Check Out What Whales Are Doing With Wayfair

Deep-pocketed investors have adopted a bullish approach towards Wayfair (NYSE:W), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in W usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Wayfair. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 70% leaning bullish and 30% bearish. Among these notable options, 5 are puts, totaling $397,952, and 5 are calls, amounting to $1,953,935.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $62.5 and $95.0 for Wayfair, spanning the last three months.

Insights into Volume & Open Interest

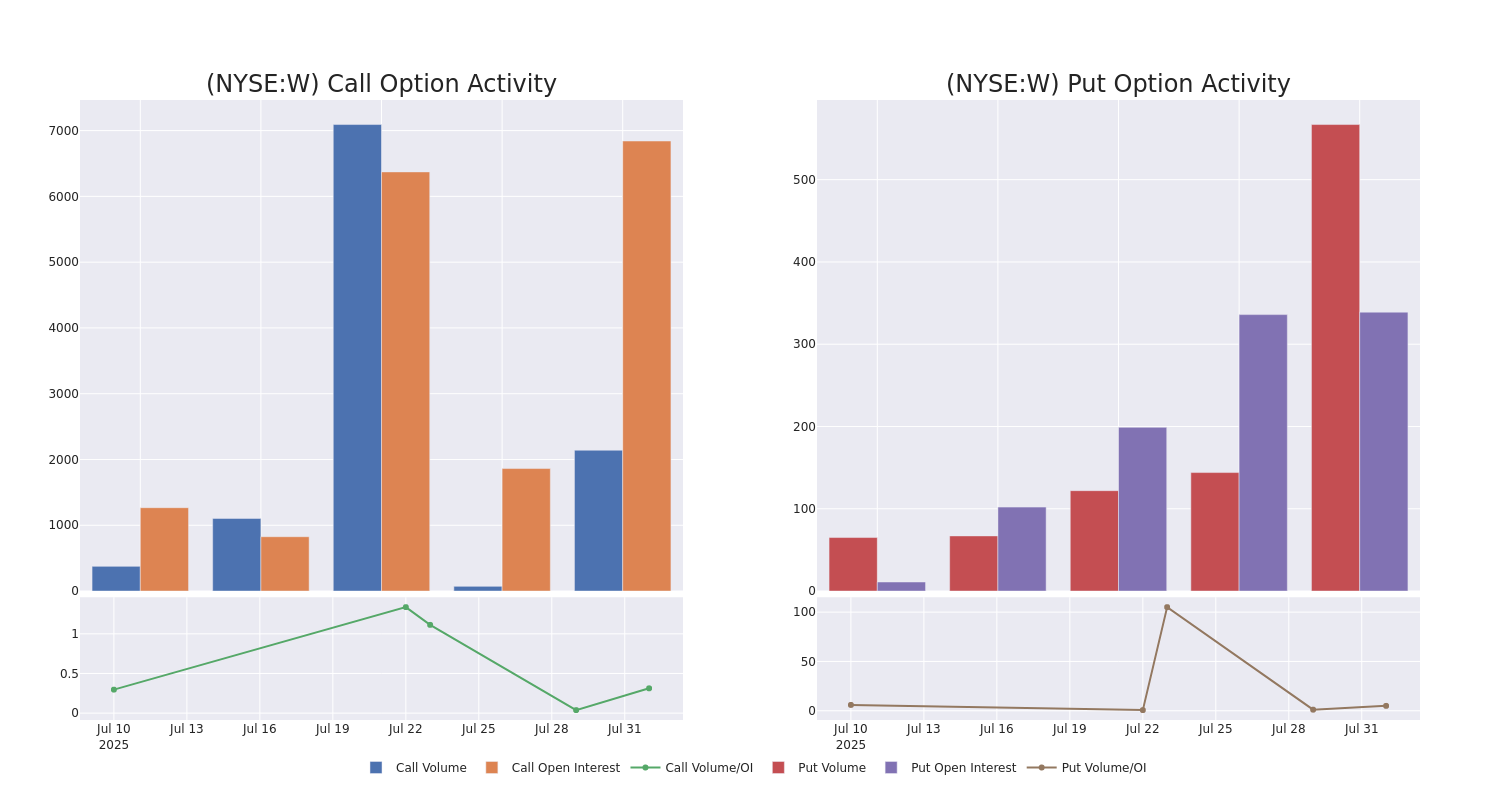

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Wayfair's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wayfair's whale activity within a strike price range from $62.5 to $95.0 in the last 30 days.

Wayfair Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | CALL | TRADE | BULLISH | 11/21/25 | $9.55 | $9.25 | $9.54 | $75.00 | $1.3M | 949 | 2 |

| W | CALL | SWEEP | BEARISH | 08/15/25 | $4.8 | $4.55 | $4.6 | $71.00 | $462.7K | 5.0K | 1 |

| W | PUT | SWEEP | BULLISH | 12/19/25 | $13.4 | $13.05 | $13.12 | $80.00 | $164.0K | 12 | 125 |

| W | PUT | SWEEP | BEARISH | 12/19/25 | $10.5 | $10.15 | $10.43 | $75.00 | $130.3K | 202 | 125 |

| W | CALL | SWEEP | BULLISH | 11/21/25 | $8.0 | $7.75 | $7.96 | $80.00 | $55.6K | 128 | 1 |

About Wayfair

Wayfair engages in e-commerce in the United States (88% of 2024 sales), Canada, the United Kingdom, and Ireland. It's also embarked on expansion into the brick-and-mortar landscape, with a handful of stores between the AllModern, Birch Lane, Joss & Main, and Wayfair banners. At the end of 2024, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

Following our analysis of the options activities associated with Wayfair, we pivot to a closer look at the company's own performance.

Current Position of Wayfair

- With a volume of 3,379,111, the price of W is up 0.53% at $73.87.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 87 days.

Expert Opinions on Wayfair

In the last month, 5 experts released ratings on this stock with an average target price of $76.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein persists with their Market Perform rating on Wayfair, maintaining a target price of $70.

* An analyst from Raymond James has decided to maintain their Strong Buy rating on Wayfair, which currently sits at a price target of $90.

* Consistent in their evaluation, an analyst from Stifel keeps a Hold rating on Wayfair with a target price of $68.

* An analyst from UBS has decided to maintain their Buy rating on Wayfair, which currently sits at a price target of $80.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Wayfair, targeting a price of $75.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wayfair, Benzinga Pro gives you real-time options trades alerts.