Coinbase Says Layer 2 Solutions Could Eat Ethereum's Lunch

A recent research report from Coinbase Global Inc (NASDAQ: COIN) warned that Layer 2 scaling solutions for Ethereum (CRYPTO: ETH) could potentially end up diverting revenue away from ETH itself.

What Happened: Layer 2 networks like Optimism (CRYPTO: OP), Polygon (CRYPTO: MATIC) and Arbitrum may well become the application layers hosting the bulk of economic activity while ETH exists solely to store transaction data, Coinbase analysts wrote in a monthly outlook report.

See Also: WHAT ARE LAYER 2 SOLUTIONS IN CRYPTO?

As more decentralized applications migrate to L2s, the analysts said that it was feasible to assume that the L2s could eventually divert revenue away from ETH, turning the largest market contract platform into a storage layer of transaction data.

“That in turn could reduce staking yields to validators and hurt the ETH price by limiting the amount staked on the network thus increasing the liquid circulating supply,” the analysts wrote.

“It could also potentially impact the overall security of the network.”

The Coinbase research analysts noted that the revenue impact over the long run would depend on whether “the overall size of the pie” or the level of activity in the ecosystem continues to rise.

“Many [L2s] still use ETH to pay for transactions, but we think the trend could be that L2 ecosystems could become competitive rather than complementary to Ethereum’s,” they said.

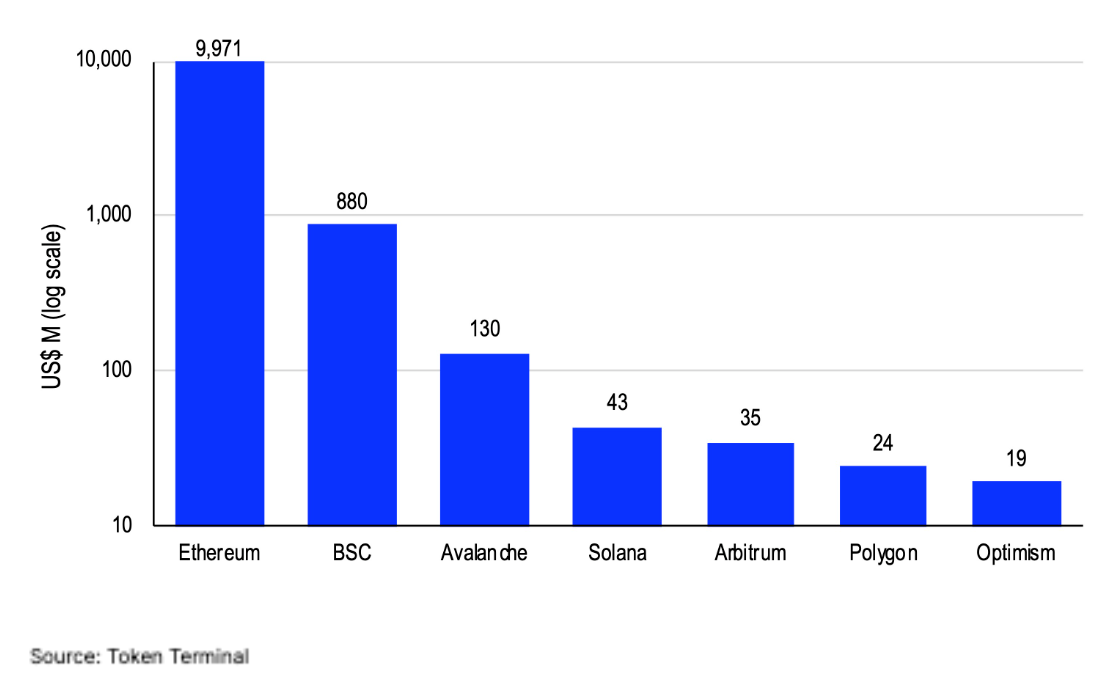

The report highlighted that over the last 12 months, ETH earned $9.9 billion in total revenue compared to an aggregate of $78 million on Arbitrum, Polygon and Optimism.

At the moment, the total value locked in L2s is just a small fraction of the amount on Ethereum, but as zkEVM implementation looks increasingly achievable, major traction could be seen in L2 growth, the analysts said.

Price Action: At press time, ETH was trading at $1,931, down 2.95% over 24 hours as per data from Benzinga Pro. MATIC was trading at $1, down 0.94% and OP was trading at $1.45, down 8% over the same period.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: BlockChains Ethereum Ethereum Layer 2 Scaling SolutionsCryptocurrency News Markets Best of Benzinga