Behind the Scenes of Oklo's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards Oklo (NYSE:OKLO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in OKLO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for Oklo. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 52% leaning bullish and 35% bearish. Among these notable options, 5 are puts, totaling $1,361,225, and 12 are calls, amounting to $1,374,448.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $100.0 for Oklo, spanning the last three months.

Volume & Open Interest Trends

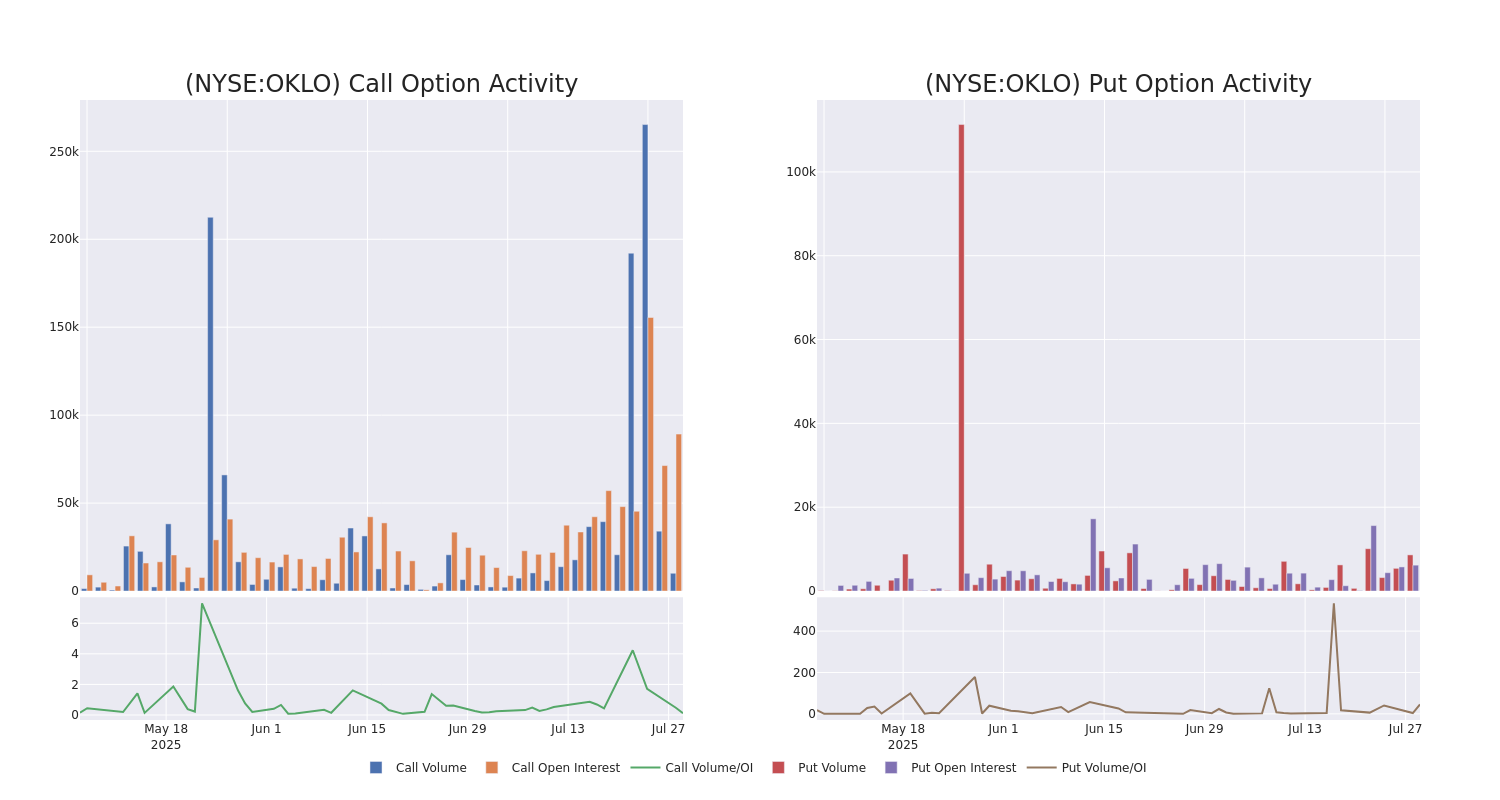

In today's trading context, the average open interest for options of Oklo stands at 4616.6, with a total volume reaching 3,342.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oklo, situated within the strike price corridor from $30.0 to $100.0, throughout the last 30 days.

Oklo 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKLO | PUT | TRADE | NEUTRAL | 01/16/26 | $12.45 | $12.1 | $12.3 | $65.00 | $615.0K | 4.9K | 500 |

| OKLO | PUT | TRADE | BEARISH | 01/16/26 | $12.25 | $12.0 | $12.15 | $65.00 | $607.5K | 4.9K | 1.5K |

| OKLO | CALL | TRADE | BULLISH | 01/16/26 | $13.0 | $12.4 | $13.0 | $100.00 | $325.0K | 5.7K | 2 |

| OKLO | CALL | SWEEP | BEARISH | 01/16/26 | $13.2 | $12.95 | $13.0 | $100.00 | $260.0K | 5.7K | 302 |

| OKLO | CALL | TRADE | BULLISH | 01/16/26 | $17.5 | $17.15 | $17.5 | $80.00 | $187.2K | 1.3K | 110 |

About Oklo

Oklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

In light of the recent options history for Oklo, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Oklo Standing Right Now?

- With a trading volume of 1,916,281, the price of OKLO is up by 0.25%, reaching $75.82.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 11 days from now.

Expert Opinions on Oklo

2 market experts have recently issued ratings for this stock, with a consensus target price of $70.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $73.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Oklo with a target price of $68.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Oklo, Benzinga Pro gives you real-time options trades alerts.