Corn, Soybean June Report: Prolonged Dryness Is A Growing Headwind

The 2025 growing season is presenting challenges with precipitation levels significantly below both last year’s levels and the norm. This sustained dryness is impacting major corn- and soybean-growing states in the United States, where prolonged drought conditions prevail. The latest World Agricultural Supply and Demand Estimates (WASDE) report indicates a shift in U.S. corn supply and demand for the upcoming year, with lower use and stocks expected. Despite a 75 million bushel reduction in old-crop feed use, U.S. corn exports have surged, prompting the USDA to raise export projections to record levels. Additionally, soybean production forecasts for 2025/26 have been slightly adjusted downward to 4.335 billion bushels, reflecting ongoing challenges in the agriculture sector.

Corn Outlook: Like a Desert Needs the Rain

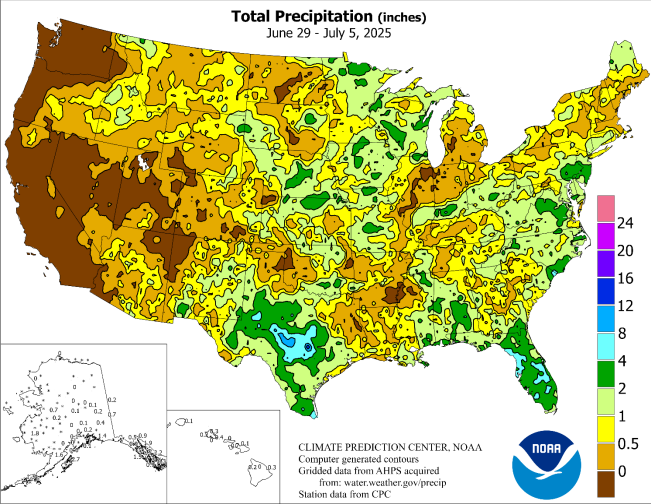

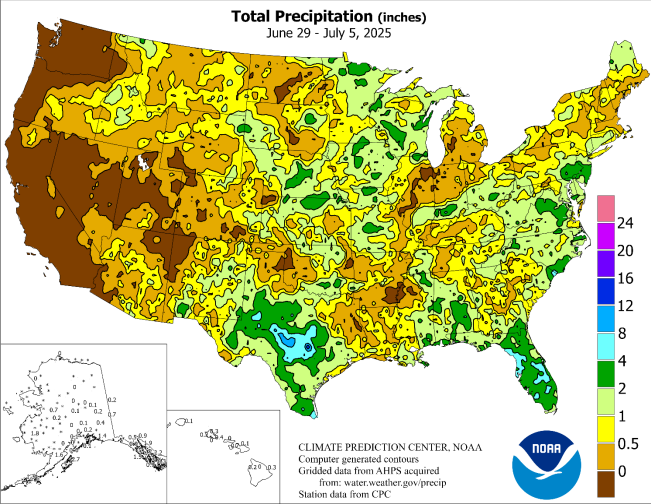

In the United States, prolonged drought has affected major corn-growing states, especially Kansas, Oklahoma and Iowa. Rainfall has been scarce since autumn 2024, and the lack of soil moisture has already negatively affected early development. If no significant rain arrives by mid-July, yield losses may worsen.

In the second half of July, the Corn Belt is expected to experience temperatures slightly above normal, further increasing drought stress.

