Verizon's AI Connect Sales Surge To $2 Billion, Fueled By Real-Time Inferencing Demand

Verizon Communications Inc. (NYSE:VZ) noted a significant surge in its AI Connect offerings during its second quarter earnings call, with the sales funnel nearly doubling to $2 billion since its launch earlier this year.

Check out the current price of VZ stock here.

What Happened: This rapid growth highlights strong market demand for the company’s next-generation enterprise solutions, particularly those designed to facilitate AI inferencing – the real-time application of AI models.

Chairman and CEO Hans Vestberg emphasized the strategic importance of this development. “Our AI Connect offerings are also generating strong interest. Our sales funnel has nearly doubled to $2 billion since launch earlier this year,” Vestberg stated.

The company is leveraging its robust network infrastructure, including extensive fiber and C-band deployment, to provide the high-bandwidth capacity and diverse routes necessary for demanding AI workloads.

“While these are often complex deals with longer sales cycles, we’re actively engaged in several sizable opportunities,” Vestberg added, signaling continued growth prospects in this specialized segment.

This momentum underscores Verizon’s unique position to support the evolving landscape of AI, where compute power at the network edge becomes essential for widespread real-time application.

The company’s infrastructure build, including its C-band deployment being ahead of schedule, directly supports these advanced capabilities.

Why It Matters: Verizon’s second quarter revenue hit $34.5 billion and adjusted EPS of $1.22 beat estimates, driven by strong wireless and broadband growth.

Verizon reaffirmed its expectation for wireless service revenue to grow between 2.0% and 2.8%. The company adjusted its earnings per share outlook from $4.59 to $4.73, down to $4.64 to $4.73, which is slightly below the consensus estimate of $4.68, due to strong demand for its premium plans.

Verizon anticipates free cash flow for 2025 to be between $19.5 billion and $20.5 billion, up from the previous range of $17.5 billion to $18.5 billion.

It also expects operating cash flow to range from $37.0 billion to $39.0 billion, an increase from the earlier projection of $35 billion to $37 billion, while maintaining its capital expenditure forecast at $17.5 billion to $18.5 billion. These projections do not account for the potential acquisition of Frontier Communications Parent.

Price Action: VZ shares rose 4.04% on Monday after the results. They were up by (5.67% on a year-to-date basis and 8.70% over the last year.

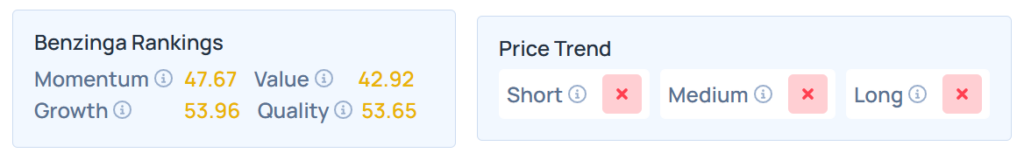

Benzinga Edge Stock Rankings shows that VZ had a weaker price trend over the short, medium, and long term. Its momentum ranking was moderate, and its value ranking was at the 42.92th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Monday. The SPY was up 0.19% at $628.77, while the QQQ advanced 0.52% to $564.17, according to Benzinga Pro data.

On Monday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Karolis Kavolelis/Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings