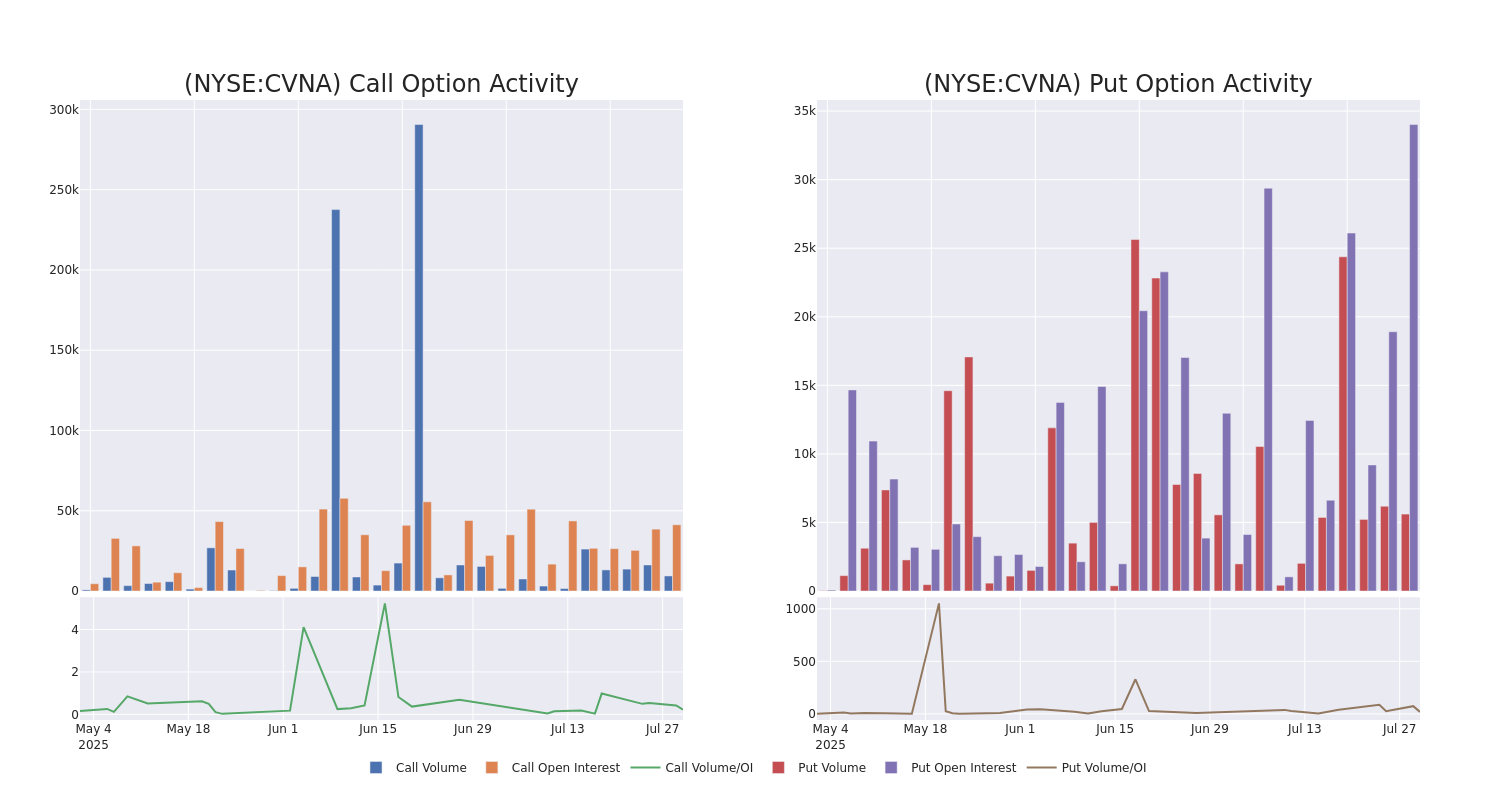

Volume & Open Interest Development

In today's trading context, the average open interest for options of Carvana stands at 1320.98, with a total volume reaching 14,901.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carvana, situated within the strike price corridor from $160.0 to $520.0, throughout the last 30 days.

Carvana Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | TRADE | BULLISH | 01/16/26 | $33.2 | $32.6 | $32.7 | $300.00 | $981.0K | 915 | 371 |

| CVNA | PUT | SWEEP | BEARISH | 08/01/25 | $17.85 | $17.4 | $17.85 | $330.00 | $142.8K | 1.2K | 405 |

| CVNA | CALL | TRADE | NEUTRAL | 08/15/25 | $7.25 | $6.9 | $7.1 | $380.00 | $142.0K | 2.2K | 265 |

| CVNA | CALL | TRADE | BULLISH | 09/19/25 | $9.4 | $9.3 | $9.4 | $400.00 | $94.0K | 4.6K | 201 |

| CVNA | PUT | TRADE | BULLISH | 01/16/26 | $188.0 | $186.0 | $186.0 | $520.00 | $93.0K | 205 | 5 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

After a thorough review of the options trading surrounding Carvana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Carvana

- Trading volume stands at 1,656,248, with CVNA's price up by 0.8%, positioned at $339.19.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 0 days.

Expert Opinions on Carvana

In the last month, 5 experts released ratings on this stock with an average target price of $386.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup has decided to maintain their Buy rating on Carvana, which currently sits at a price target of $415.

* In a positive move, an analyst from Oppenheimer has upgraded their rating to Outperform and adjusted the price target to $450.

* An analyst from Wells Fargo persists with their Overweight rating on Carvana, maintaining a target price of $390.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Carvana, targeting a price of $350.

* Reflecting concerns, an analyst from Gordon Haskett lowers its rating to Hold with a new price target of $329.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.