Pfizer's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Pfizer.

Looking at options history for Pfizer (NYSE:PFE) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $378,835 and 7, calls, for a total amount of $258,682.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $22.5 and $25.0 for Pfizer, spanning the last three months.

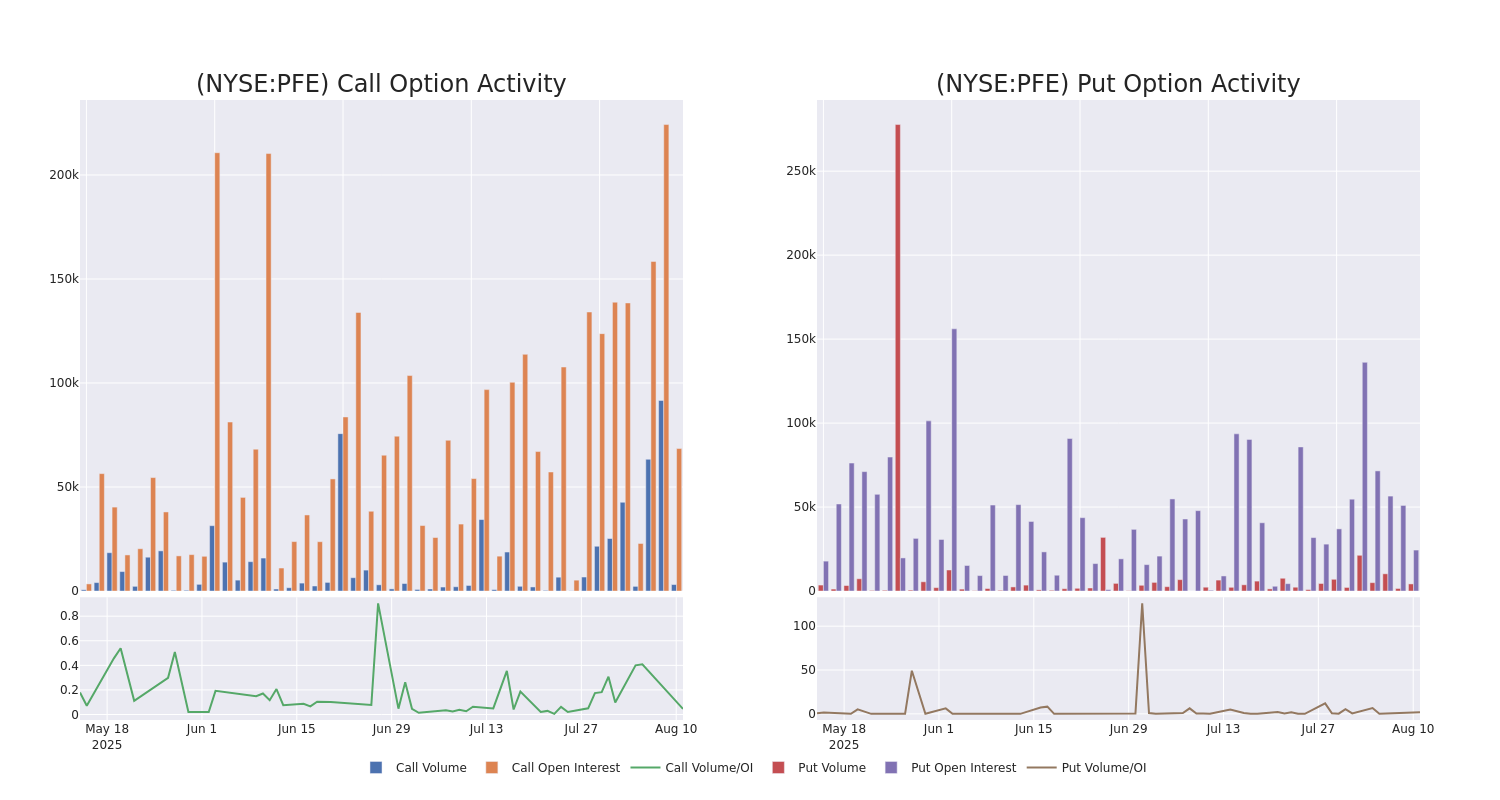

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Pfizer's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Pfizer's whale activity within a strike price range from $22.5 to $25.0 in the last 30 days.

Pfizer Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | PUT | TRADE | BULLISH | 10/17/25 | $0.98 | $0.95 | $0.96 | $25.00 | $172.8K | 4.3K | 1.8K |

| PFE | PUT | SWEEP | NEUTRAL | 09/18/26 | $2.56 | $2.55 | $2.54 | $25.00 | $88.3K | 1.4K | 458 |

| PFE | CALL | TRADE | BEARISH | 12/19/25 | $1.21 | $1.18 | $1.18 | $25.00 | $46.6K | 8.8K | 1.2K |

| PFE | CALL | SWEEP | BEARISH | 01/16/26 | $1.51 | $1.46 | $1.46 | $25.00 | $43.8K | 40.2K | 63 |

| PFE | CALL | TRADE | BULLISH | 01/16/26 | $1.45 | $1.45 | $1.45 | $25.00 | $43.5K | 40.2K | 396 |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales of roughly $60 billion. While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing 40% of total sales. Within international sales, emerging markets are a major contributor.

Having examined the options trading patterns of Pfizer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Pfizer's Current Market Status

- With a volume of 19,497,354, the price of PFE is up 0.09% at $24.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 78 days.

Expert Opinions on Pfizer

3 market experts have recently issued ratings for this stock, with a consensus target price of $29.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has decided to maintain their Neutral rating on Pfizer, which currently sits at a price target of $26.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Pfizer, targeting a price of $28.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Pfizer, maintaining a target price of $33.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.