Source: https://www.cpc.ncep.noaa.gov/

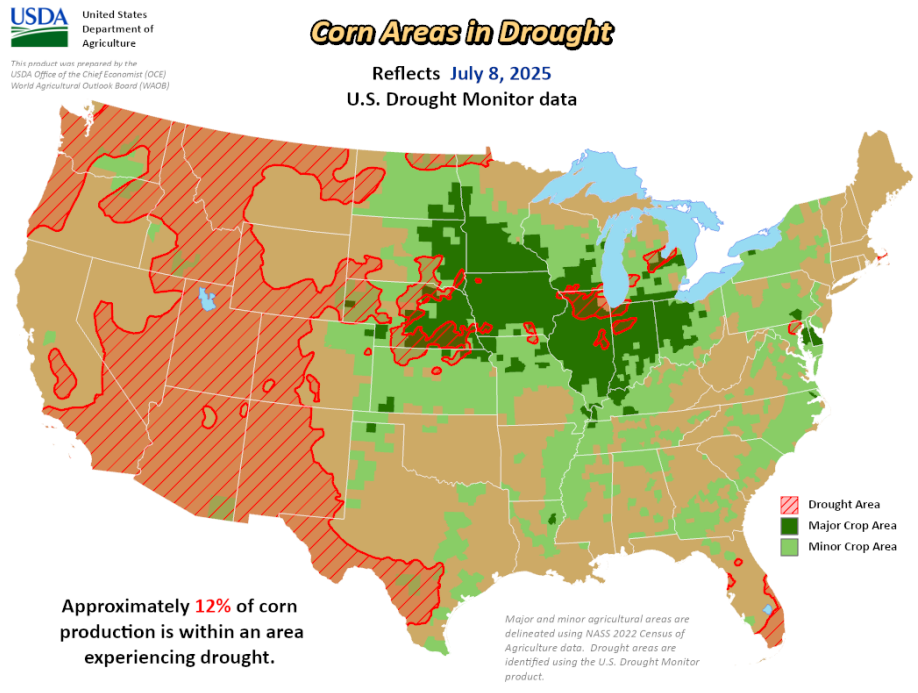

Widespread rains and thunderstorms are maintaining soil moisture for summer crops in the Corn Belt, and only about 12% of U.S. corn was challenged by drought as of July 8.

In fact, temperatures in the Midwest remained below stress thresholds. In the Plains, however, rain was more sporadic – only scattered showers were reported in Kansas/Nebraska, leaving some dry areas and minor planting delays. In contrast, the western U.S. saw very hot, dry weather (daily highs ~37.8–43.3°C in places), which could stress spring-planted corn and other crops there. In the Southern U.S., however, scattered storms brought some moisture, though the western Gulf Coast still remained hot and dry.

All in all, the 2025 precipitation levels remain significantly below both the 2024 and historically normal levels, indicating sustained dryness through the early growing season. While 2024 experienced notably high rainfall from May through August — surpassing normal levels — the current year has seen a clear precipitation deficit, particularly in the critical months of May and June when crop moisture demand peaks. This shortfall heightens drought concerns across the Corn Belt and key soybean-growing areas, increasing the risk of yield losses unless conditions improve in late July or early August. The persistent gap between the 2025 line and the historical average highlights the ongoing impact of below-normal rainfall on U.S. crop production.

2025 has experienced rainfall amounts above the previous year (2024), yet still below the historical norm. While 2024 was notably dry — especially between March and April — 2025 showed a more consistent rainfall pattern, reducing the severity of dryness in key agricultural regions. However, despite the improvement over last year, 2025's cumulative precipitation remained consistently under historical averages, particularly in April and May, which are critical months for the second corn crop (safrinha) harvest. The shortfall compared to the normal curve suggests moderate moisture stress, especially in late-planted areas. Continued precipitation into July slightly narrowed the gap, offering some relief, but overall weather conditions remain marginally suboptimal for peak yields.

NDVI (Normalized Difference Vegetation Index) is a satellite-derived index used to measure the health and density of vegetation. NDVI values climbed steadily from March through late June, indicating improving crop vigor and greenness across key agricultural regions. By early July 2025, NDVI had reached its seasonal peak slightly earlier than usual, indicating accelerated crop development in many growing locations. The data also show that vegetation conditions have remained within the historical min–max range, with no significant anomalies. This robust vegetative signal points to favorable crop conditions overall, although regional disparities in rainfall, especially in the western Corn Belt, may still influence yield potential at a local level.

Corn Market Dynamics: Late-Season Growing Conditions in Focus

The USDA's July 11 WASDE report kept the U.S. 2025/26 corn yield at a record-high 181.0 bushels/acre and slightly trimmed production to 15.705 billion bushels (down 115 million from June). This reflects slightly reduced planted area reported in late June, with yields assumed steady. Global corn production was forecast nearly unchanged as U.S. output is above-trend, Brazil's 2024/25 crop was nudged slightly higher (though recent reports trimmed it to ~132.0 million tons), and Argentina's second-crop outlook was stable. Overall world corn supplies remained ample – in part due to robust South American output – even after small adjustments in forecasts. Given current weather data showing subnormal rainfall in parts of the Corn Belt and mixed NDVI signals, the final production figure will depend heavily on late-season growing conditions, particularly pollination and grain fill stages in July and August.

