JA Solar Holdings (JASO): Put trading heats up

Stock has outpaced the S&P 500 by 30%.

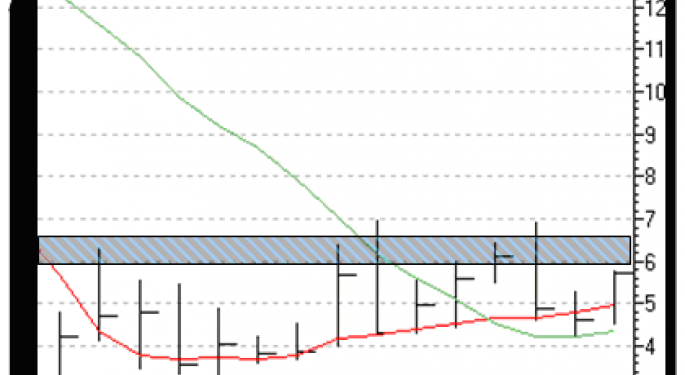

On one hand, JA Solar Holdings Co. (NASDAQ: JASO, Stock Forum) has been a broad-market standout lately, outpacing the S&P 500 Index (SPX) by 30% during the past 20 sessions. From a longer-term perspective, though, the shares have trended somewhat sideways, meandering between support at their 10-month and 20-month moving averages and resistance in the overhead $6-to-$6.50 region.

In fact, the long-term resistance now looming just overhead could explain why options speculators have ramped up their bearish positions lately. More specifically, the stock’s 10-day International Securities Exchange (ISE) put/call volume ratio of 0.23 ranks in the 74th annual percentile, implying that traders on the exchange have initiated bearish bets over bullish at a faster pace only 26% of the time during the past year.

To read more, click here.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: International Securities Exchange JA Solar Holdings Co. S&P 500 StockHouse.comNews Futures Markets