Spotlight on Dell Technologies: Analyzing the Surge in Options Activity

High-rolling investors have positioned themselves bullish on Dell Technologies (NYSE:DELL), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DELL often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 22 options trades for Dell Technologies. This is not a typical pattern.

The sentiment among these major traders is split, with 59% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $25,025, and 21 calls, totaling $1,854,246.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $150.0 for Dell Technologies, spanning the last three months.

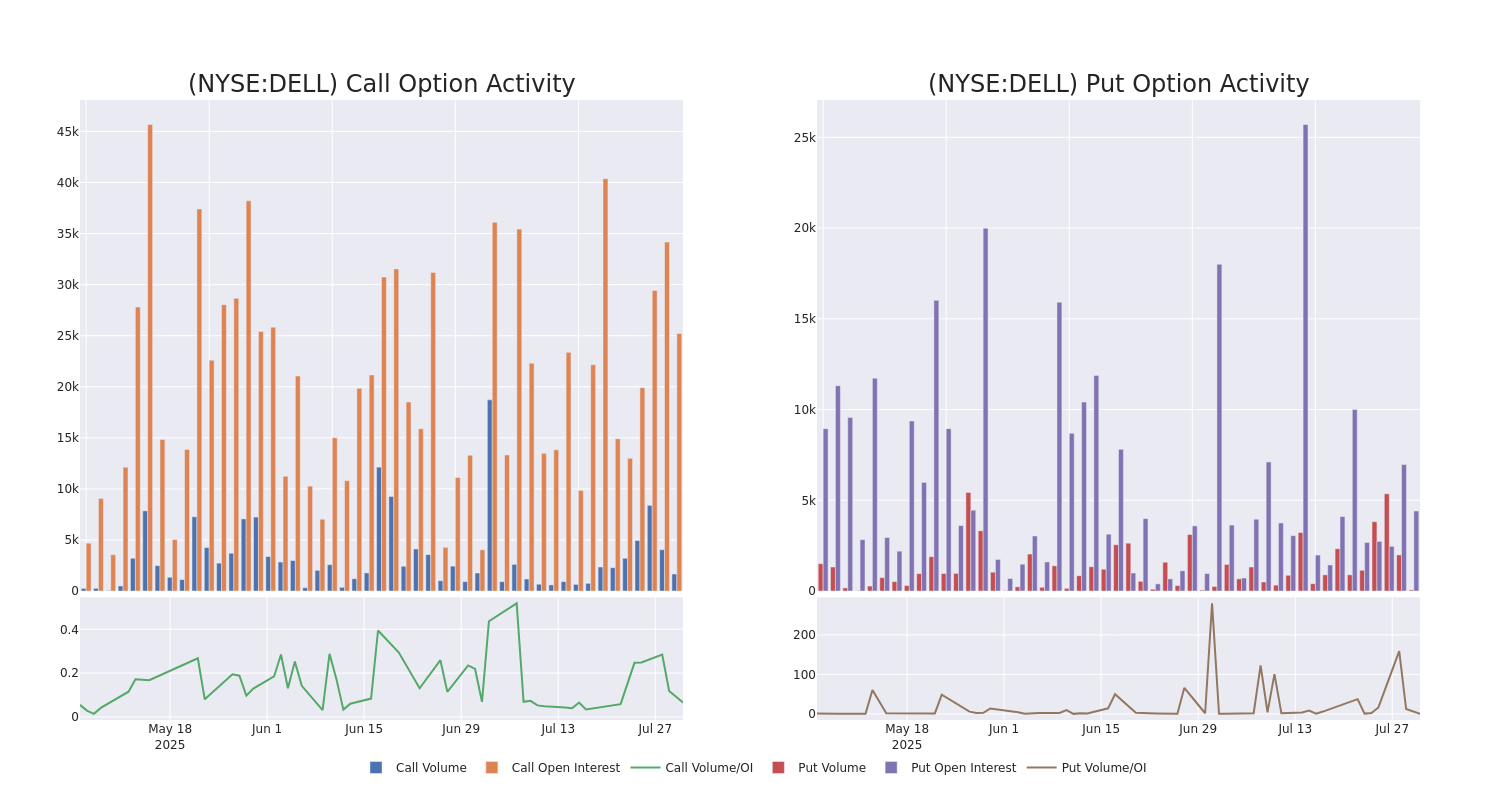

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Dell Technologies stands at 1850.81, with a total volume reaching 1,728.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dell Technologies, situated within the strike price corridor from $100.0 to $150.0, throughout the last 30 days.

Dell Technologies Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | BEARISH | 12/18/26 | $25.75 | $24.45 | $24.8 | $145.00 | $868.0K | 1.1K | 350 |

| DELL | CALL | TRADE | NEUTRAL | 12/18/26 | $48.0 | $47.2 | $47.66 | $100.00 | $238.3K | 698 | 50 |

| DELL | CALL | SWEEP | BULLISH | 06/18/26 | $43.0 | $42.7 | $43.0 | $100.00 | $81.7K | 753 | 6 |

| DELL | CALL | SWEEP | BULLISH | 08/15/25 | $4.0 | $3.85 | $4.0 | $135.00 | $68.4K | 3.3K | 395 |

| DELL | CALL | SWEEP | BULLISH | 09/19/25 | $5.75 | $5.55 | $5.67 | $145.00 | $51.0K | 2.7K | 197 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Following our analysis of the options activities associated with Dell Technologies, we pivot to a closer look at the company's own performance.

Present Market Standing of Dell Technologies

- Currently trading with a volume of 1,356,758, the DELL's price is up by 0.41%, now at $134.09.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

Professional Analyst Ratings for Dell Technologies

In the last month, 2 experts released ratings on this stock with an average target price of $155.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Dell Technologies, targeting a price of $165.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Dell Technologies, which currently sits at a price target of $145.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Dell Technologies options trades with real-time alerts from Benzinga Pro.