Jim Cramer Says Palantir's 'Next Stop Is $200' After Q2 Earnings Blowout: Dan Ives Calls It 'The Messi of AI'

AI giant, Palantir Technologies Inc. (NASDAQ:PLTR), is drawing loud praise from Wall Street analysts following the company’s robust second-quarter performance, as it surged past consensus estimates.

Check out the current price of PLTR stock here.

What Happened: On Monday, senior analyst Dan Ives, who refers to the company as the “Messi of AI,” joined Yahoo Finance’s Market Domination Overtime to share his reactions and discuss its second-quarter performance.

According to Ives, this was “a blowout across the board,” as he praised CEO Alex Karp’s leadership as a “Hall of Fame performance.” Speaking on valuation concerns, Ives says that, in his view, the company will reach a “trillion dollar market cap” over the next two to three years.

The host of CNBC’s Mad Money, Jim Cramer, doubled down on his bullish outlook on the stock, following its results. “Palantir, when it was $50, I said it would go to $100, when it was at $100, I said it would go to $150,” and now Cramer says the “next stop is $200,” which is a 24.48% upside from current levels.

Cramer also highlighted a term used during Palantir’s earnings call, “Doomerism,” referring to the negativity surrounding AI and the company itself, likely promoted by short-sellers.

Meanwhile, Neil Sethi, the managing partner at fund manager, Sethi Associates, lauds the company’s outperformance in the face of “sky-high expectations.”

He notes that “sales jumped 68% to $733 million,” and the company “raised its revenue outlook for the full year to $4.14 billion to $4.15 billion, exceeding analysts' prior expectation of $3.91 billion,” as it cites the “astonishing impact” of artificial intelligence on its business.

Why It Matters: Palantir released its second-quarter earnings on Monday, reporting revenue of $1.004 billion, up 48% year-over-year, and beating analyst estimates of $939.71 million. It posted a profit of $0.16 per share, which was again ahead of consensus estimates at $0.14 per share.

Riding the AI momentum, the company raised its guidance for the full year to $4.15 billion, up from its prior guidance of $3.90 billion, which was in line with consensus estimates.

Price Action: Palantir shares were up 4.14% on Monday, trading at $160.66, and are up another 4.57% after hours, following its earnings announcement after markets closed.

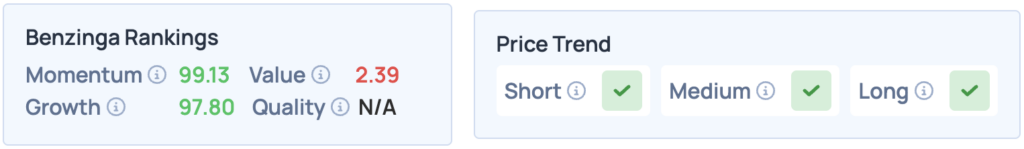

According to Benzinga’s Edge Stock Rankings, Palantir shares score high on Momentum and Growth, with a favorable price trend in the short, medium and long term. Click here for deeper insights into the stock, its peers and competitors. .

Read More:

Photo: slyellow / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.