Trump Threatens 200% Pharma Tariffs, But Analyst Says This Stock Is Immune And Expected To 'Benefit' From Levies

While President Donald Trump's proposed 200% tariffs on pharmaceutical imports could potentially squeeze the profit margins, this stock is poised to “benefit” from the levies.

What Happened: Trump announced on Tuesday that the pharma tariffs, part of a Section 232 investigation launched in April, are expected to be detailed by month's end, with a grace period of "about a year, year and a half" before implementation.

Barclays cautioned that a 200% tariff would "inflate production costs, compress profit margins, and risk supply chain disruptions.” However, the delay offers little relief, as CNBC reported, quoting UBS analysts that it's "insufficient time" for firms to relocate manufacturing, typically a four-to-five-year process.

But despite the potential negative impact on pharma companies, Louis Navellier told Benzinga that Eli Lilly and Co. (NYSE:LLY) is “expected to benefit from tariffs on pharmaceutical imports, since the company has been boosting its domestic manufacturing.”

Additionally, Thomas Shipp, head of equity research at LPL Financial, told Benzinga that Lilly's attempt to try “to avoid PBMs,” exemplified by its direct-to-consumer model, ‘LillyDirect’ in partnership with Amazon.com Inc. (NASDAQ:AMZN), positions it to bypass traditional pharmacy benefit managers, enhancing its resilience against tariff-related disruptions.

Why It Matters: Additionally, Lilly's strategic moves, including a $1.3 billion acquisition of Verve Therapeutics, signal its focus on innovation and U.S.-based growth.

Ark Research noted that this acquisition validates gene-editing therapies for cardiovascular disease, a market with "trillions of dollars" in potential, as Lilly scales solutions like PCSK9-targeting therapies that reduce LDL-C by up to 69%.

Apart from the effects on the profitability of pharmaceutical companies, according to PhRMA, the tariffs could raise U.S. drug prices by $51 billion annually with just a 25% tariff levy, potentially increasing costs by 12.9%.

Price Action: Eli Lilly stock declined 0.078% in premarket on Friday; it was up 1.62% on a year-to-date basis but down by 15.36% over the last year.

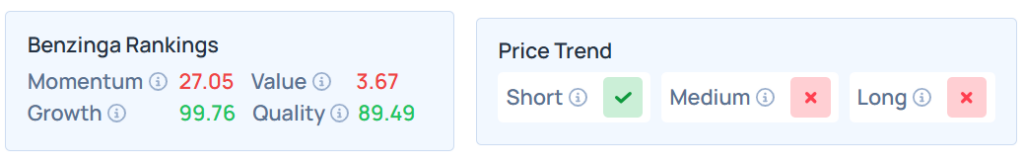

Benzinga Edge Stock Rankings shows that LLY had a weak momentum and value ranking; however, its growth and quality metrics were very strong. The details of all the important indicators are available here.

These are some pharma stocks and ETFs that could be impacted as Trump warned on Tuesday that long-awaited industry-wide tariffs would be announced "very soon".

Pharma Stocks

YTD Performance

One Year Performance

Eli Lilly And Co. (NYSE:LLY)

1.62%

-15.36%

AbbVie Inc. (NYSE:ABBV)

8.67%

14.77%

Bristol-Myers Squibb Co. (NYSE:BMY)

-14.56%

19.07%

Regeneron Pharmaceuticals Inc. (NASDAQ:REGN)

-21.73%

-48.18%

Pfizer Inc. (NYSE:PFE)

-3.12%

-10.05%

Gilead Sciences Inc. (NASDAQ:GILD)

24.66%

63.70%

Merck & Co Inc. (NYSE:MRK)

-15.28%

-34.85%

Amgen Inc. (NASDAQ:AMGN)

15.85%

-7.60%

Johnson & Johnson (NYSE:JNJ)

9.49%

5.34%

Pharma ETFs

YTD Performance

One Year Performance

VanEck Pharmaceutical ETF (NASDAQ:PPH)

3.50%

-3.73%

iShares US Pharmaceuticals ETF (NYSE:IHE)

3.15%

-0.88%

Invesco Pharmaceuticals ETF (NYSE:PJP)

0.68%

-0.49%

SPDR S&P Pharmaceuticals ETF (NYSE:XPH)

-0.16%

2.31%

KraneShares MSCI All China Health Care Index ETF (NYSE:KURE)

25.74%

30.34%

First Trust Nasdaq Pharmaceuticals ETF (NASDAQ:FTXH)

-1.00%

-4.29%

Direxion Daily Pharmaceutical & Medical (NYSE:PILL)

-14.12%

-14.74%

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shuttertsock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.