Jim Cramer Says Tariffs Will Become A 'Build-In Cost For Companies' As Caterpillar Takes Hit Amid Mixed Q2

After Caterpillar Inc. (NYSE:CAT) delivered a mixed second-quarter earnings result, CNBC’s ‘Mad Money’ host Jim Cramer highlighted how President Donald Trump‘s policies are reshaping corporate cost structures and may normalize tariff hits as a business expense.

What Happened: Caterpillar’s GAAP operating profit of $2.860 billion, representing a 17.3% margin, decreased by $622 million, or 18%, compared with $3.482 billion from the second quarter of the previous fiscal year.

This was primarily due to unfavorable manufacturing costs, which the company repeatedly said “largely reflected the impact of higher tariffs.”

Cramer highlighted in a series of X posts that despite this hit, he bought the stock anyway.

Apart from the margin pressure, the management underscored that the tariffs also hit the segment sales of ‘resource industries’ and ‘energy & transportation’ during the quarter.

Despite the tariff hit, Caterpillar said the order backlog increased by approximately $2.5 billion during the quarter across all primary segments.

Cramer further explained that any price pressure from tariffs will become a built-in cost for companies, and investors would eventually stop caring.

This is underpinned by the fact that investors would buy “growth with tariff costs” over “no growth with no tariff,” noted Cramer,

Why It Matters: The company expects the third quarter incremental tariff costs to range between $400 million and $500 million. For the full year, it estimates net incremental tariff costs of $1.3 billion to $1.5 billion.

The management also added that, “Including the net impact from incremental tariffs, we expect third quarter enterprise adjusted operating profit margin to be lower versus the prior year.”

The firm reported revenue of $16.569 billion, down 1% from $16.689 billion a year earlier, beating the analyst consensus of $16.17 billion. Whereas, its adjusted earnings per share of $4.72 missed the $4.90 estimate.

Price Action: CAT stock closed 0.12% higher on Tuesday, and it rose 0.18% in premarket on Wednesday.

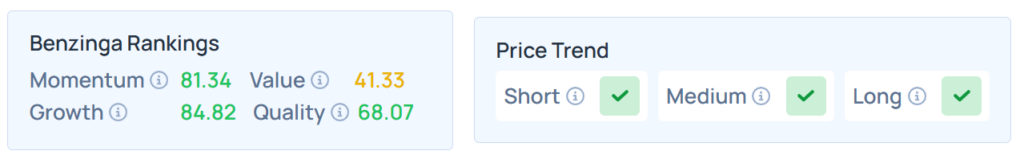

Benzinga's Edge Stock Rankings indicate that CAT maintains a strong price trend across the short, medium, and long term. However, the stock scores moderately on value rankings. Additional performance details are available here.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.23% at $629.43, while the QQQ advanced 0.20% to $561.39, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News