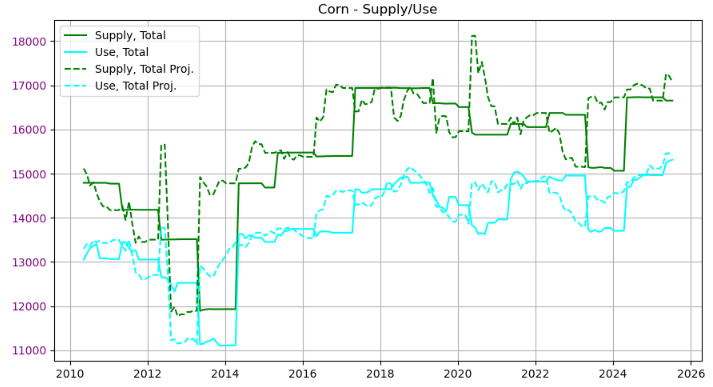

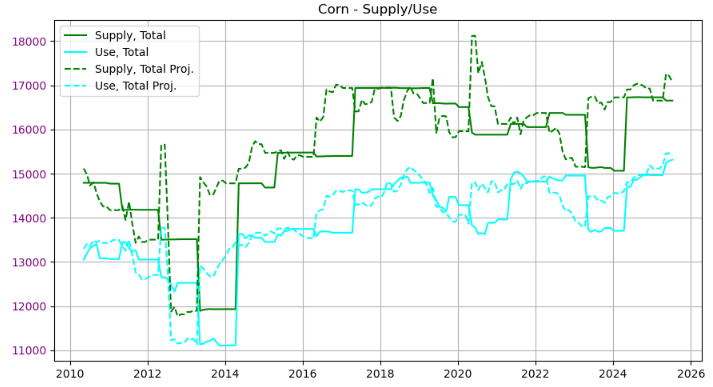

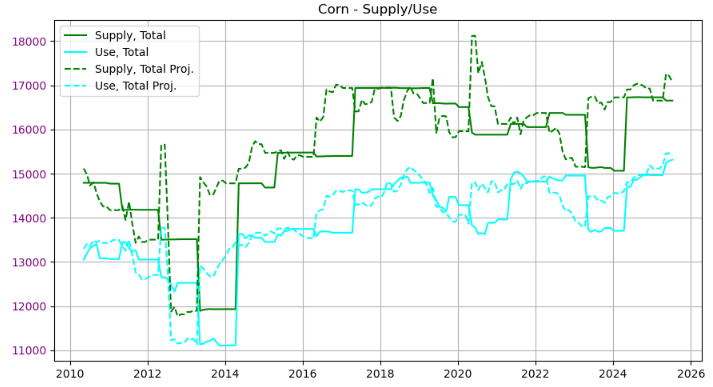

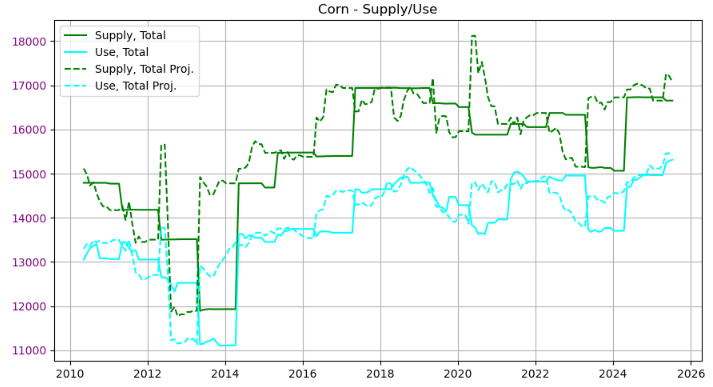

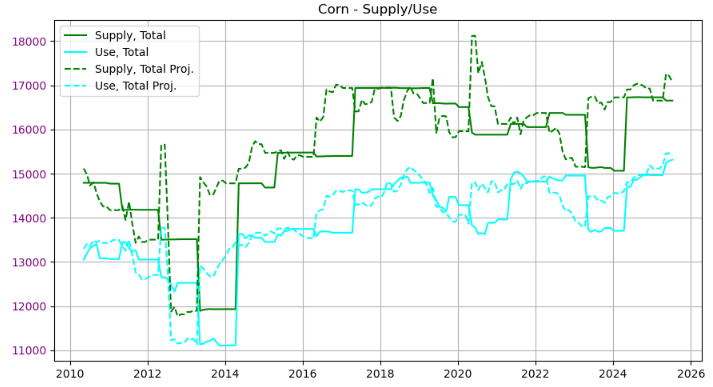

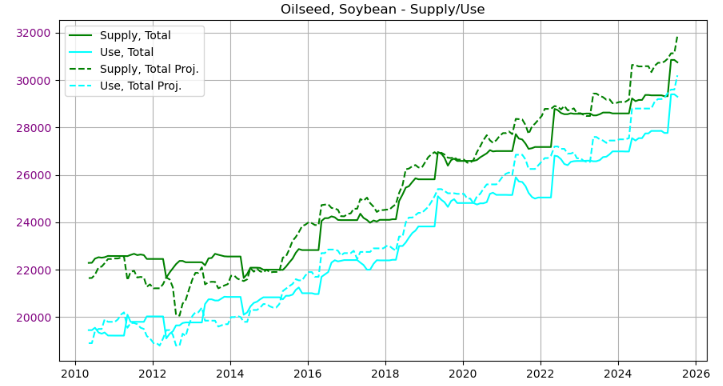

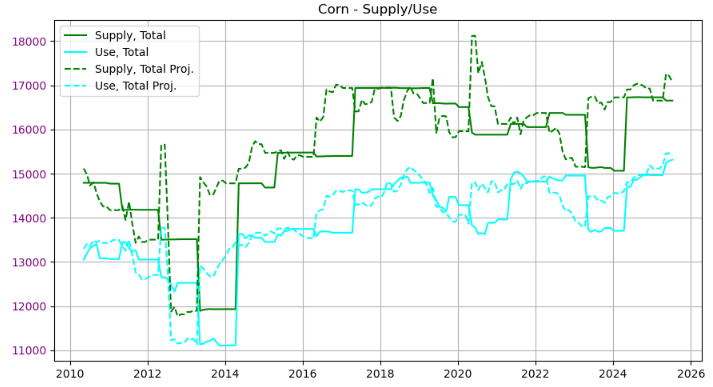

WASDE noted that U.S. corn supply/demand for 2025/26 shifts to lower use and stocks. Old-crop (2024/25) feed use was cut 75 million bushels based on June disappearance data, and new-crop (2025/26) feed/residual use was trimmed 50 million. These cuts more than offset the 115-million-bushel drop in production. As of mid-2025, the U.S. corn supply remains robust, with total supply projections exceeding 17,000 million bushels, maintaining the upward trend seen in recent years. This reflects strong beginning stocks and steady production expectations. On the demand side, total use is also trending higher, approaching record levels near 15,500 million bushels. This increase is supported by sustained domestic feed demand and stable export flows, although global competition and economic uncertainty continue to shape trade dynamics. The gap between projected supply and projected use remains positive, suggesting a comfortable supply buffer for the 2025/26 marketing year.

U.S. corn exports have been exceptionally strong. Notably, USDA raised U.S. exports by 100 million bushels for the current year (2024/25) and by 100 million for 2025/26, up to a record 2.8 billion bushels. The export boost partly reflected outstanding sales and shipments to date. Recent USDA "flash sales" highlight this trend: for example, on July 11 private exporters reported sales of 4.3 million bushels of corn for 2025/26, including large shipments to Mexico. Cumulative corn sales to Latin American and Asian buyers (Mexico, Colombia, China, etc.) remained well above the year-ago period, reflecting tight world supplies outside the U.S. Conversely, some traditional markets (like Japan) are purchasing smaller volumes, but U.S. exporters have gained share in Mexico and elsewhere. Seasonal import demand from China is also competitive. Overall, strong global demand for U.S. corn – including feed use in Southeast Asia and ethanol production – is tightening the U.S. exportable surplus.

