Jim Chanos Slams Palantir Management For Continuing To 'Ridicule' Skeptics While Executives Sell $328 Million Worth Of Stock

Renowned short-seller Jim Chanos has taken aim at Palantir Technologies Inc. (NYSE:PLTR) executives for what he perceives as hypocrisy in their public messaging versus private actions.

What Happened: “Palantir management continues to ridicule the skeptics on their stock price…while they keep selling material amounts of shares,” Chanos wrote on X, responding to news of significant insider selling.

Stephen Cohen, Palantir’s President, and Co-founder executed a substantial stock sale between Mar. 12-17, divesting 4.06 million shares worth approximately $328 million, according to The U.S. Securities and Exchange Commission filings.

The data analytics company, known for its software used by intelligence agencies and commercial clients, has drawn investor attention due to these large transactions, particularly given its premium valuation metrics.

Palantir currently trades at a price-to-earnings ratio of 463, while the stock has declined nearly 30% over the past month, according to data from Benzinga Pro.

See Also: China’s DeepSeek Sparks National Security Alarm: ‘Do Not Download, View, Access Any Applications…’

Why It Matters: This criticism comes amid a broader market debate about Palantir’s growth prospects. Martin Shkreli, the controversial former hedge fund manager, recently questioned but ultimately defended Palantir’s projections. Shkreli challenged the common analysis that only about 20,000 companies can afford Palantir’s $4 million data analytics suite, arguing that the software might generate positive returns regardless of budget constraints, and that per-seat pricing could expand market reach.

Despite these discussions, Palantir has performed well since November, surging over 55% following President Donald Trump‘s election victory. The company was recently added to the S&P 100 index, replacing Dow Inc., effective Mar. 24.

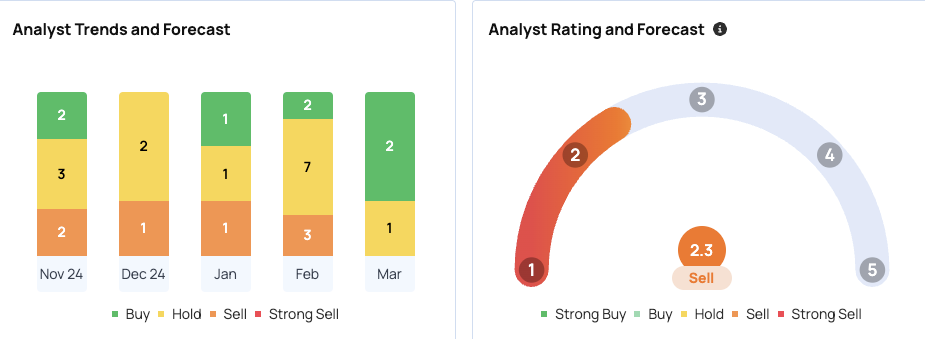

Recent analyst price targets from Wedbush Securities, Loop Capital, and Citigroup average $123.67, suggesting a 46% upside potential from current levels, despite Shkreli’s acknowledgment of competitive threats from Snowflake Inc. (NYSE:SNOW), Databricks, and AI startups.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: benzinga neuro Jim Chanos KeyProjEquities News Short Sellers Markets