FOMC Minutes In Focus

Good Morning Everyone!

Crypto winter has been rough for everyone. Especially Coinbase:

-

Q4 2021: $840m net profit

-

Q4 2022: $557m net loss

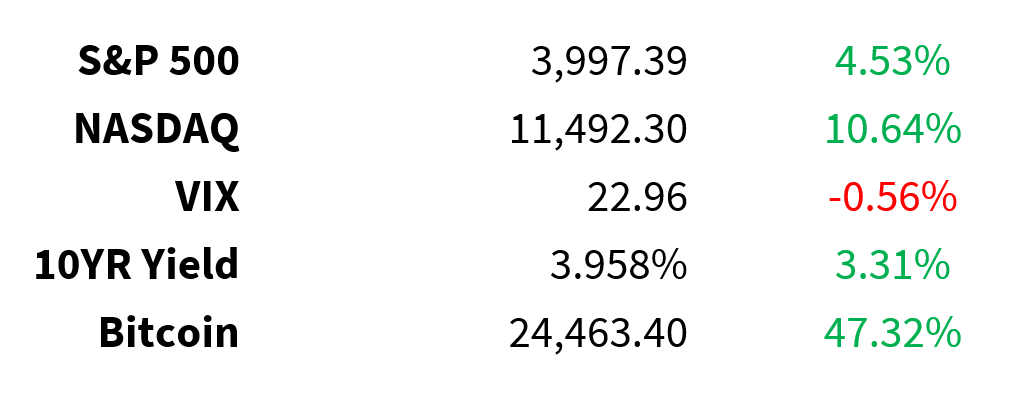

Prices as of 4 pm EST, 2/21/23; % YTD

MARKET UPDATE

2 pm: FOMC minutes

-

Market embracing higher-for-longer

-

Federal funds rate expectations ~5.3% in June

-

4.9% three weeks ago

-

-

US02Y at November highs

-

US01Y above 5% for first time since 2006

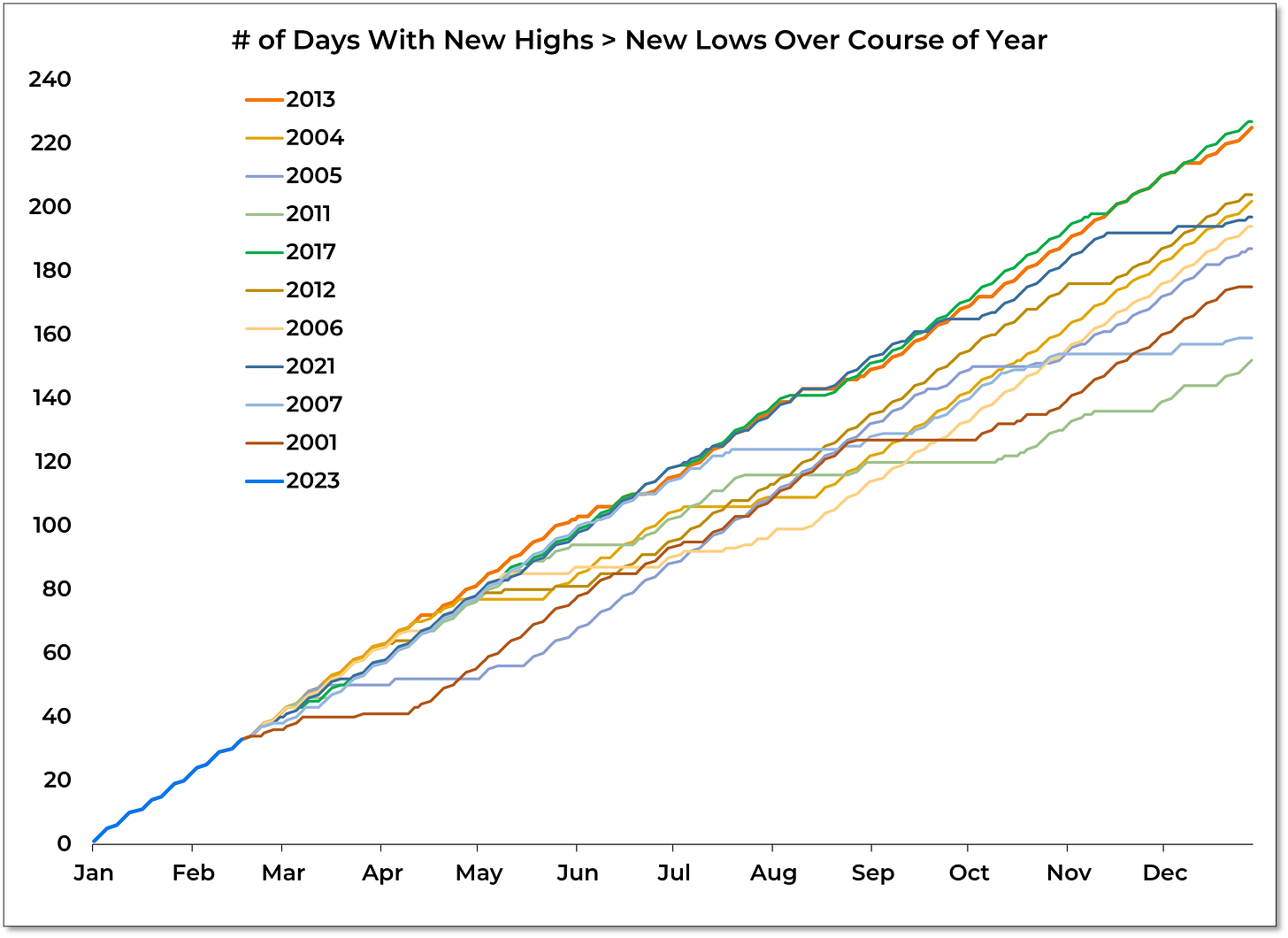

Yesterday was the first day of the year where New Lows > New Highs

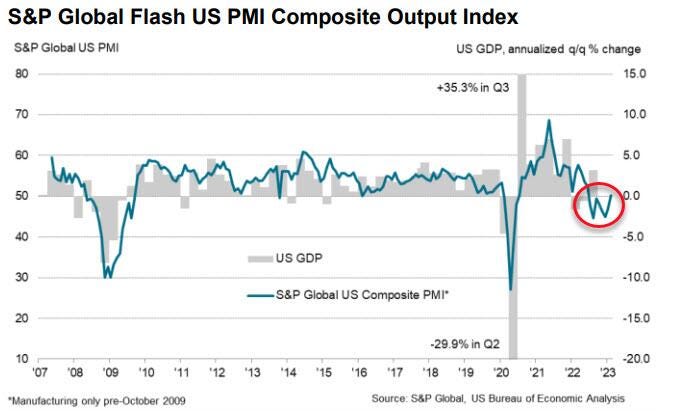

S&P Global flash PMIs

-