With demand cut slightly less than supply, USDA lowered U.S. ending stocks by 90 million bushels (to about 1.66 billion bushels for 2025/26). The WASDE projects U.S. 2025/26 corn ending stocks at about 1.66 billion bushels, down from prior forecasts but still sizable by historical standards. For 2024/25 (old crop) USDA estimated carryout at about 1.34 bbu. World corn ending stocks (for 2025/26) were adjusted slightly lower – to about 272.1 million metric tons – mainly on reductions for China and India (partly offset by higher Brazil).

A stocks-to-use ratio near 10% indicates that market conditions remain moderately tight, increasing sensitivity to yield risks, geopolitical trade disruptions, or shifts in energy markets (e.g., ethanol demand). While not critically low, this ratio supports relatively firm price levels and points to limited flexibility should unexpected shocks reduce supply or increase demand further.

Following the July reports, corn futures moved to fresh lows. USDA's season-average farm price (SAFP) for 2025/26 corn remained at $4.20/bu. For now, weather (as the crop progresses) and harvest yield guesses are keeping corn prices suppressed. If weather turns adverse, any tightening could provide support, but absent that, the outlook in mid-July is for prices to remain near current levels (roughly $4.10–$4.30 in the new crop). As of July 12, 2025, U.S. corn futures have fallen to $397.51 per bushel, marking a decline from above $420 earlier in the month. The price trajectory over the past month reflects significant volatility, with a sharp mid-June drop followed by a brief rebound in early July before resuming a downward trend.

No major new U.S. policy changes emerged in July for corn. The Renewable Fuel Standard (RFS) and biofuel policy continue to underpin ethanol demand (ethanol consumes over 40% of U.S. corn). No changes in RFS mandates were announced in July, so policy support remains steady. Internationally, some tariff and phytosanitary issues persist, but no new trade disputes or quotas were enacted in July that directly affect corn.

