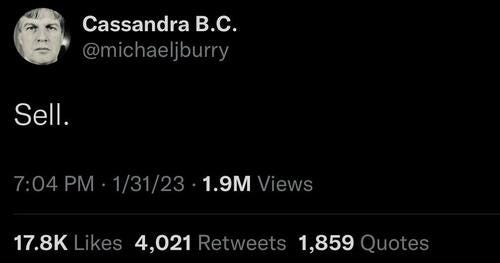

Burry In Q1: "Sell", Also Burry In Q1:

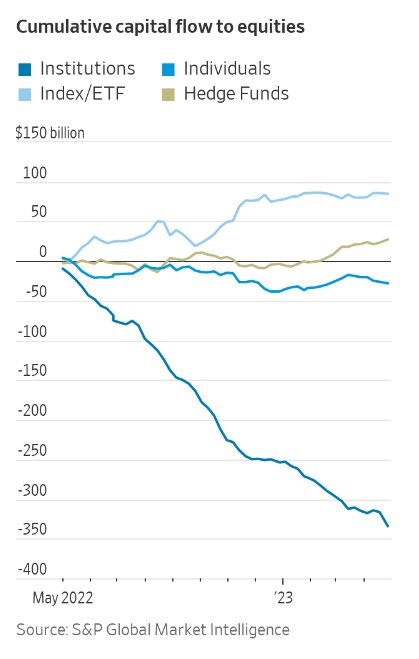

Institutional investors have been dumping stocks for the last 12 months. You have to ask yourself some serious questions when you see this.

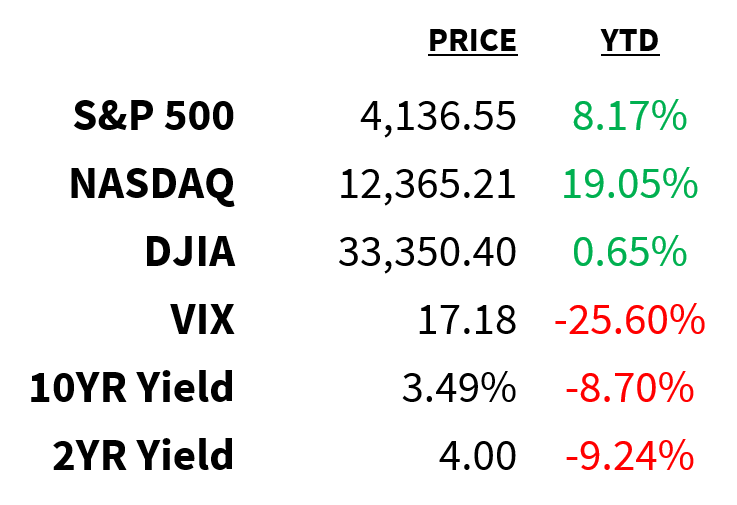

Market

Prices as of 4 pm EST, 5/15/23

Macro

According to CME Group’s FedWatch Tool, markets give virtually zero (0.4%) chance that interest will remain at their current level of 5-5.25bps by the end of the year.

-

Yesterday, however, Fed officials pushed back on those odds.

-

Atlanta President Raphael Bostic said he doesn’t predict any rate cuts until “well into 2024”.

-

Minneapolis Fed President Neel Kashkari (who is a voting member this year), meanwhile, said the Fed still has “more work to do…to bring down inflation”.

Total consumer debt has hit a new record at over $17 trillion.

-

The fresh highs come despite the lowest level of mortgage originations since 2014.

-

For the first time in 20 years, consumers failed to pay down their credit card balances in Q1.

-

This suggests households are struggling under the pressure of higher prices.

Manufacturing activity in New York collapsed to its lowest level in 4 months, falling to -31.8 in May.

-

Excluding the pandemic, the 42.6 drop was the largest ever.

-

Relative to expectations, it was the 3rd largest drop on record.

-

The biggest drops were seen in new orders (-53.1), shipments (-40.3), and inventories (-20.5).

-

Was April’s 10.8 reading a headfake?

Zero Hedge

Stocks

Mark Kolanovic has reiterated his underweight call for US and EU equities.

-

As the X-date approaches, the top JPMorgan strategist points to the debt ceiling impasse as a catalyst for stock market volatility ahead.

-

He cites 2011’s debt event as a roadmap for investors if the “issue goes down to the wire”, as it appears likely to do so.

Activist investor Nelson Peltz has upped his stake in Walt Disney.

-

After cutting its position by 34% by the end of March, his firm (Trian Partners) has purchased another 500k shares, bringing its total share count to 6.4 million.

-

Peltz had backed off his push for a board seat in February after the company announced a $5.5 billion cost-cutting plan.

Here’s what a couple of Wall Street’s biggest names were buying/selling in Q1:

-

Warren Buffett:

-

Michael Burry:

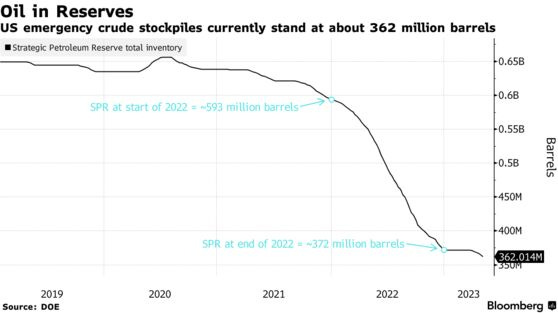

Energy

The US is planning to buy up to 3 million barrels of sour crude oil in August to restock its Strategic Petroleum Reserve (SPR).

