Check Out What Whales Are Doing With BBIO

Investors with a lot of money to spend have taken a bullish stance on BridgeBio Pharma (NASDAQ:BBIO).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with BBIO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for BridgeBio Pharma.

This isn't normal.

The overall sentiment of these big-money traders is split between 71% bullish and 21%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $97,005, and 12 are calls, for a total amount of $785,004.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $70.0 for BridgeBio Pharma over the recent three months.

Analyzing Volume & Open Interest

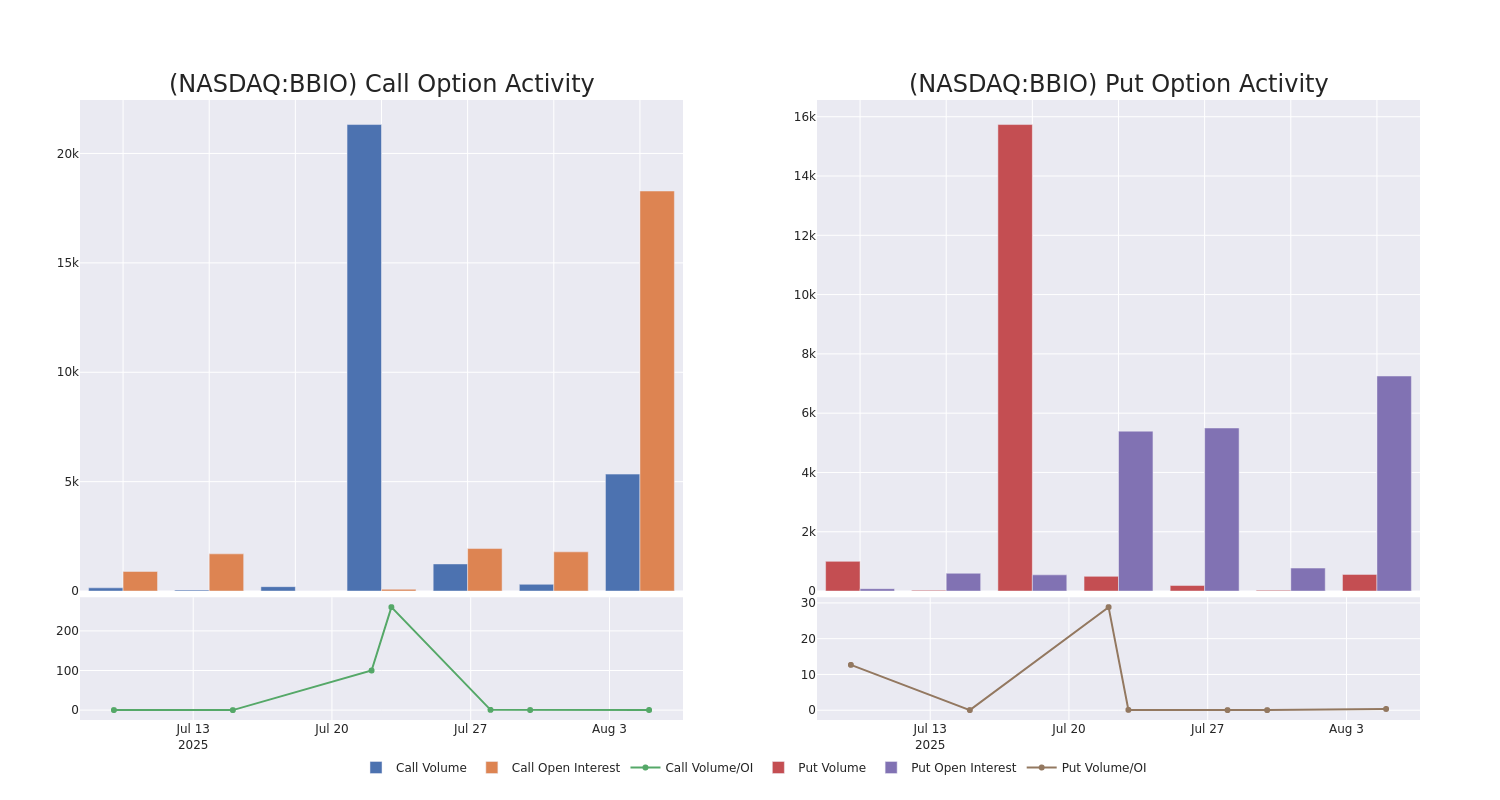

In terms of liquidity and interest, the mean open interest for BridgeBio Pharma options trades today is 2837.56 with a total volume of 5,906.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for BridgeBio Pharma's big money trades within a strike price range of $40.0 to $70.0 over the last 30 days.

BridgeBio Pharma Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BBIO | CALL | SWEEP | NEUTRAL | 02/20/26 | $12.8 | $12.8 | $12.8 | $40.00 | $256.0K | 1 | 0 |

| BBIO | CALL | SWEEP | BULLISH | 08/15/25 | $2.5 | $2.25 | $2.5 | $50.00 | $95.7K | 4.7K | 1.9K |

| BBIO | CALL | TRADE | BULLISH | 01/16/26 | $2.25 | $1.05 | $2.15 | $70.00 | $86.0K | 856 | 424 |

| BBIO | CALL | SWEEP | BULLISH | 08/15/25 | $1.8 | $1.5 | $1.8 | $50.00 | $61.6K | 4.7K | 806 |

| BBIO | PUT | SWEEP | BEARISH | 08/15/25 | $1.2 | $1.1 | $1.2 | $42.50 | $49.9K | 1.4K | 497 |

About BridgeBio Pharma

BridgeBio Pharma is a biotechnology company focused on discovering, developing, testing, and delivering transformative treatments for patients with genetic diseases. The company has four programs in its late-stage pipeline focusing on Mendelian disorders, oncology, and gene therapy. One of its key programs, Attruby (acoramidis) , is an orally administered small molecule designed to stabilize tetrameric transthyretin for the treatment of transthyretin amyloid cardiomyopathy.

After a thorough review of the options trading surrounding BridgeBio Pharma, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of BridgeBio Pharma

- With a trading volume of 2,893,034, the price of BBIO is down by -0.67%, reaching $47.43.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 0 days from now.

Expert Opinions on BridgeBio Pharma

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $71.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup persists with their Buy rating on BridgeBio Pharma, maintaining a target price of $67.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $95.

* Reflecting concerns, an analyst from Jefferies lowers its rating to Buy with a new price target of $70.

* In a cautious move, an analyst from Truist Securities downgraded its rating to Buy, setting a price target of $66.

* An analyst from Oppenheimer upgraded its action to Outperform with a price target of $60.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BridgeBio Pharma options trades with real-time alerts from Benzinga Pro.