Soybeans Outlook: Healthy Rainfall in the US, but Moderate Dryness in Southeast China

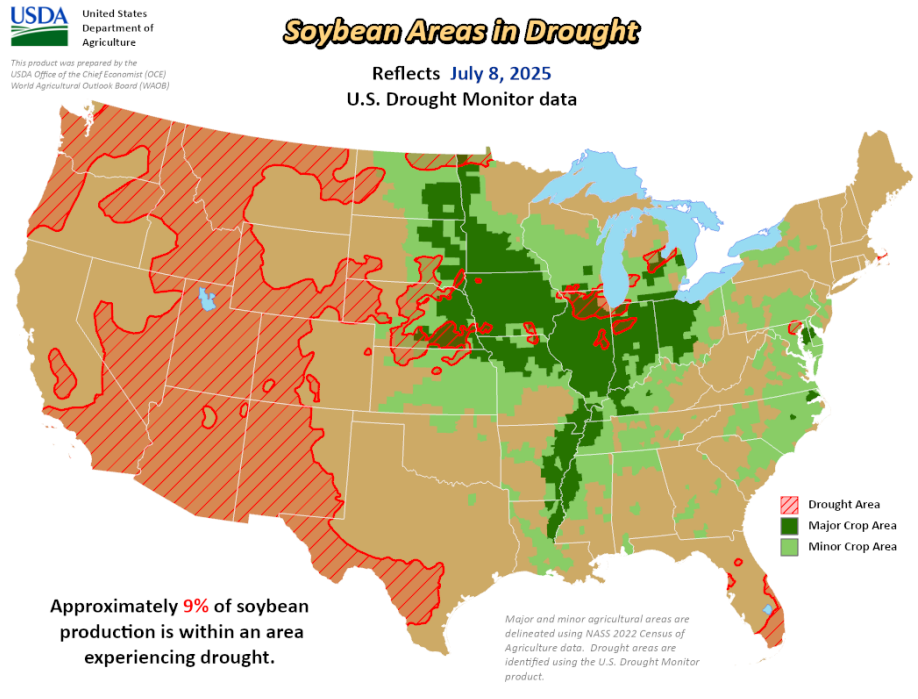

U.S. soybean weather was closely tracked with that of corn in July. The Midwest's scattered rains have maintained healthy soil moisture: only about 9% of the U.S. soybean area was in drought by July 8. U.S. soybean areas are also experiencing drought, especially in parts of the western and central regions. While soybeans were planted from late April through June, continued dryness is a critical concern. Soybeans are particularly vulnerable to long-lasting droughts, and water stress during July and August could severely limit yields. Similar to corn, a temperature anomaly above seasonal norms is forecast in the main agricultural belt. In Brazil, weather conditions during planting were mostly favorable, although some southern regions experienced dry spells.