-

The government drained the SPR by 2.9 million barrels last week.

-

At ~372 million barrels, reserves are currently at the lowest level since 1983.

Earnings

Yesterday’s highlights:

Nu Holdings (NYSE: NU): $0.04 EPS (vs. $0.03 expected), $1.62 billion in sales (vs. $1.39B expected).

-

Net income reached $142 million on revenue which nearly doubled YoY.

-

The company added 4.5 million customers in Q1, bringing its global total to 79.1 million.

Monday.com (NASDAQ: MNDY): $0.14 EPS (vs. -$0.28 expected), $162.3 million in sales (vs. $155.3M expected).

-

The company revealed plans to open its platform to third-party developers to build AI apps.

-

It also posted stronger-than-expected billings and raised its full-year revenue outlook.

What we’re watching today:

-

Home Depot (NYSE: HD)

-

Sea Limited (NYSE: SE)

-

Baidu (NASDAQ: BIDU)

-

Vodafone (NASDAQ: VOD)

-

Keysight Technologies (NYSE: KEYS)

-

Tencent Music (NYSE: TME)

-

On Holding (NYSE: ONON)

-

Doximity (NYSE: DOCS)

Top Headlines

-

Icahn probe: Federal prosecutors in New York are investigating allegations made by Hindenburg Research against Icahn Enterprises.

-

El Niño: The periodic weather phenomenon has the potential to disrupt global commodity markets.

-

Russian oil: Exports of Russian oil hit their highest level since the invasion of Ukraine in April.

-

Survey says: BofA’s latest global fund managers’ survey revealed investors are the most pessimistic they’ve been all year.

-

Fed is done: Billionaire Paul Tudor Jones thinks the Fed is done raising rates and predicts stocks end the year higher from here.

-

Settlement: Wells Fargo will pay $1 billion to settle a lawsuit accusing it of making misleading compliance statements.

-

Super-app moves: Elon Musk’s Twitter made its first acquisition in job-matching tech startup Laskie.

-

Musk subpoena: Elon Musk has been subpoenaed in a lawsuit against JPMorgan over its relationship with Jeffrey Epstein.

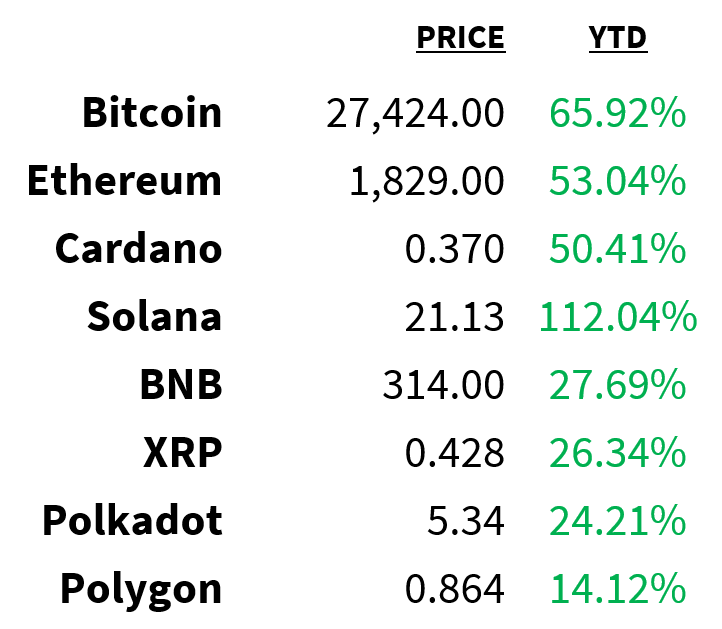

Crypto

Prices as of 4 pm EST, 5/15/23

-

Secret deal: The SEC says Jump Trading engaged in a secret deal to prop up stablecoin TerraUSD.

-

Feet dragging: The SEC has rejected Coinbase’s request for regulatory clarity saying it has no requirement to do so.

-

Asset flows: Digital investment products saw their 4th straight week of outflows totaling $54 million.

-

Correlation: The correlation between Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) has dropped to its weakest since 2021.

-

Active users: Despite rising transactions, the number of active addresses on the Bitcoin network is falling.

Deals

-

Approved: Despite UK and US opposition, the EU has approved Microsoft’s $69 billion takeover of Activision Blizzard.

-

Blocked: The FTC plans to block Amgen’s $27.8 billion acquisition of Horizon Therapeutics.

-

Burger battle: Activist investor Engaged Capital is preparing to launch a proxy fight for 3 board seats at Shake Shack.

-

Credit investing: Private equity group TPG will buy debt and real estate manager Angelo Gordon for $2.7 billion.

-

VW sale: Russia’s government has approved the sale of Volkswagen’s Russian assets to auto dealer Avilon for ~$140 million.

Meme Of The Day

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency Macro Economic Events News Penny Stocks Small Cap Economics Markets General