Can You Really Retire On Just 1 Bitcoin By 2035? A Look Beyond The Hype

With the rise of Bitcoin as a hedge against inflation and an alternative store of value, a provocative question has taken hold of the financial imagination: "Can you retire on just 1 BTC by 2035?" According to a widely circulated chart from Smitty's Bitcoin Retirement Guide, the answer in many countries is yes. But is that realistic?

The Charts That Sparked the Buzz

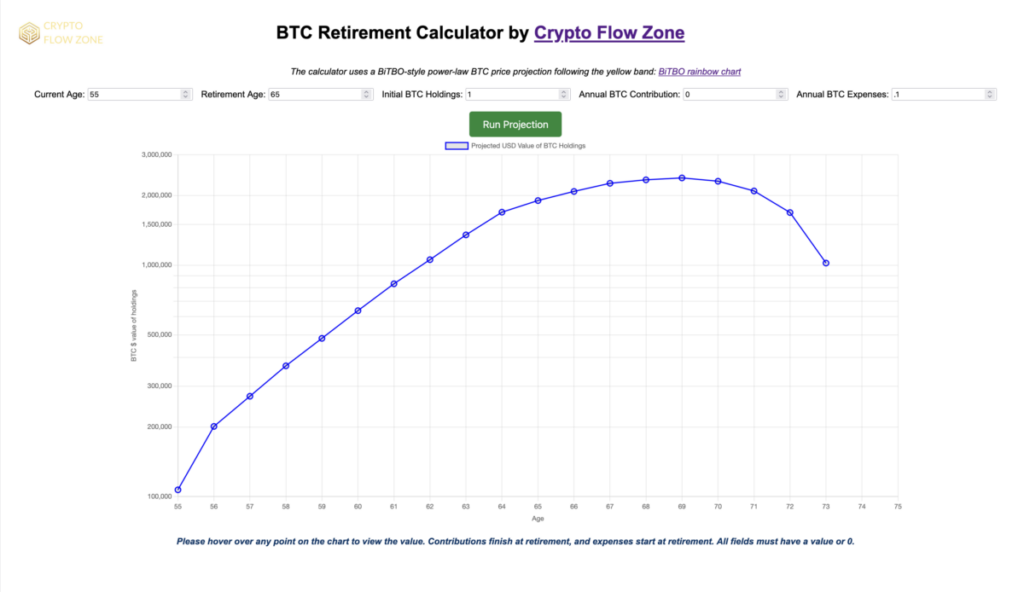

The first chart (below) from a Crypto Flow Zone retirement calculator, models the potential USD value of BTC holdings over time based on age, retirement goals, and spending needs. It follows a conservative growth trajectory inspired by the "BitBO Rainbow Chart" and assumes no contributions post-retirement:

This free calculator is here for anyone to use/share. We encourage all investors to model their portfolio with it.

The projection above shows that starting with 1 BTC at age 55 , then retiring in 10 years and spending a modest 0.1 BTC per year post-retirement, your holdings may be enough to support a decent lifestyle for about 7–8 years depending on BTC performance.

