Coinbase Global Unusual Options Activity For August 11

Whales with a lot of money to spend have taken a noticeably bearish stance on Coinbase Global.

Looking at options history for Coinbase Global (NASDAQ:COIN) we detected 40 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 47% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $989,596 and 36, calls, for a total amount of $4,160,511.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $260.0 to $500.0 for Coinbase Global over the recent three months.

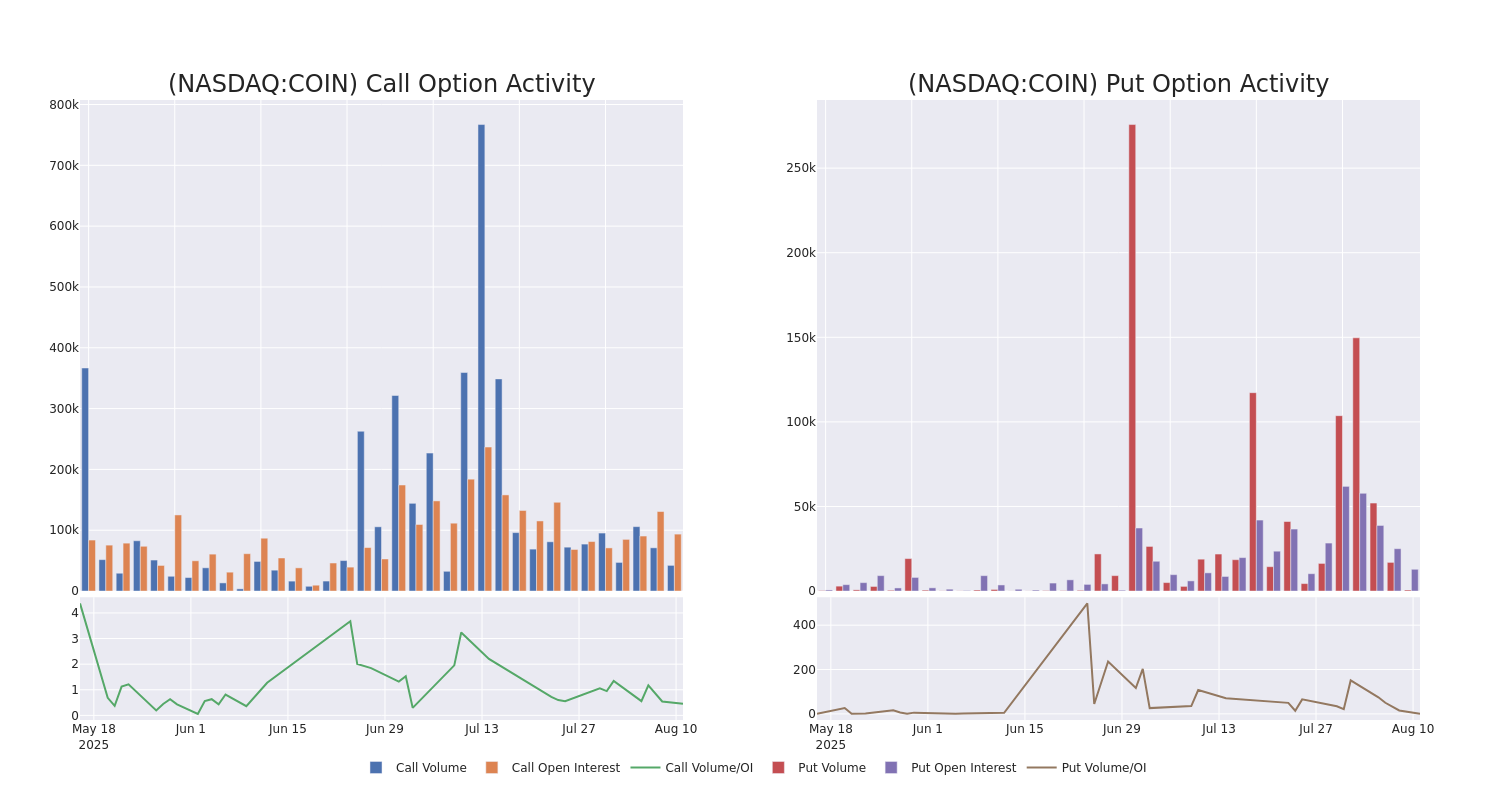

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Coinbase Global's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coinbase Global's whale trades within a strike price range from $260.0 to $500.0 in the last 30 days.

Coinbase Global Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | CALL | SWEEP | BEARISH | 12/18/26 | $95.2 | $95.0 | $95.0 | $320.00 | $1.9M | 780 | 284 |

| COIN | PUT | TRADE | BULLISH | 01/16/26 | $17.6 | $17.3 | $17.35 | $260.00 | $867.5K | 1.5K | 4 |

| COIN | CALL | SWEEP | BULLISH | 08/15/25 | $12.0 | $11.6 | $12.0 | $320.00 | $196.8K | 6.4K | 299 |

| COIN | CALL | TRADE | BULLISH | 08/22/25 | $18.5 | $18.15 | $18.5 | $320.00 | $185.0K | 2.5K | 1.1K |

| COIN | CALL | TRADE | BEARISH | 12/18/26 | $95.45 | $95.3 | $95.3 | $320.00 | $162.0K | 780 | 492 |

About Coinbase Global

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Following our analysis of the options activities associated with Coinbase Global, we pivot to a closer look at the company's own performance.

Present Market Standing of Coinbase Global

- With a volume of 6,274,504, the price of COIN is up 6.94% at $332.1.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 79 days.

Expert Opinions on Coinbase Global

5 market experts have recently issued ratings for this stock, with a consensus target price of $426.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies has decided to maintain their Hold rating on Coinbase Global, which currently sits at a price target of $405.

* An analyst from Argus Research has revised its rating downward to Buy, adjusting the price target to $400.

* Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Coinbase Global with a target price of $440.

* An analyst from Oppenheimer persists with their Outperform rating on Coinbase Global, maintaining a target price of $417.

* An analyst from Rosenblatt has decided to maintain their Buy rating on Coinbase Global, which currently sits at a price target of $470.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coinbase Global options trades with real-time alerts from Benzinga Pro.