Microsoft Stock Poised For 23% Rally As AI Monetization Gains Steam, Dan Ives Says

Reflecting the surging tide of artificial intelligence, Wedbush Securities analyst Dan Ives has raised his price target for Microsoft Corp. (NASDAQ:MSFT) to $600, up from an earlier estimate of $425, citing a “massive adoption wave” of AI-driven Azure services.

What Happened: The announcement, made via X, underscores Ives’ confidence in Microsoft's pivotal role in the AI revolution, dubbing it the company's “shining moment.”

The new target implies a 23% upside for Microsoft investors based on Tuesday's closing price.

Ives, a veteran tech bull on Wall Street, bases his bullish outlook on recent field checks revealing robust AI customer adoption.

Microsoft's Azure cloud platform, enhanced by innovations like Nvidia Corp.‘s (NASDAQ:NVDA) Hopper GPUs and custom-built silicon, is at the forefront, with monetization strategies outlined in the Azure API Management framework driving significant growth.

The new target, approximately 25% premium over the current Wall Street consensus of $517.85, reflects Ives' belief that AI infrastructure is propelling Microsoft ahead of competitors.

Why It Matters: Currently, based on the 29 analysts tracked by Benzinga, MSFT has a consensus target price of $517.85 apiece, with a ‘buy’ rating.

The targets range from $475 to $605. Recent price targets from Wells Fargo, Citigroup, and RBC Capital imply a 15.07% upside for Microsoft Corp.

MSFT shares were up 0.22% in premarket on Wednesday and ended 0.85% higher at $490.11 apiece on Tuesday. It has risen by 17.09% on a year-to-date basis and 8.68% over the past year.

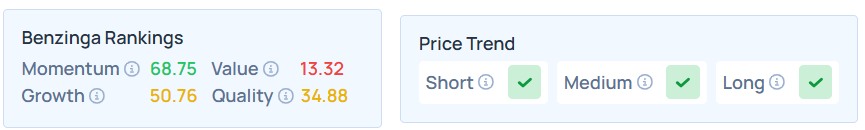

Benzinga Edge Stock Rankings shows that MSFT had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid; however, its value ranking was poor at the 13.32nd percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was down 0.054% at $607.11, while the QQQ rose 0.16% to $540.66, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: AI artificial intelligence Azure chips Dan Ives Daniel Ives GPUNews