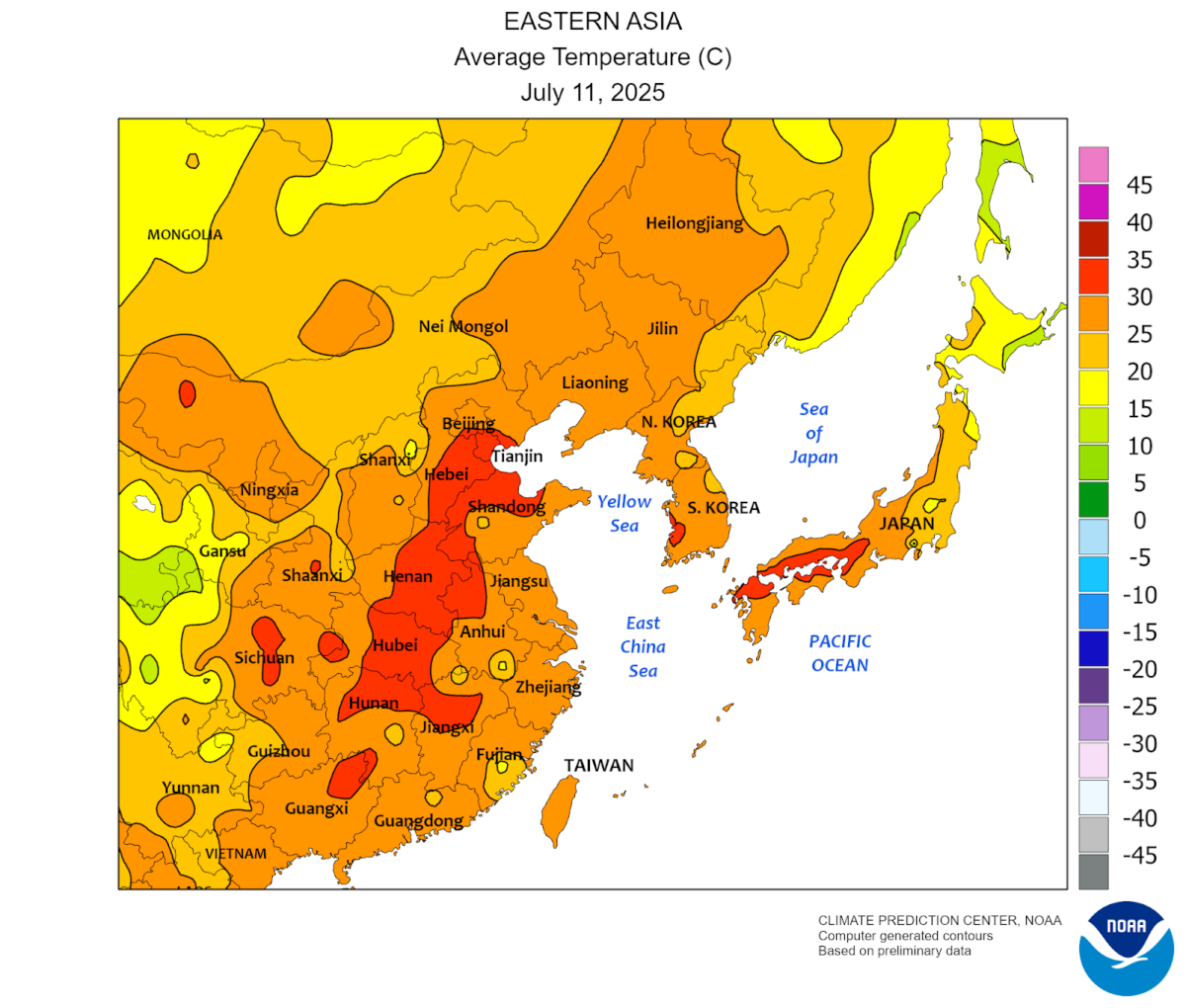

Increased rainfall ranging from 10 to over 100 mm benefited portions of northeastern China and the North China Plain, where soybeans are nearing the reproductive stage. These wetter conditions alleviated prior dryness and enhanced soil moisture availability, supporting crop development.

Source: https://www.cpc.ncep.noaa.gov/products/JAWF_Monitoring/China/GFS_forecasts.shtml

However, southeastern China faced hot and dry weather, with temperatures in the upper 30s °C and limited rainfall, adding stress to crops in those areas. Overall, the recent shift toward wetter conditions in key soybean-producing zones of northeastern China is favorable for yield potential, though the continued dryness in the south poses localized risk.

Source: https://www.cpc.ncep.noaa.gov/products/JAWF_Monitoring/China/temperature.shtml

China’s cumulative precipitation is close to, although slightly above, the long-term norm. The increase in precipitation from June to early July indicates improved moisture availability during the critical period for summer crops such as corn and soybeans. Overall, weather conditions in 2025 are currently characterized by stable to favorable growing conditions, especially on the North China Plain, which is critical for grain and oilseed production.

Growers reported showers nearly every week across the Corn Belt, so crops are generally well-watered. Temperatures have been moderate in key growing regions, avoiding extreme heat stress.

NDVI data suggests favorable growing conditions during the peak vegetative period of the crop. Although NDVI values began to decline slightly in March and April, they remained close to or above normal levels, indicating healthy crop development overall. The higher-than-average NDVI throughout the season reflects adequate moisture availability and minimal stress, supporting strong yield potential for soybeans in the current cycle.

Soybean Market Dynamics: Favorable Weather Conditions Suggest Bearish Trend to Prevail

The USDA's July 11 WASDE forecast U.S. 2025/26 soybean production at 4.335 billion bushels, slightly down 5 million from June. This reflects marginally smaller harvested acreage reported in the June acreage data, with yield unchanged at 52.5 bu/acre. Brazil's 2024–25 soybean crop was left at 169.0 million tons (unchanged), and Argentina's was unchanged in the WASDE. Global soybean supplies remain ample: world production for 2025/26 was projected slightly higher (with Ukraine's crop lifted), but higher demand moderated stocks. Soybean production remains relatively stable but slightly below the highs observed in previous years. The projected figures also suggest limited upside, with no indication of a strong rebound. This stability, coupled with supportive NDVI conditions earlier in the season, implies that weather has not severely disrupted yields, but production has not significantly expanded either, possibly due to acreage limitations or other structural factors.

