Align Technology Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Align Technology (NASDAQ:ALGN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ALGN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Align Technology. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 16% bearish. Among these notable options, 4 are puts, totaling $480,504, and 8 are calls, amounting to $2,227,233.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $250.0 for Align Technology over the last 3 months.

Analyzing Volume & Open Interest

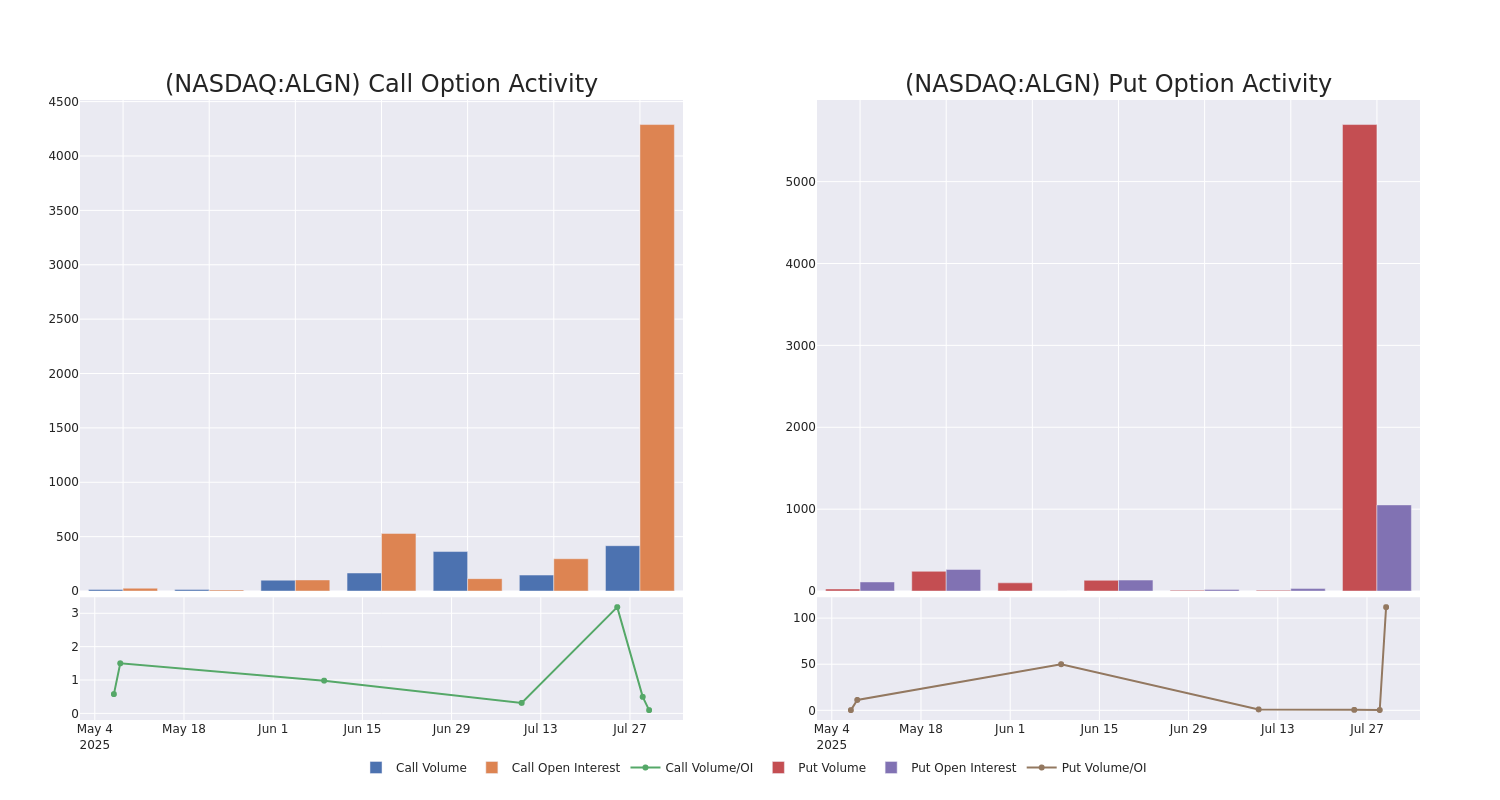

In terms of liquidity and interest, the mean open interest for Align Technology options trades today is 89.67 with a total volume of 2,860.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Align Technology's big money trades within a strike price range of $100.0 to $250.0 over the last 30 days.

Align Technology Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALGN | CALL | TRADE | BEARISH | 06/18/26 | $19.3 | $17.1 | $17.7 | $160.00 | $1.7M | 65 | 1.0K |

| ALGN | PUT | TRADE | BULLISH | 12/18/26 | $10.8 | $10.1 | $10.1 | $100.00 | $303.0K | 102 | 301 |

| ALGN | CALL | SWEEP | NEUTRAL | 01/16/26 | $6.5 | $6.4 | $6.4 | $170.00 | $113.9K | 48 | 315 |

| ALGN | PUT | TRADE | BULLISH | 01/15/27 | $116.4 | $111.8 | $112.64 | $250.00 | $90.1K | 34 | 8 |

| ALGN | CALL | SWEEP | BEARISH | 01/16/26 | $6.4 | $6.3 | $6.3 | $170.00 | $85.0K | 48 | 136 |

About Align Technology

Align Technology is the leading manufacturer of clear aligners. Invisalign, its main product, was approved by the Food and Drug Administration in 1998 and has since dominated, controlling over 90% of the market. Invisalign can treat roughly 90% of all malocclusion cases (misaligned teeth), and there are over 230,000 Invisalign-trained dentists and orthodontists. In 2022, Invisalign treated over 2 million cases, or roughly 10% of all orthodontic cases for the year, and it has treated over 14 million patients since its launch. Align also sells intraoral scanners under the brand iTero, which captures digital impressions of patients' teeth and illustrates treatment plans. Over 85% of Invisalign cases are submitted by digital scans, and iTero scans make up over half of these scans.

Where Is Align Technology Standing Right Now?

- Trading volume stands at 1,743,256, with ALGN's price up by 3.1%, positioned at $140.75.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 79 days.

What The Experts Say On Align Technology

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $192.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Align Technology with a target price of $190.

* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Equal-Weight with a new price target of $154.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Align Technology with a target price of $199.

* An analyst from Stifel has decided to maintain their Buy rating on Align Technology, which currently sits at a price target of $200.

* An analyst from Evercore ISI Group persists with their Outperform rating on Align Technology, maintaining a target price of $220.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Align Technology options trades with real-time alerts from Benzinga Pro.