Apple May End Up Acquiring Perplexity Like It Did With Beats In 2014, Says Dan Ives—Consumers Need 'Reasons To Upgrade' As iPhone Maker Falls 'Way Behind' In AI Race

Following Apple Inc.'s (NASDAQ:AAPL) WWDC 2025, Dan Ives, global head of technology research at Wedbush Securities, said the tech giant ‘might be forced’ to pursue a merger or acquisition with an AI platform like Perplexity, or one of several others—similar to its 2014 acquisition of Beats—to remain competitive in AI and meet growing consumer demands.

What Happened: During an interview with DW Business on Tuesday, Ives discussed Apple's current position in the AI race, highlighting the company's lag behind competitors like Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google, Microsoft Corporation (NASDAQ:MSFT) and AI startups like OpenAI.

He highlighted that Apple's iOS ecosystem could provide an advantage, but the company needs to act quickly to leverage AI.

Read Also: What's Going On With GameStop Stock Wednesday?

He also noted that consumers need reasons to upgrade, especially when AI advancements are becoming a key driver in technology. Without a strong AI offering, Apple risks falling behind in a critical area that's shaping the future of tech.

“On one hand, you have a golden install base in the world … you got to monetize on AI,” he said, adding, “Right now they’re way behind and I think that’s a concern for investors and I’d say even from a consumer perspective. You need reasons to upgrade.”

When asked about the argument that AI isn't yet aligned with Apple's brand, Ives suggested that Apple must participate in AI or risk being left behind.

“I do think maybe culturally in some of their standards … but look, the reality is they’re going to have to accelerate this because it’s the biggest technology innovation in the last 40-50 years and Apple can’t be on the outside looking in,” he stated.

Perplexity did not immediately respond to Benzinga's request for comment on whether the AI firm is open to acquisition.

Why It's Important: Apple’s new iOS 26 design, “Liquid Glass,” introduced at WWDC 2025, is also facing significant backlash online. The translucent, fluid interface spans across various elements like buttons and the Control Center, aiming to enhance user experience.

Despite Apple touting its innovation, people on social media, including investor Ross Gerber, have expressed strong disapproval, with some saying Steve Jobs would not have approved.

Previously, Ives also characterized the event as highlighting “slow and steady improvements,” but ultimately dismissed it as “a yawner.”

On the other hand, Gene Munster of Deepwater Asset Management said Apple isn’t yet ready to reveal its more advanced AI efforts but has time to catch up.

He noted the most important WWDC 2025 announcement was the Foundation Model framework, which enables easier on-device integration of Apple Intelligence for developers.

Price Action: Apple shares have declined 18.48% year-to-date and are down 6.71% over the past 12 months, according to Benzinga Pro data.

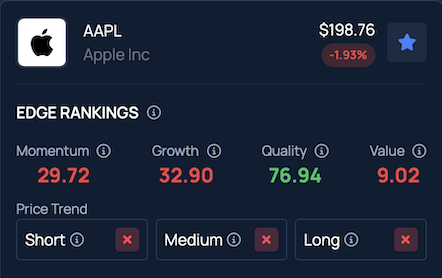

Benzinga's Edge Stock Rankings reflect a downward trend for Apple across short, medium and long-term periods. Additional performance metrics can be found here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Prathmesh T on Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Appeverse artificial intelligence benzinga neuroEquities M&A News Markets Tech