Smart Money Is Betting Big In PLTR Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Palantir Technologies.

Looking at options history for Palantir Technologies (NASDAQ:PLTR) we detected 346 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 34% with bearish.

From the overall spotted trades, 109 are puts, for a total amount of $7,871,951 and 237, calls, for a total amount of $17,326,242.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $240.0 for Palantir Technologies during the past quarter.

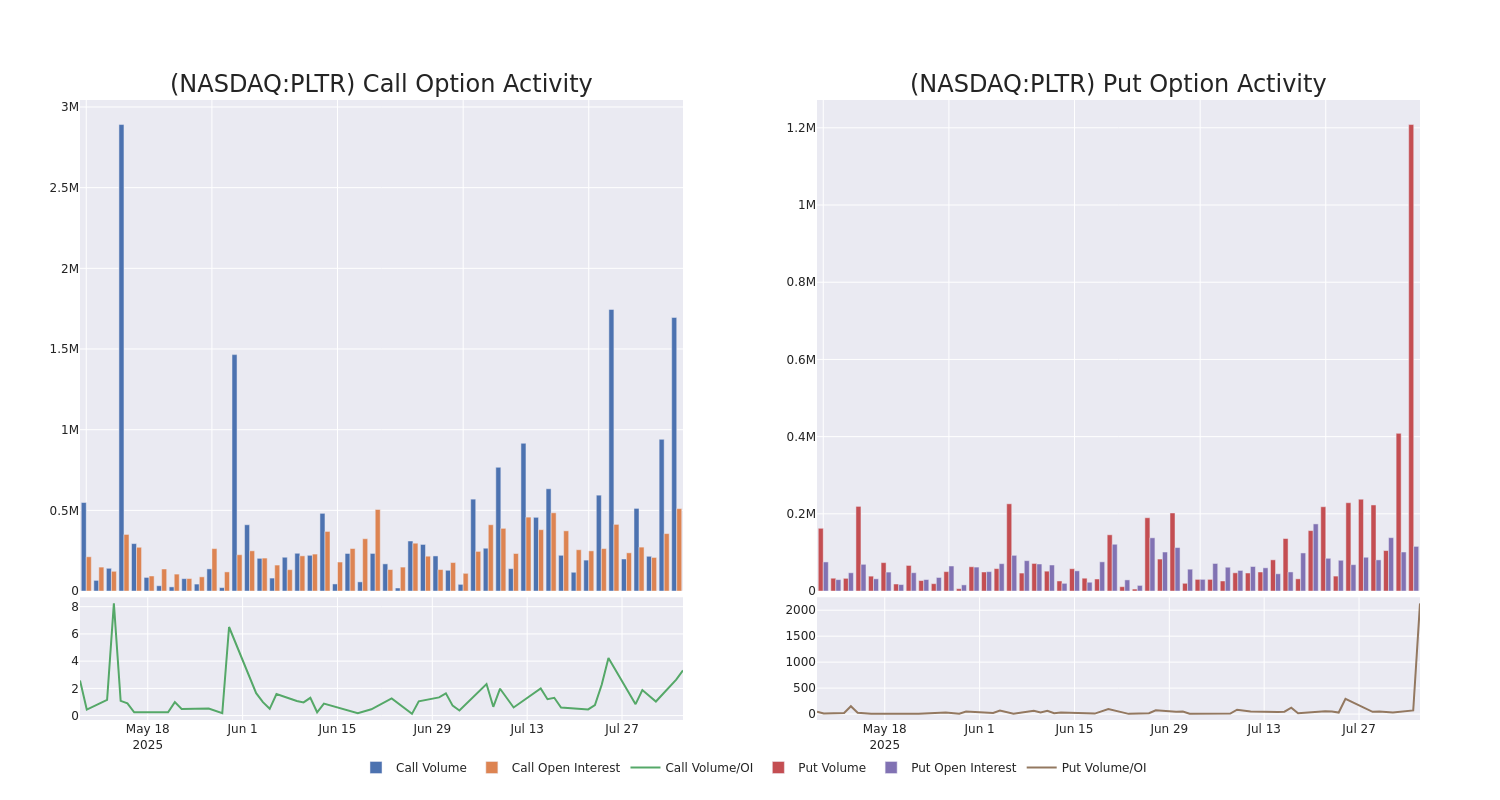

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Palantir Technologies's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palantir Technologies's whale activity within a strike price range from $35.0 to $240.0 in the last 30 days.

Palantir Technologies Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | SWEEP | NEUTRAL | 10/17/25 | $12.55 | $12.4 | $12.55 | $180.00 | $485.7K | 14.2K | 5.6K |

| PLTR | CALL | SWEEP | NEUTRAL | 10/17/25 | $10.7 | $10.5 | $10.7 | $185.00 | $413.7K | 4.7K | 2.0K |

| PLTR | CALL | SWEEP | BEARISH | 09/19/25 | $1.25 | $1.21 | $1.21 | $220.00 | $154.4K | 6.1K | 1.9K |

| PLTR | PUT | SWEEP | BEARISH | 08/08/25 | $2.95 | $2.94 | $2.94 | $170.00 | $125.0K | 706 | 65.1K |

| PLTR | CALL | SWEEP | BULLISH | 08/08/25 | $2.95 | $2.94 | $2.95 | $175.00 | $104.7K | 14.3K | 61.0K |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. Palantir works only with entities in Western-allied nations and reserves the right not to work with anyone that is antithetical to Western values. The Denver-based company was founded in 2003 and went public in 2020.

Having examined the options trading patterns of Palantir Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Palantir Technologies

- With a trading volume of 118,728,247, the price of PLTR is up by 7.13%, reaching $172.11.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 90 days from now.

What The Experts Say On Palantir Technologies

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $172.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Palantir Technologies, targeting a price of $155.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Palantir Technologies, targeting a price of $177.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Overweight with a new price target of $170.

* An analyst from B of A Securities has decided to maintain their Buy rating on Palantir Technologies, which currently sits at a price target of $180.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Palantir Technologies with a target price of $182.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palantir Technologies with Benzinga Pro for real-time alerts.