Fed's Rosengren Calls for Open-Ended QE to "Boost Asset Prices"

The President of the Federal Reserve Bank of Boston -- Eric Rosengren -- advocated sizable asset purchases by the Fed when he was interviewed on CNBC Tuesday morning. Rosengren is not a voting member of the Federal Open Market Committee, but he is an alternate member for both 2012 and 2013 and has some influence over Fed policy.

In the interview, Rosengren advocated for the Fed to increase its holdings of mortgage backed securities. By doing so, the Fed could help to further decrease real borrowing costs for consumers and companies, while restoring consumer confidence.

Sarah Eisen of Bloomberg Surveillance pointed out Tuesday morning that real income growth is outpacing real consumption growth.

Rosengren advocated sizable purchases with no limit on the total number, explaining that the Fed's only limit of easing is the amount of bonds outstanding.

Further QE programs could restore consumer confidence in two ways: reflating asset prices and creating a wealth effect and by decreasing unemployment and causing further optimism in those searching for employment. By achieving both of those, the Fed could help to stimulate the economy, which has shown notable signs of slowing since the middle of 2011.

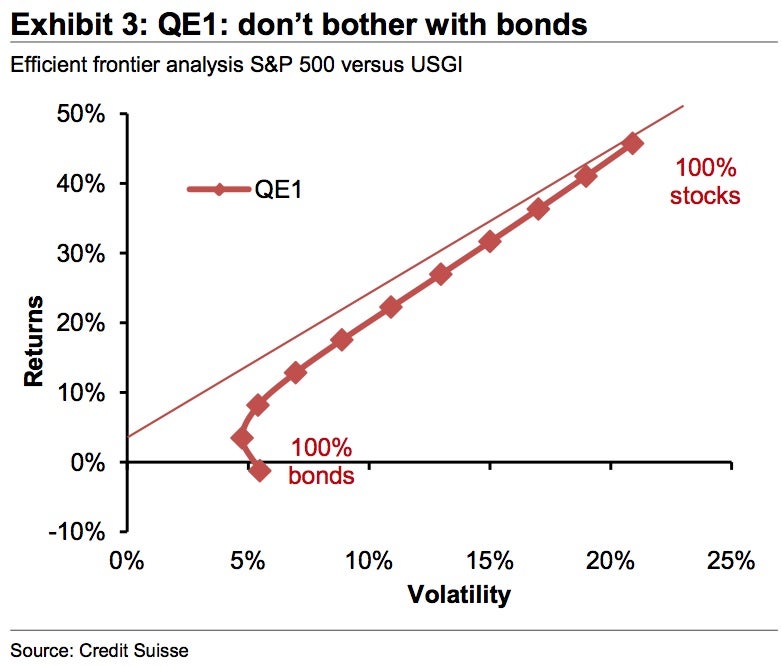

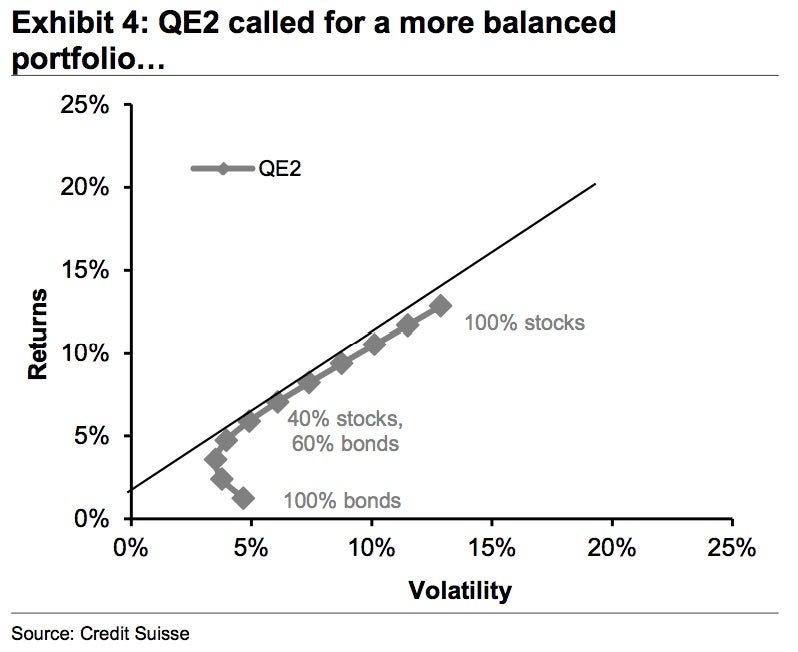

Credit Suisse issued a note late last week highlighting that even though the Fed is buying bonds in easing programs, owning a portfolio of equities and bonds provides maximum risk-adjusted returns during easing. As the above chart shows, the efficient portfolio to hold during QE1 was purely stocks. During QE2, as shown below, the portfolio eased to 40 percent stocks and 60 percent bonds. For a potential QE3, Credit Suisse suggests a higher allocation to equities of about 50-60 percent.

Chairman Ben Bernanke's speech at the Jackson Hole economic conference on August 31 could outline new easing policies. In the 2010 meeting he outlined QE2. Many expect that, if QE3 is imminent, it will be discussed by the Chairman there. The conference will precede the Fed's next meeting in mid-September.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News Bonds Commodities Previews Forex Global Econ #s Economics Best of Benzinga