Peter Schiff Predicts 'Fireworks,' Says Michael Saylor's Strategy Will See Unrealized Loss During Bitcoin's Next Bearish Dip

Economist and market commentator Peter Schiff projected Monday that the next Bitcoin (CRYPTO: BTC) pullback would trigger an unrealized loss for Michael Saylor-led Strategy Inc. (NASDAQ:MSTR) on its BTC purchases.

What Happened: During his YouTube podcast, Schiff weighed in on Bitcoin recapturing the crucial $100,000 level and Strategy buying billions in the cryptocurrency funded by debt.

“His average cost now is almost 70,000 a bitcoin, so it’s getting higher and higher,” he said.

Schiff predicted that Strategy’s average acquisition cost might reach $70,000 by his next purchase, and the subsequent Bitcoin decline could push the firm “into the red” for the first time. “We’ll see what kind of fireworks that sparks,” he added.

Strategy didn’t immediately respond to Benzinga’s request for comment.

Why It Matters: Saylor’s company Strategy, formerly MicroStrategy, has been heavily investing in Bitcoin. The firm reported acquiring 13,390 BTC for approximately $1.34 billion at an average price of $99,856 per coin on Monday, pushing their total Bitcoin holdings to 568,840 BTC, accumulated at a combined cost of $39.41 billion and an average purchase price of $69,287.

Notably, the Bitcoin treasury company came close to experiencing an unrealized loss on its investments last month after the apex cryptocurrency slipped below $75,000 following President Donald Trump’s sweeping tariff announcement.

Schiff, a fierce critic of all things Bitcoin, has consistently questioned Strategy’s Bitcoin playbook, arguing that its commitment to repay a large sum of money to debt holders could be at risk if the leading cryptocurrency falls sharply.

Price Action: At the time of writing, Bitcoin was exchanging hands at $102,656.68, down 1.24% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy rose 1.02% in after-hours trading after closing 2.67% lower at $404.91 during Monday’s regular session. Year-to-date, the stock has gained nearly 80%.

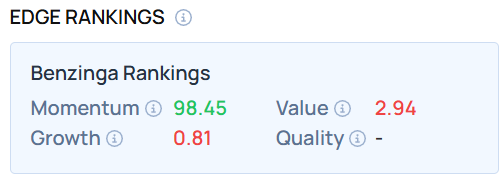

MSTR demonstrated a high momentum score of 98.45 as of this writing. Visit Benzinga Edge Stock Rankings to select similar high-momentum stocks for your portfolio.

Photo Courtesy: Wirestock Creators on Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bitcoin KeyProj Michael Saylor Peter Schiff strategyCryptocurrency News Markets