Composite output (chart) rose sharply driven by services (both at 8-month highs)

-

Uptick in manufacturing (4-month high)

-

New orders down but pace of contraction decelerating

-

Cost pressures soften but output charges rise

-

Optimism highest since May 2022

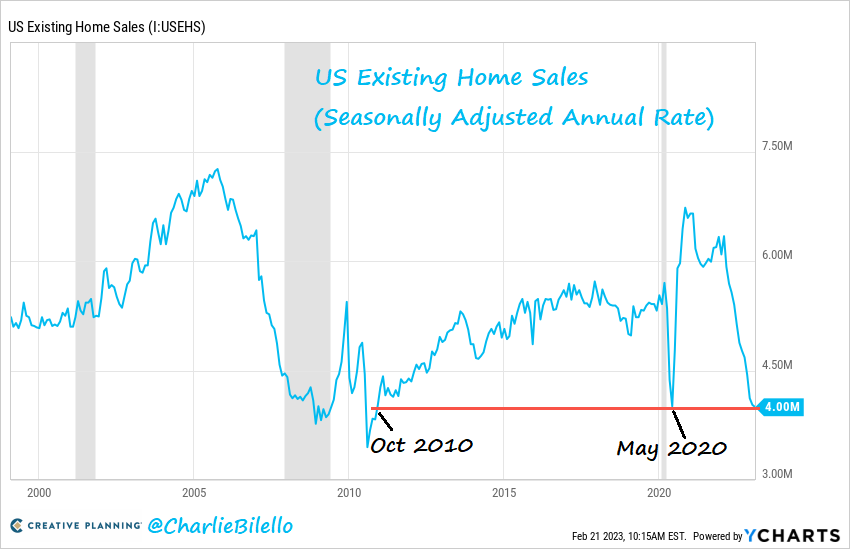

Existing home sales

-

Dropped by 0.7%, 12th straight monthly decline

-

Slowest pace since Oct 2010

-

-

-37% YoY, worst on record

-

Median home price +1.3% YoY

-

Prices fell MoM for 7th straight month

-

Palo Alto Networks (NASDAQ: PANW)

-

Beat on top & bottom lines

-

3 consecutive Qs of profitability after decade in the red

-

Raised outlook, earnings guidance for 2023

Microsoft (NASDAQ: MSFT)