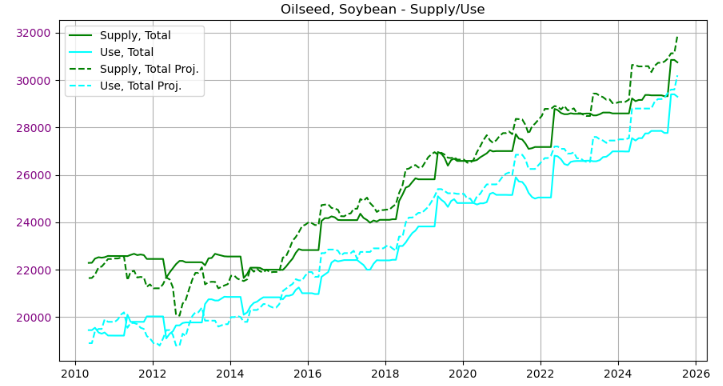

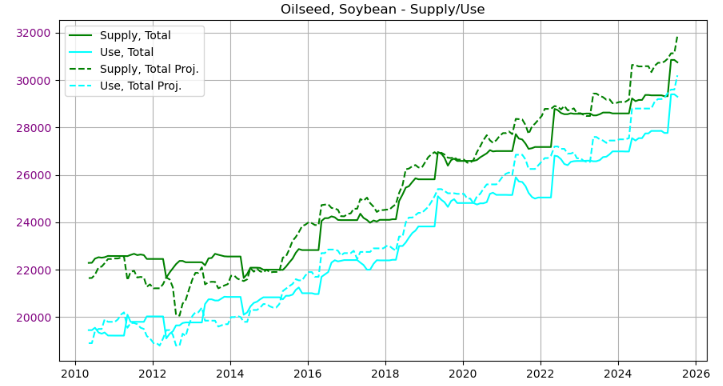

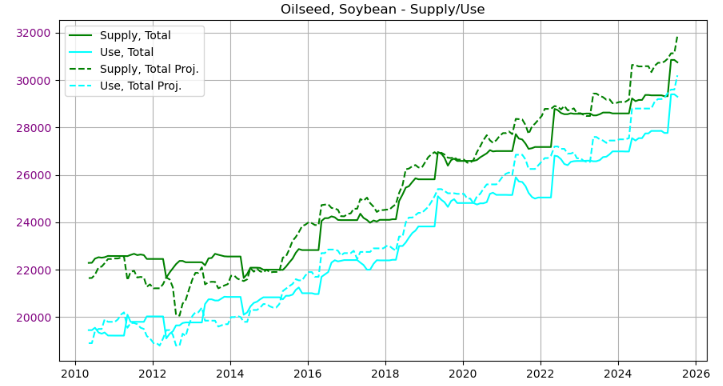

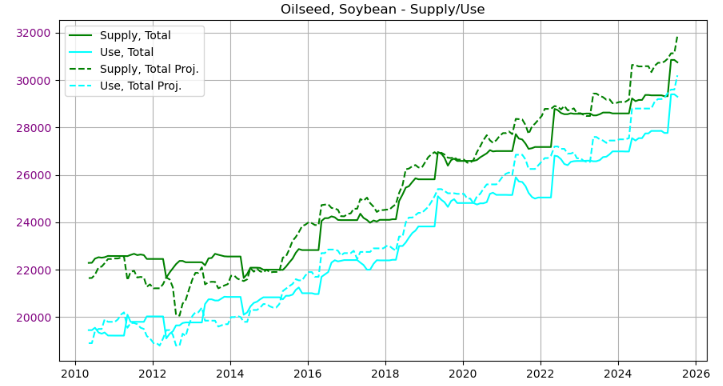

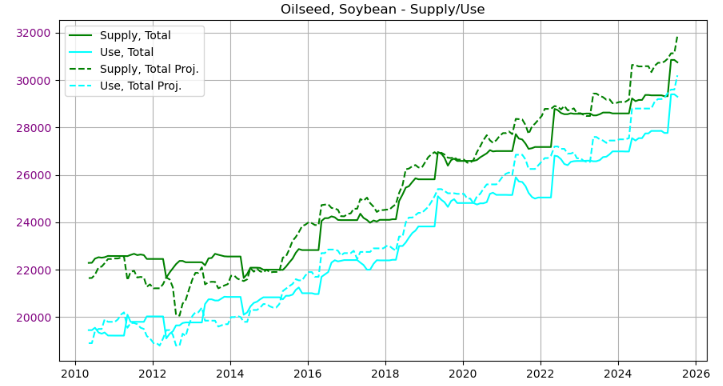

Crush demand was raised by 50 million bushels to 2.54 billion bu (up 2% month-to-month), driven by strong demand for soybean oil for biofuel. Increases in oil and fat production volumes and oil consumption are associated with the proposed RFS requirements (and associated tax incentives) from the Environmental Protection Agency. These policy shifts led USDA to raise its soybean-oil-for-biofuel forecast sharply. Conversely, no new trade restrictions or tariffs on U.S. soybeans were imposed in July. Soybean oil production continues its strong upward trajectory. Estimated output has reached approximately 29 million metric tons, marking a new all-time high and reflecting sustained growth over the past decade. Projections for the remainder of 2025 suggest further increases, potentially exceeding 30 million metric tons. This ongoing rise highlights increasing processing capacity and robust demand for soybean oil, likely driven by expanding food, industrial, and biofuel applications globally. The steady growth trend also suggests that recent weather conditions and crop yields have been supportive of oilseed processing.

both the total supply and total use of soybeans are trending higher, continuing their long-term upward trajectories. Total soybean supply has surpassed 31 million metric tons, while total use is approaching 30 million metric tons, reflecting strong domestic and global demand. The gap between supply and use remains relatively stable, suggesting balanced market conditions. Projections indicate further increases in both metrics through the end of 2025, driven by favorable weather in key producing regions and expanding consumption in food, feed, and industrial sectors. This sustained growth supports bullish sentiment in the soybean complex.

