Coca-Cola's 200-Country Playbook Gets A Thumbs-Up From JPMorgan Analysts Amid Trump Tariffs

Soft drinks giant, Coca-Cola Co.‘s (NYSE:KO) playbook for global scale and distribution is back in focus amid growing geopolitical uncertainties.

What Happened: Last week, JPMorgan Chase & Co. (NYSE:JPM) analysts raised their price target for Coca-Cola Co. to $78 per share by the end of 2025, up from $74 previously, citing the company’s resilience amid growing tensions and uncertainties surrounding tariffs. The move came ahead of Coca-Cola's first-quarter earnings report.

The analysts, led by Andrea Teixeira, maintained their “Overweight” rating on the stock, highlighting the company's strong defensive qualities and describing it as a “port in a storm,” according to a report by CNBC.

See More: 3 Big Brand Stocks To Lean On During Tariff Troubles

According to Teixeira, Coca-Cola's broad geographic reach, with the U.S. accounting for just 17% of its total volumes, helps the company offset slowdowns in some regions with stronger-than-expected performance in others.

While she acknowledged that Coca-Cola is not completely immune to tariffs or a potential global economic slowdown, she argued the company is “relatively more defensive” due to its strong organic sales growth. She also noted that the direct impact of tariffs is largely limited to the juice, which is sourced both locally and internationally.

Teixeira notes that the 25% tariffs on steel and aluminum will have an impact if the company’s bottlers offset the cost by passing it on to the consumers. “The company helps bottlers manage through the impacts through its cross-enterprise procurement team, and also can emphasize different package types if there is cost pressure on aluminum,” she adds.

Why It Matters: Coca-Cola’s resilience to geopolitical uncertainties has been built over several decades of careful supply-chain and distribution planning, which involves working with several local bottling partners in each country it operates in.

Early this year, the company’s CEO, James Quincey, said, “we are predominantly a local business when it comes to making each of the beverages.”

“The vast majority of everything that’s consumed in the U.S. is made in the U.S. Similarly, we’re in virtually every country around the world. And so while it’s a global business, it’s very local,” he added, while speaking with analysts during the company’s fourth quarter earnings release.

Just last week, it was reported that the company is escaping the tariffs imposed by President Donald Trump, since all of its concentrates are made within the United States. This was in sharp contrast to PepsiCo Inc. (NASDAQ:PEP), which imports a bulk of its concentrates from Ireland, which is now subject to 10% tariffs.

Price Action: The company’s stock was down 0.17% on Monday, and is down 0.13% in after-hours trading, ahead of the company’s first quarter earnings on Tuesday.

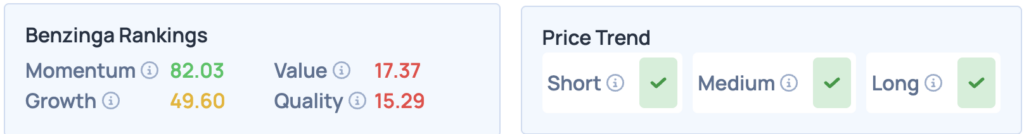

Coca-Cola’s stock shows strong momentum, but scores weak on growth quality and value. It does, however, show strong price trends in the short, medium, and long terms. For more such insights, consider signing up for Benzinga Edge Stock Rankings.

Read More:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Coca Cola JPMorgan Chase pepsico tariffsMarkets Analyst Ratings