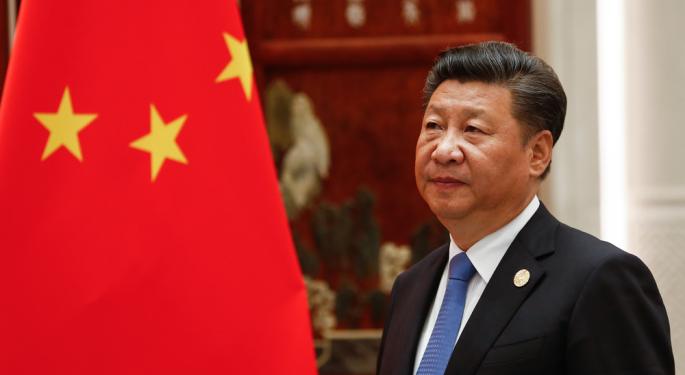

As Xi Jinping Wins A Historic Third Term, Prominent Economist Says 'Asymmetry,' Not 'Reciprocity' The Way To Deal With China

As Chinese President Xi Jinping gets re-elected for a historic third term and the Biden administration imposes sweeping tech restrictions on China, Patrick Chovanec, economic adviser at Silvercrest Asset Management, believes ‘asymmetry’ and not ‘reciprocity’ is the way to deal with China.

If there’s one argument I’d like to hear more, it’s that reciprocity is NOT the way to deal with China. Asymmetry is.

— Patrick Chovanec (@prchovanec) October 24, 2022

Market Recovery: With President Xi consolidating power, expectations regarding the continuation of key policies like Covid Zero have intensified, leading to a bloodbath in mainland China and Hong Kong stocks on Monday.

Also Read: Investing For Beginners

Tuesday witnessed some bit of recovery. Shares of Alibaba Group Holding Ltd (NYSE: BABA) were trading over 3% higher while Tencent Holdings (OTC: TCEHY) shares were trading over 1% higher in Hong Kong.

Shares of JD.Com Inc (NASDAQ: JD), too, recovered and were trading over 4% higher while Xpeng Inc (NYSE: XPEV) shares were up over 5% in Hong Kong. Nio Inc (NYSE: NIO) shares, however, continued trading in the red, down 0.78%.

Asymmetry: Chovanec explained that reciprocity allows China to define the contest on its terms, i.e. to clash where it has the advantage. “Asymmetry is about identifying where you have an advantage than can’t be matched, and taking the contest there, instead of where you adversary prefers to have it,” he said.

U.S.-China tensions have been simmering ever since the Biden administration imposed restrictions on chip exports to China. The Taiwan Semiconductor Manufacturing Company Ltd (NYSE: TSM) has reportedly suspended the production of advanced silicon for Chinese start-up Biren Technology to ensure compliance with U.S. regulations.

At the same time, Chinese chipmaker Yangtze Memory Technologies Corp has reportedly ousted American employees in core tech positions following the U.S. embargo on China.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: China Hong Kong Stocks Xi JinpingAsia News Top Stories Markets Tech Best of Benzinga