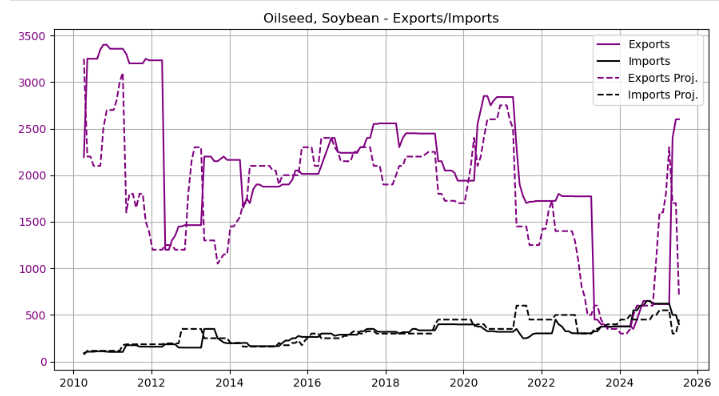

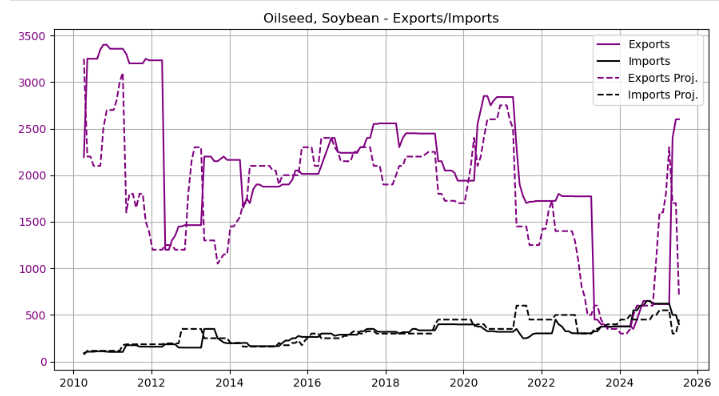

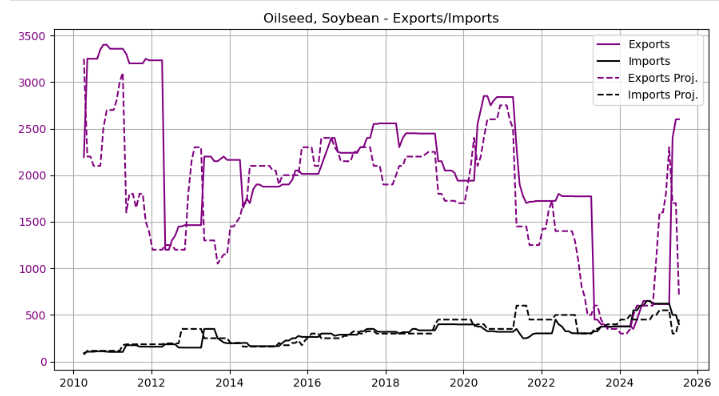

Soybean trade remains focused on Latin American importers. In July, U.S. soybean exports have been led by purchases from Mexico – for example, private exporters reported 8.1 million bushels of soybeans sold to Mexico for the 2025/26 year. South American competition has kept prices low: Brazil is filling much of China's demand and new buyers are emerging for Paraguayan/Uruguayan soy. On the soybean meal side, smaller U.S. export sales (amid higher Argentine and Ukrainian exports) also contributed to the lowered U.S. export forecast. Domestically, strong crush (for biodiesel and livestock) has eaten into available supply for export. Overall, U.S. soybean export pace has been slower than expected, helping push USDA's forecast down.

With the higher crush and lower exports, the USDA now projects U.S. 2025/26 soybean ending stocks at 310 million bushels. This is up from 295 million last month and well above the ~250 million anticipated. By comparison, the 2024/25 carryout was estimated at about 350 million (unchanged from June). Globally, world soybean stocks were raised to ~126.1 million metric tons, reflecting higher stocks in Brazil and the U.S. (offsetting drops in China/Argentina).

Projections ending stocks-to-use ratio suggest a moderate increase in stocks relative to use later this year, which could ease supply pressure slightly. However, the overall trend still reflects a constrained balance sheet, keeping upward pressure on prices and underscoring the market’s sensitivity to production risks.

As USDA left the season-average farm price (SAFP) for new-crop soybeans at $10.10/bu (down 15¢ from June), soybean futures are trading at around $1003 per bushel. Over the past month, the market has experienced a steady downward trend, falling from above $1063 in mid-June to its current levels. This decline suggests ongoing pressure from more favorable than expected weather conditions and potentially improving supply outlook. Despite brief recoveries in early July, the overall price direction remains bearish, indicating that traders are pricing in reduced risk to soybean yields or a less tight balance sheet than previously feared.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasCommodities Opinion Trading Ideas