-

Making moves to ease regulator fears over Activision (NASDAQ: ATVI) takeover

-

Signs 10-year contract with Nintendo for Call of Duty

-

CoD will be released same day, same features for Nintendo as Xbox

-

-

Agrees to bring games to Nvidia's (NASDAQ: NVDA) GeForce Now Service

-

Nvidia now supports regulatory approval of MSFT/ATVI acquisition

-

-

EU reviewing deal

-

US FTC has sued to block

Earnings

-

TJX (NYSE: TJX)

-

Nvidia (NASDAQ: NVDA)

-

Baidu (NASDAQ: BIDU)

-

eBay (NASDAQ: EBAY)

-

Etsy (NASDAQ: ETSY)

-

Overstock.com (NASDAQ: OSTK)

-

Garmin (NYSE: GRMN)

-

iQIYI (NASDAQ: IQ)

-

Charles River Labs (NYSE: CRL)

-

Brink's (NYSE: BCO)

-

NiSource (NYSE: NI)

-

Bausch + Lomb (NYSE: BLCO)

-

Vertiv (NYSE: VRT)

-

Driven Brands (NASDAQ: DRVN)

-

Travel + Leisure (NYSE: TNL)

-

Sinclair (NASDAQ: SBGI)

-

Installed Building Products (NYSE: IBP)

CRYPTO UPDATE

Coinbase (NASDAQ: COIN)

-

Beat earnings & revenue estimates

-

Userbase is shrinking

-

8.3 million monthly transacting users in Q4

-

Down from 8.5 million

-

Polygon Labs layoffs

-

Cutting 20% of workforce (~100 jobs)

-

Consolidating multiple business units

Paxos breaks up with Binance

-

Paxos CEO says ending relationship with Binance

-

Paxos served Wells notice by SEC over BUSD issuance/listing

-

Will Binance also move away from BUSD?

-

Binance has been increasing its USDC holdings

-

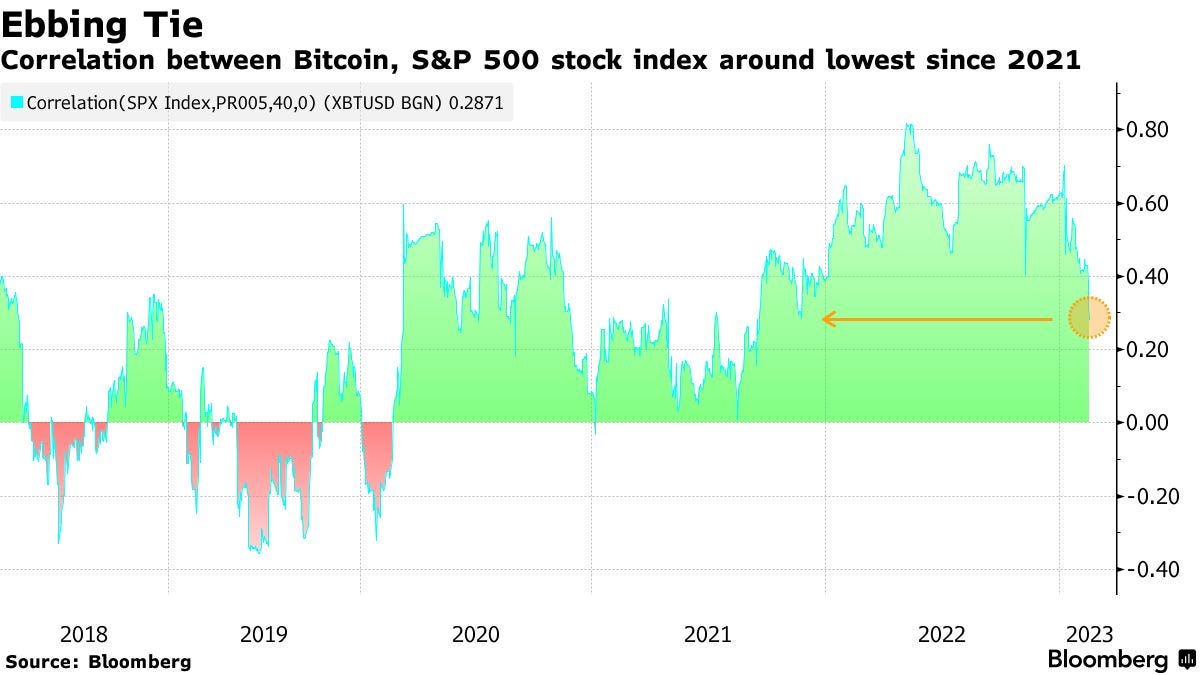

Bitcoin vs. S&P 500

-

40-day correlation at lowest since 2021

-

Down to <0.3 from record 0.8 in May 2022

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: contributorsCryptocurrency Earnings News Small Cap Markets Tech Real Estate