A Closer Look at Dollar Tree's Options Market Dynamics

Deep-pocketed investors have adopted a bearish approach towards Dollar Tree (NASDAQ:DLTR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DLTR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Dollar Tree. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 16% leaning bullish and 75% bearish. Among these notable options, 2 are puts, totaling $104,000, and 10 are calls, amounting to $728,872.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $130.0 for Dollar Tree over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Dollar Tree options trades today is 702.0 with a total volume of 7,058.00.

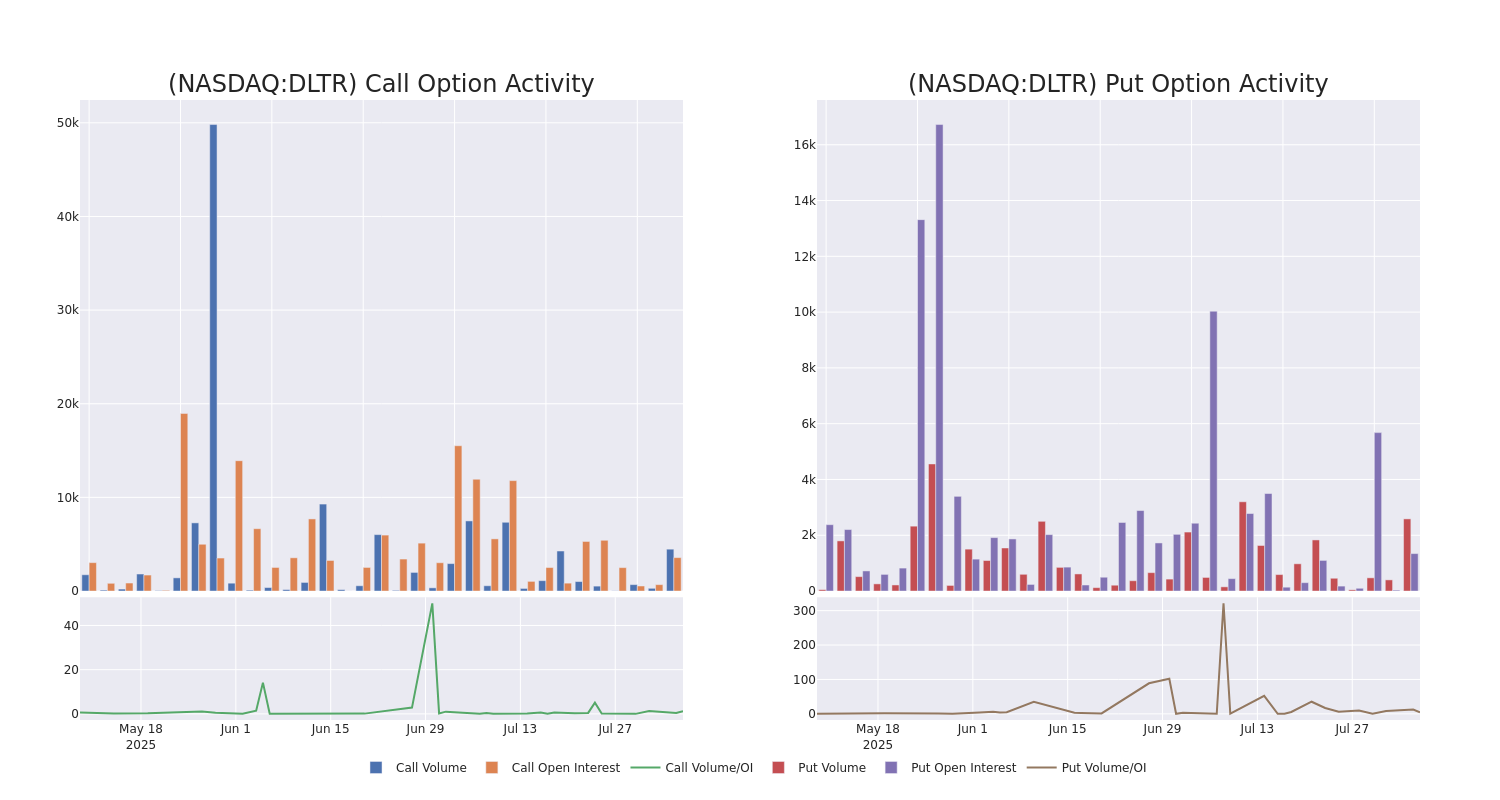

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dollar Tree's big money trades within a strike price range of $70.0 to $130.0 over the last 30 days.

Dollar Tree Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DLTR | CALL | SWEEP | BEARISH | 08/08/25 | $19.5 | $18.8 | $18.8 | $98.00 | $291.4K | 160 | 160 |

| DLTR | CALL | TRADE | BULLISH | 09/19/25 | $2.38 | $1.76 | $2.18 | $130.00 | $128.4K | 2.2K | 1.6K |

| DLTR | CALL | SWEEP | BEARISH | 09/19/25 | $2.33 | $2.18 | $2.18 | $130.00 | $62.1K | 2.2K | 318 |

| DLTR | PUT | TRADE | BEARISH | 08/15/25 | $1.18 | $1.12 | $1.18 | $115.00 | $59.0K | 788 | 61 |

| DLTR | CALL | SWEEP | BEARISH | 09/19/25 | $2.24 | $2.17 | $2.18 | $130.00 | $47.3K | 2.2K | 101 |

About Dollar Tree

Dollar Tree operates discount stores across the United States and Canada, with over 8,800 shops under its namesake banner. About 50% of Dollar Tree's sales in fiscal 2024 were consumables (including food, health and beauty, and cleaning products), around 45% variety items (including toys and homewares), and 5% seasonal items. Dollar Tree sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. The retailer has agreed to sell Family Dollar (with about 7,000 stores) to private equity investors for $1 billion.

Where Is Dollar Tree Standing Right Now?

- Currently trading with a volume of 1,813,909, the DLTR's price is up by 0.85%, now at $116.64.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 28 days.

What The Experts Say On Dollar Tree

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $129.33.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Barclays has elevated its stance to Overweight, setting a new price target at $120.

* An analyst from Wells Fargo persists with their Overweight rating on Dollar Tree, maintaining a target price of $130.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Dollar Tree, which currently sits at a price target of $138.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dollar Tree, Benzinga Pro gives you real-time options trades alerts.