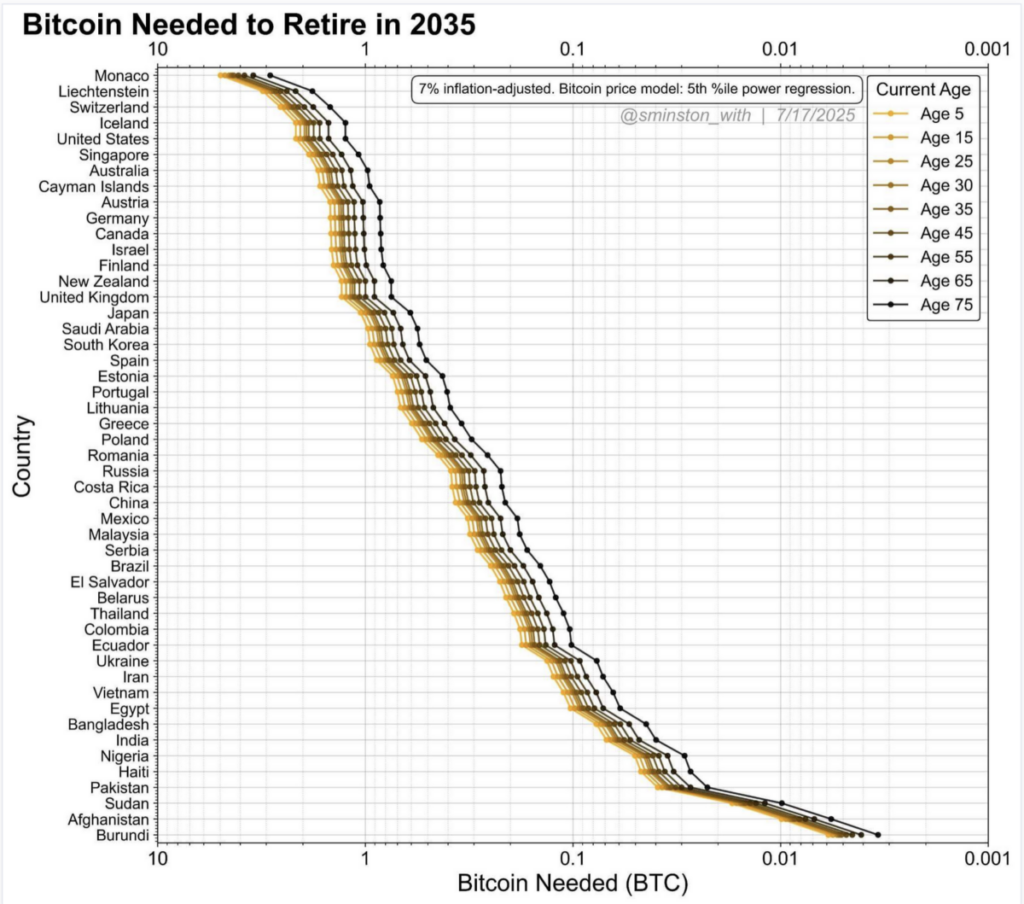

Meanwhile, this second chart is shown below from the source article;

This paints a more optimistic picture:

This visual compares the estimated amount of BTC needed to retire in 2035 across dozens of countries, using a 7% inflation-adjusted model and a conservative (5th percentile) BTC price forecast. For example:

• Thailand or Turkey: ~0.05–0.1 BTC may suffice.

• United States or UK: closer to 0.5–1 BTC.

• Monaco or Switzerland: up to 10 BTC.

But these figures don't appear to factor in your personal expenses post retirement. That's where the flaw in the "1 BTC myth" becomes evident.

The Problem: Retirement ≠ Just Holding BTC

The "1 BTC retirement" narrative is seductive but oversimplified. Here's why:

1. Living Expenses Vary Widely

Rent, healthcare, food, travel ; all of these must be accounted for. A minimalist lifestyle in Chiang Mai Thailand or Alanya Turkey is vastly different from one in London or Sydney.

2. Market Volatility

BTC may surge, or it may crash. Basing your entire retirement on speculative price appreciation is risky , even with conservative modeling and planning.

3. Spending BTC Shrinks the Portfolio

The Crypto Flow Zone model shows that even with just 0.1 BTC in annual spending, the BTC holdings deplete over time and retirement is a long game.

4. Inflation + BTC Adoption

Widespread BTC use could raise its purchasing power, but inflation or global instability could work against that.

A Balanced Perspective

So, can you retire with 1 BTC in 10 years time? Maybe but only under very specific circumstances;

• You live in a low-cost country,

• BTC reaches or exceeds long-term targets,

• You have other income or safety nets,

• And you spend very little.

Otherwise, a more prudent strategy is to:

✅ Accumulate more BTC,

✅ Diversify across assets of different classes,

✅ Include projected expenses in any retirement calculator,

✅ And treat BTC as a long-term hedge — not a magic ticket.

Final Thoughts

The charts are useful starting points but are not substitutes for real financial planning. Don't let the hype distract you from the basics: calculate your annual spending needs, project realistic returns, and adjust your BTC holdings accordingly , because while 1 BTC might be enough for some, it definitely won't be enough for everyone.

Feature Image is AI Generated

Disclosure: The author has a BTC investment

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasCryptocurrency Long Ideas Opinion