Meta Platforms Unusual Options Activity For August 11

Investors with a lot of money to spend have taken a bullish stance on Meta Platforms (NASDAQ:META).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 119 uncommon options trades for Meta Platforms.

This isn't normal.

The overall sentiment of these big-money traders is split between 40% bullish and 35%, bearish.

Out of all of the special options we uncovered, 36 are puts, for a total amount of $3,036,374, and 83 are calls, for a total amount of $14,167,536.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $1080.0 for Meta Platforms during the past quarter.

Insights into Volume & Open Interest

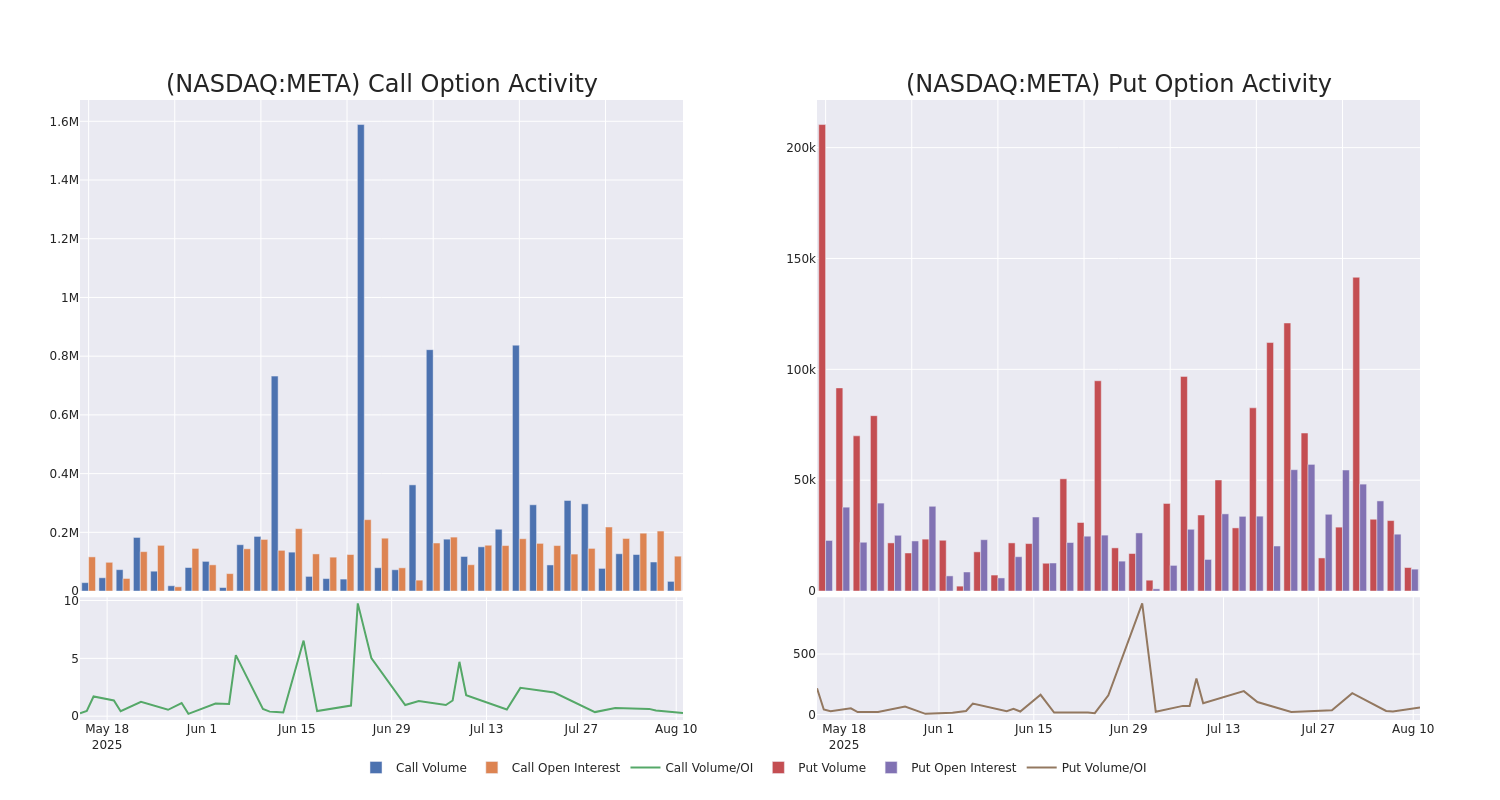

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $5.0 to $1080.0 over the preceding 30 days.

Meta Platforms Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | TRADE | BULLISH | 01/16/26 | $35.2 | $34.9 | $35.19 | $850.00 | $5.2M | 6.3K | 1.5K |

| META | CALL | TRADE | BULLISH | 12/17/27 | $762.5 | $761.0 | $762.5 | $5.00 | $305.0K | 4.5K | 9 |

| META | CALL | TRADE | BULLISH | 12/17/27 | $764.25 | $761.0 | $763.5 | $5.00 | $229.0K | 4.5K | 5 |

| META | CALL | TRADE | BULLISH | 10/17/25 | $43.6 | $43.5 | $43.6 | $760.00 | $87.2K | 667 | 69 |

| META | CALL | TRADE | BEARISH | 09/19/25 | $28.8 | $28.6 | $28.6 | $770.00 | $85.8K | 5.0K | 528 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Having examined the options trading patterns of Meta Platforms, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Meta Platforms

- Currently trading with a volume of 2,986,206, the META's price is down by -0.11%, now at $768.46.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 79 days.

What Analysts Are Saying About Meta Platforms

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $870.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Meta Platforms, targeting a price of $915.

* Consistent in their evaluation, an analyst from Raymond James keeps a Strong Buy rating on Meta Platforms with a target price of $900.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Meta Platforms, targeting a price of $897.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Meta Platforms, targeting a price of $840.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Meta Platforms, targeting a price of $800.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Meta Platforms options trades with real-time alerts from Benzinga Pro.